Pan – A Crucial Tool for Taxes & KYC

PAN stands for Permanent Account Number and is used to identify various taxpayers in the country. PAN is a 10-digit alphanumeric identification number (including both alphabets and numbers) issued to Indians, to facilitate and track tax payments. Hence, PAN is among the many identifying documents that can be used for KYC verification , particularly PAN KYC verification. Online pan verification with the passage of time, has become a priority for easy onboarding of customers as well as vendors.

Since the fiscal year 2016-17, the number of PAN cards issued has increased massively. There were around 30 crores PAN holders in 2016-17. By 2020 (June), this figure has risen to more than 50 crores.

Apart from the Aadhaar card and Voter ID, the PAN KYC verification is an incredibly important identification verification in a wide range of processes. Furthermore, it is a necessary document for the execution of various operations in regulated sectors such as finance, telecom, insurance, and more.

Where are PAN Cards used?

The PAN Card has a lot of advantages, and it can be used for several reasons. The benefits of obtaining a PAN Card are as follows:

- Creating a Bank Account

Individuals who do not have a PAN card will be unable to create a bank account, as per existing regulations, as PAN verification is necessary for bank account creation.

One exception to this regulation is when one chooses to create a zero-balance account as part of Prime Minister Jan Dhan Yojana. Within that scenario, a Ration card or a Voter ID card can be used as identification. Similarly, a PAN card is required to open a trading account.

- Income Tax Return Filing:

A PAN must be provided while submitting income tax returns for any individual, resident Indian, or NRI.

Quoting a PAN Card and performing PAN verification at various locations can assist in lowering the TDS rate. Banks, for example, would withhold TDS of 30% on the interest generated beyond Rs 10,000 in a savings account instead of 10% if PAN is not provided.

Refunds are available when the taxpayer’s tax due exceeds the amount paid in TDS. However, PAN must be connected to the bank account where one is applying for reimbursement. This process requires PAN verification.

- Mark of Identity:

PAN card acts as a legitimate method of identity verification and is necessary for numerous transactions. PAN verification also helps in the procedure of tracking tax dues.

- Reduction in Fraud:

The process of PAN verification via a PAN card aids in the identification of fraudulent transactions. It also decreases tax avoidance and increases openness in buyer-seller interactions.

However, among the essential functions of a PAN card is its use in KYC verification – a procedure conducted for anti-money laundering (AML) purposes.

Types of PAN Verification

There are primarily three forms of online PAN verification, which are:

- File-Based PAN Verification:

File-based PAN card verification is the method of validating the authenticity of a PAN (Permanent Account Number) card by comparing the information on the card to that contained in a file kept by the Income Tax Department.

Financial institutions and other organizations frequently employ file-based PAN card verification as part of their Know Your Customer (KYC) procedures to verify customers’ identities before providing them with services like establishing a bank account or applying for a loan. Individuals use it to check the legitimacy of their PAN cards.

- Screen-Based PAN Verification:

The technique of checking the authenticity of a PAN (Permanent Account Number) card using an internet system is called screen-based PAN card verification. Individuals or companies can use this technology to verify PAN card data immediately on the Income Tax Department’s website, eliminating the requirement to provide physical copies of the PAN card.

Screen-based PAN card verification eliminates the requirement to provide physical copies of the card or wait for manual verification by the Income Revenue Department.

The method of validating the authenticity of a PAN (Permanent Account Number) card using an application programming interface (API) offered by the Income Tax Department is referred to as software (API)-based PAN card verification.

This API enables software developers to seamlessly incorporate PAN card verification into their applications, resulting in a smooth and automated verification procedure.

Why KYC Verification is Essential During Onboarding

KYC or Know Your Customer, in the financial sector, requires that businesses verify the identity and risks associated with establishing a business connection with a customer. The processes are under the purview of a bank’s anti-money laundering policy.

KYC consists of three components:

-

- Customer Identification Program (CIP): The consumer is who they claim they are.

- CDD (Customer Due Diligence): Examine the user’s overall risk, including the beneficial owners of a corporation.

- Monitoring and control: Ongoing monitoring of customer transaction trends and reporting of questionable behavior.

1. Customer Identification Program (CIP):

A bank requests identifying information from a client to conform with a Customer Identification Program. This is because each financial institution has its own CIP approach that relies on its level of risk.

For an individual, the documents required for CIP are mainly a driver’s license, PAN card, or passport. When it comes to matters of a company, it requires certified articles of incorporation, a government-issued business license, a partnership agreement, and a trust instrument. Financial institutions must rely on documentation, non-documentary authentication, or both to ensure that this information is correct and reliable.

