West Bengal Stamp Paper – An Overview

Any firm operating inside the state of West Bengal must pay stamp duty while purchasing West Bengal stamp papers. This article will cover how stamp duty is paid in West Bengal and the facilities for stamp paper available in West Bengal.

An e stamp, which can be visible on a digitally stamped document, serves as proof of stamp duty payment as well as certification that a document or other piece of information supplied electronically originated with the institution that provided it. In an effort to minimise counterfeits and mistakes, the Indian government established the e-stamping service in July 2013. The Stock Holding Corporation of India Limited (SHCIL) functions as the country’s Central Record Keeping Agency for all e-stamps (CRA).

Stamp duty is levied at various rates not on traditional stamp papers but the traditional ones West Bengal on various types of property transactions. Stamp duty rates in West Bengal are determined by certain factors:

- Location of the property: Rural properties get cheaper rates than metropolitan properties. While e stamp paper in Kolkata and whole West Bengal is unavailable, this means that if you acquire a Rs 1 crore property in a rural region of West Bengal, you would have to pay 3% of the property value in stamp duty and registration fees. The stamp duty and registration cost for a property of the same value located in an urban area will be 5%. It can be explained better from the table below:

| Location of the Property | Stamp Duty (Property Below ₹25 Lakhs) | Stamp Duty (Property Above ₹40 Lakhs) |

| Corporation area (Howrah and Kolkata) | 4% | 5% |

| Notified area or Municipality Corporation or Municipal | 4% | 5% |

| Areas excluded from the above-mentioned categories | 3% | 4% |

- Property value: Stamp duty rates are lower for properties worth up to Rs 1 crore than for properties worth more than Rs 1 crore.

- No gender consideration: Unlike the majority of states, West Bengal does not provide a tax break if the property is registered in the name of a woman.

A contract is legally legitimate if the relevant stamp duty is paid to the government through online e-stamp or by purchasing the relevant stamp papers.

Stamp paper procurement in West Bengal helps verify transactions and renders contracts admissible as evidence in state courts.

In West Bengal, stamp duty and registration costs can be paid electronically or by other means, such as the Government Receipt Portal System (GRIPS). At the moment, online payment of Stamp Duty and Registration Fees is possible if the Stamp Duty due exceeds Rs. 5,000/- and is required if the Stamp Duty payable exceeds Rs. 5 Lakhs.

By notice no. 151 FT dt. 17.1.94, the Government of West Bengal has enacted certain regulations in supersession of all earlier rules and orders issued by the Government of Bengal on the subject.

According to these rules, non-judicial West Bengal stamp papers can only be purchased in the following forms:

Impressed Stamps – These stamp papers are impressed or engraved upon documents after stamp duty is paid. Impressed stamp papers are translucent and make use of certain security features to prevent misuse. These stamp papers are issued to authorized stamp vendors to whom stamp duty payments must be made.

Adhesive Stamps – These types of stamp paper can also be purchased from authorized stamp paper vendors and are stuck onto the requisite document.

Franking -State-issued franking machines are used to emboss the first page of the document with a mark denoting the stamp. The officer in charge of franking may be required to sign the stamp and include certain details to trace the document back to the machine used for franking.

The Directorate has issued a notification permitting the use of Serialized Authenticated Bank Receipts (SABR) in lieu of non judicial stamp paper in West Bengal valued over Rs.5000/- for the payment of stamp duty. The SABR will be distributed to the registered public by the State Bank of India’s various branches.

More details about online non judicial stamp paper in West Bengal can be found here.

West Bengal stamp paper is appropriate for all documents required stamp duty payment. Here is a brief list of the documents and the stamp duty fee that is levied in the state of West Bengal:

|

Property Documents and Instruments |

Stamp Duty |

Registration Charges |

| Power of Attorney for Properties under Rs. 30 Lakhs | Rs. 5,000 | No Charges |

| Power of Attorney for Properties valued between Rs. 30 -60 Lakhs | Rs. 7,000 | No Charges |

| Power of Attorney for Properties valued between Rs. 60 Lakhs – Rs. 1 Crore | Rs. 10,000 | No Charges |

| Power of Attorney for Properties valued between Rs. 1 – 1.5 Crores | Rs. 20,000 | No Charges |

| Power of Attorney for Properties valued between Rs. 1.5 – 3 Crores | Rs. 40,000 | No Charges |

| Power of Attorney for Properties valued Rs. 3 Crores and more. | Rs. 75,000 | No Charges |

