Note: NPCI has issued Circular No: NPCI/2018-19/NACH/CIRCULAR NO.35 suspending the eSign based eMandate services. However, we still offer API based eMandate services. Know more about the API based eMandate service.

eMandate

A mandate is a physical document that is processed by a person or an organization to achieve a certain objective, mostly from a bank. Similarly, an eMandate is its electronic/digital alternative that enables quicker and easier processing of such objectives.

With an aim to provide Indian citizens unrestricted access to all payment services, the National Payments Corporation of India (NPCI) was formed in 2008 by a consortium of major banks in the country backed by the Reserve Bank of India.

With the same intent of making payments simpler, the NPCI implemented the National Auto Clearing House (NACH) in 2013.

NACH is a web-based solution for direct-debit and direct-credit solutions. It has proven to substantially reduce erstwhile high transaction costs.

The implementation of NACH by NPCI helps eMandate to serve expedient convenience to the organizations as well as individuals using the same.

Individuals and Businesses who need to make regular, repetitive payments may avail of the automated service by requesting the same from their respective banks.

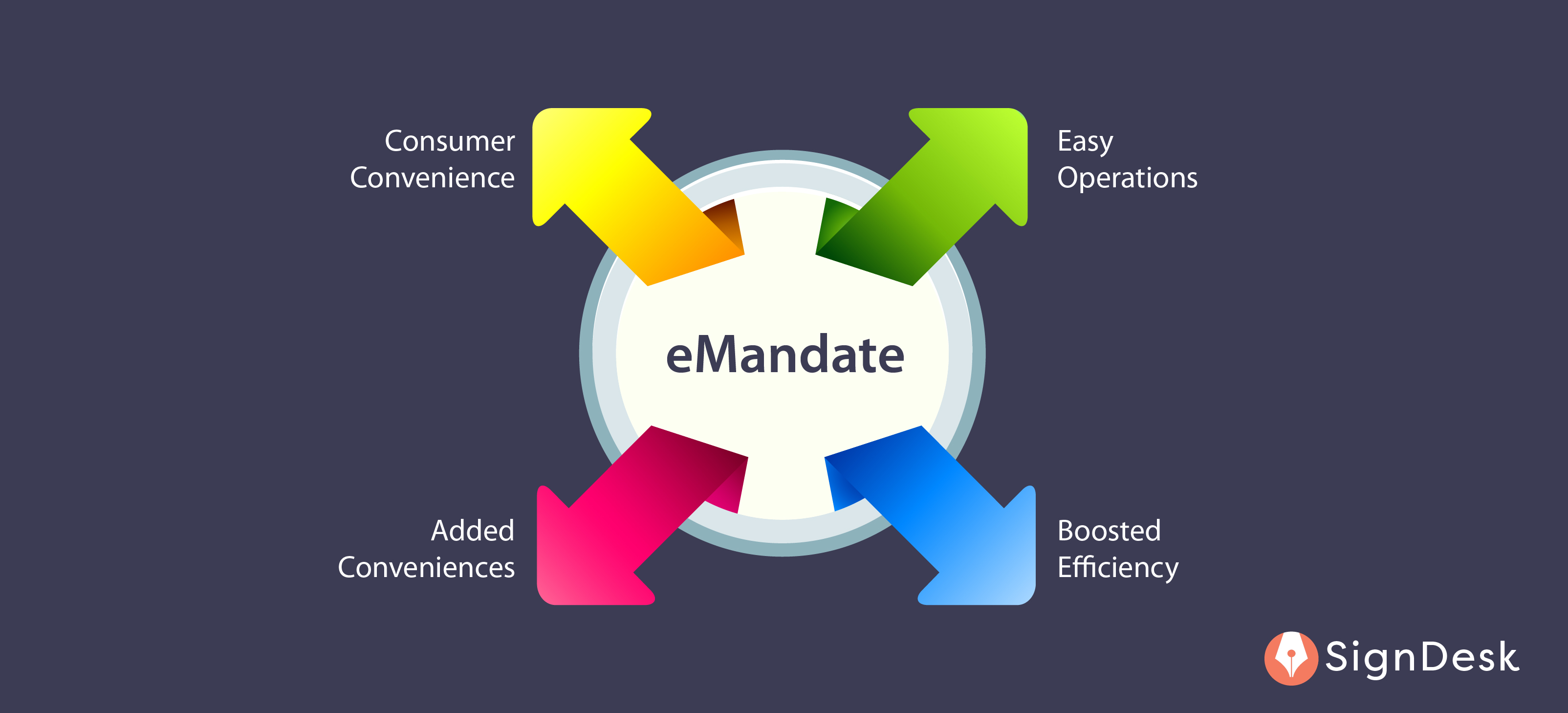

Digitization of the mandate has proven to bring in a significant shift to business processes in the following ways:

4 Benefits of eMandate in India

1. Easy Operations

eMandate removes the need for a business to make manual payments by designating resources for the same. With eMandate, the process is now automated. The business can now focus on other important processes.

2. Boosted Efficiency

Making a large number of payments on a regular basis is cumbersome downright. Imagine having to make 200 payments manually and keeping records for the same on a monthly basis.

A facility like eMandate helps financial processes in a business to save such recurring time lapses. This also help in saving the massive human capital.

3. Consumer Convenience

Tech smart companies like Flipkart, Uber and Whatsapp have taken to the technology in a big way.

The tech simply eliminates mediators like payment gateways and other payment wallets enabling the consumer to receive or make payments in an incredibly easy way.

4. Added Conveniences

With such new-age inventiveness around the technology, it is only obvious that complementary conveniences could be leveraged off the same too.

eMandate also helps you to gift funds that can be received at your choice of time.

Also Uber, another large-scale user of this technology is finding ways to implement a saving feature, done within the technology, to help drivers benefit from the same.

Conclusion

Technology has enabled convenience to get more convenient by the day.

A newfangled technology like eMandate sure is going to be followed by businesses for the diverse possibilities it opens up as it makes payments radically dynamic and easy.