| Partnership Contract of Rs. 500 | Rs. 20 | Rs. 7 |

| Partnership Contract of Rs. 10,000 | Rs. 50 | Rs. 7 |

| Partnership Contract of Rs. 50,000 | Rs. 100 | Rs. 7 |

| Partnership Contract valued above Rs. 50,000 | Rs. 150 | Rs. 7 |

| Lease Transfer Deed

(For Government land transferred to family) |

0.5% of the Property Price | Conveyance Deed Charges |

| Lease Transfer Deed

(Others) |

Conveyance Deed Charges | Conveyance Deed Charges |

| Property Gift Deed to a Family Member | 0.5% of the Property Price | Conveyance Deed Charges |

| Property Gift Deed to Anyone | Conveyance Deed Charges | Conveyance Deed Charges |

| Agreement of Sale of Property valued below Rs. 30 Lakhs. | Rs. 5,000 | Rs. 7 |

| Agreement of Sale of Property valued between Rs. 30 – 60 Lakhs. | Rs. 7,000 | Rs. 7 |

| Agreement of Sale of Property valued between Rs. 60 Lakhs – Rs. 1 Crore | Rs. 10,000 | Rs. 7 |

| Agreement of Sale of Property valued between Rs. 1 – Rs. 1.5 Crores. | Rs. 20,000 | Rs. 7 |

| Agreement of Sale of Property valued between Rs. 1.5 – Rs. 3 Crores. | Rs. 40,000 | Rs. 7 |

| Agreement of Sale of Property valued above Rs. 3 Crores. | Rs. 75,000 | Rs. 7 |

How to Purchase West Bengal Stamp Papers For Properties

To pay West Bengal stamp duty and property registration fees, go to the Government Receipt Portal System (GRIPS) and perform the following steps.

Step 1: Log in and then click on Payment of Taxes & Non-Taxes Revenue.

Step 2: To pay the stamp duty charges, choose the Directorate of Registration and Stamp Revenue and Payment of Stamp Duty and Registration cost from the dropdown menu. Enter your contact information, such as your name, address, and phone number. Enter the Query year and Query number from your e-assessment slip.

Step 3: Double-check the information supplied and then click on Online Payment. Save the e-challan with the GRN (Government Reference Number) and BRN (Bank Reference Number) for future use.

In the event of a transaction cancellation, the buyer is entitled to a refund of the West Bengal Stamp duty paid. However, this may only occur if the property paperwork is not processed for registration at the sub-register office.

The buyer can then seek a refund of the stamp duty and registration fees from the portal of the Directorate of Registration and Stamp Revenue of West Bengal.

Can Businesses Use eStamping For Inter-State Operations?

If a company conducts activities that span state boundaries in India, the necessary documents must be stamped in both states.

In this instance, the stamp duty that must be paid is known as differential stamp duty.

Businesses will only be required to pay the differential stamp duty if the stamp duty charge in one state differs from the stamp duty rate in the other. The differential stamp duty to be paid in this scenario is the difference in stamp duty amounts for the two states.

Semi-Digital Stamping for Stamp Procurement in West Bengal

SignDesk’s unique digital stamping product (“stamp.it”) is an API-based platform that simplifies stamp paper procurement. This solution automates stamp duty payment by providing features such as quick drafting, online stamp duty payment, and eSignature integration. West Bengal stamp paper purchase iscmade hassle-free using real-time activity tracking on a smart dashboard, which includes QR codes for verifying stamping data.

In West Bengal the SHCIL facility isn’t presently available, meaning that clients are unable to procure online stamp papers in West Bengal. Instead, they have to manually procure the stamp papers via various vendors.

SignDesk acts as the mediator between stamp paper vendors in West Bengal and the client. Predominantly, the West Bengal government has the exclusive storage rights of traditional stamp papers of denominations 10, 20, 50, 500, 1000, and 5000.

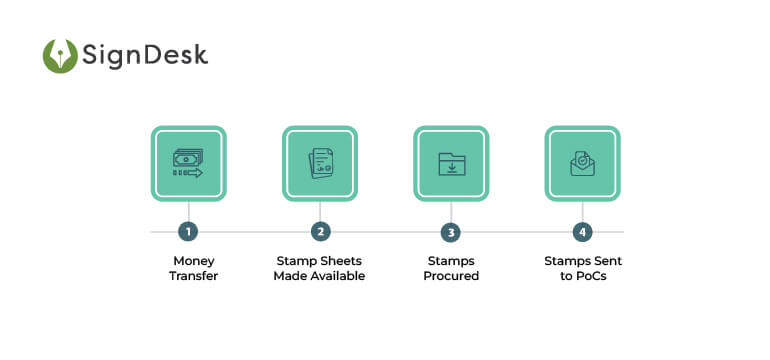

The unavailability of e stamp paper in West Bengal means that stamp paper procurement is conducted semi-digitally. Here’s an overview of the steps involved:

- Balance for stamp purchase is transferred to the wallet

- Traditional stamp sheets are made available for pre-order

- After the transaction is done, the procurement procedure is initiated

- Traditional stamp sheets are sent to the client PoCs

How To Pay Stamp Duty For West Bengal Stamp Papers

For states like West Bengal, where the eStamping services are not available, SignDesk enables a pre-order module for streamlined stamp paper procurement from trusted vendors.

In this module, businesses pre-order the required stamp papers 15 days before consumption, specifying the precise stamp paper denominations, quantity, and state name. Following approval, a member of SignDesk’s operations team will source the necessary stamp papers from vendors/agents and upload them to SignDesk’s repository.

In this case, the whole amount paid as per the client’s request is kept as the net available balance, and any further amounts bought are stored for later usage.

The procurement procedure begins with a request for money to be released to the vendor. The overall turnaround time for this process is 12-15 days, and the steps involved are as follows:

- Traditional stamp sheets are handed directly to SignDesk PoCs

- QR codes are printed & scanned, stamp papers are then uploaded according to customer specifications

- Rejected uploads are examined for faults and re-uploaded if necessary

- Following upload, the Maker-Checker process is used to check for errors

- Soft copy stamp sheets will be provided for client consumption after clearance (Based on their requirement).

- The stamp sheets then get legend text added to them (Usually loan account numbers, as per client requirements can also include their short agreement text) for defacement according to stamping laws

- The stamp papers will not be made available for client consumption after scanning. These will be distributed to clients for review. Following confirmation, scanned copies will be made available for use.

Stamp papers are necessary to create contracts, agreements, and affidavits. Every transaction, from the office lease to a vendor or distributor agreement, must be authorised by paying stamp duty.

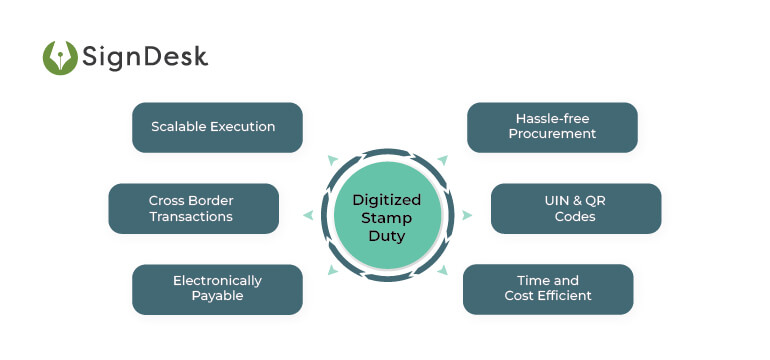

Digitized stamp duty payment offers several benefits for businesses:

-

- Online stamp duty payment expedites the acquisition of stamp paper and the execution of documents.

- The e Stamping certificate has its own UIN and QR code, showing that it is authentic and cannot be tampered with.

- Digital stamping speeds up agreement execution while lowering procurement costs.

- Semi-online procedures, such as eStamping, are easily scalable, enabling for organizational growth with reduced overhead expenses.

- Users have the option of selecting any stamp denomination, state, or instrument type. This facilitates cross-border transactions.

- Stamp duty is payable electronically through vendor websites or through a specialised stamping gateway.

- In a nutshell, digital stamping solutions have been shown to reduce contract TAT by more than 50% and enhance corporate efficiency by assisting in the resolution of logistical issues.

SignDesk – Digitized Stamp Duty Payment Across India

SignDesk, India’s leading provider of document automation services, offers a Digital Stamping solution for vendors as well as an eSign process solution to assist organisations in going paperless via Stamp. It. By utilising these tools, client businesses have brought their turnaround time for agreement execution down to minutes.

Businesses can leverage SignDesk’s stamping solution to streamline procurement of West Bengal stamp papers, with SignDesk’s extensive vendor tie-ups and scalable operational capabilities.

QR codes, real-time stamp status tracking, and custom alerts help streamline the stamp procurement process and ensure that stamps aren’t duplicated. Integrate with our nationally acclaimed stamping solution to accelerate agreement execution and digitize stamping operations. Book a free demo with one of our solution consultants to learn more.