2. Customer Due Diligence (CDD):

The process of customer due diligence involves the abilities of banks or financial institutions (FIs) to assess the risk that can affect the organization. Large banks investigate various sorts of payments that a client may undertake to discover abnormal (or dubious) behavior. This enables banks to give a risk rating to the customer. The risk rating enables banks to monitor the consumer and their transactions in the future.

3. Monitoring and Control:

Monitoring entails banking institutions continuously checking their consumers’ dealings for potentially fraudulent conduct. This process uses a risk-based, dynamic approach to KYC. When potentially fraudulent activity is found, the financial institution must file a Suspicious Activities Report (SAR) with FinCEN and any applicable law enforcement authorities for which identification processes like PAN verification is encouraged.

A Suspicious Activity Report, also known as a Suspicious Transaction Report, is a complaint filed by a bank concerning dubious or possibly malicious activity.

KYC verification, therefore, is a crucial process to be undertaken compulsorily by all banks, NBFCs & FIs. PAN cards play a key role in this process.

Pan verification for KYC and Digital Onboarding

The PAN serves as a confirmation of both your identification and your earnings. It also demonstrates that the customer is a citizen who pays taxes. As a result, a PAN Card is a statutory requirement while completing the KYC procedure, making PAN verification a necessary component of banking and other financial sectors.

There are broadly three methods of updating a PAN Card for PAN verification:

- Offline verification:

In the offline method, the user must first download a KYC form. After filling out the form, add a self-attested copy of an address proof, i.e., PAN, Aadhaar, or even the passport. Attach a passport-size photograph and submit the form to your nearest branch, completing the verification process and ensuring easy onboarding.

- Online verification:

This is the easiest way of getting KYC verification done. Customers must simply log in to the website of the KYC verification service provider, upload an image of their PAN card and then capture a live picture of the same. PAN Verification APIs are then used to read, retrieve and verify the details in the PAN card to a high degree of accuracy. Online PAN verification is completed within seconds, compared to the days it takes offline verification, and is required for the easy onboarding of customers.

- Aadhaar and Biometrics:

One can use biometric information to finish the procedure for PAN verification if the person has an Aadhaar ID. For the biometric procedure, customers must visit the bank, or the bank personnel must visit the applicant’s home or office. The customer provides a copy of the Aadhaar card and the PAN card, and the provided information is verified by authenticating the customer’s biometric data, such as fingerprints, retina scans, etc.

When is PAN Verification through KYC is Necessary?

The following situations involving regulated industry sectors require online & offline PAN verification:

- Opening New Accounts or Applying for Credit Cards:

To open a new bank account, apply for credit cards or even lodge a service request, PAN verification is necessary, as per the norms by the government. Failing this, a person may be unable to avail of any of these services. PAN verification also facilitates the person to sign up for the locker facility of the bank.

- Investments in Mutual Fund Portfolios:

Prevention of Money Laundering Act, 2002 guidelines and SEBI have mandated PAN verification. All new transactions and investments, be they SIP or purchases, require PAN verification, without which the transaction won’t be counted.

- Service Request to Change Signatories or Beneficiaries:

In case of changing the beneficiaries due to circumstances in the bank, the PAN verification eases the way of altering the signatories. It also further helps when one applies for a loan via credit card.

- Obtaining New Mobile or Landline Connections:

PAN verification is crucial when telecom providers onboard customers for new phone connections. This process of PAN verification typically takes a few minutes when completed online. It simply involves the customer providing a digital copy of their PAN card, which is then instantly verified using smart KYC verification technology. PAN verification is also a necessary step for due diligence in the telecommunications sector.

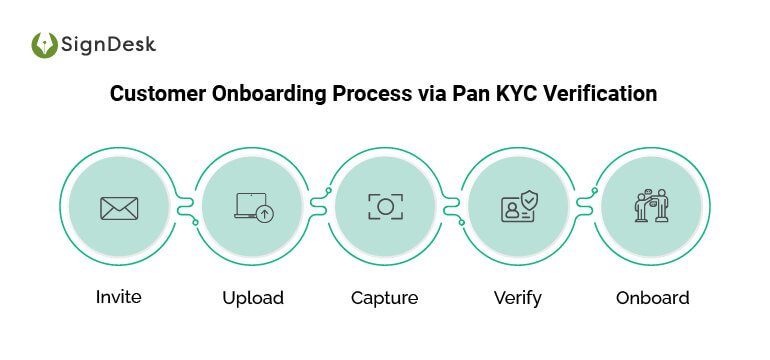

How To Onboard Customers Via PAN Verification

Banks, NBFCs, investment firms, and other FIs can leverage PAN verification to streamline and expedite their customer onboarding process.

Here’s how onboarding and PAN verification works.

- Invite

The FI integrates with a PAN verification service provider who then sends an online invite to the customer for the PAN verification process. This invite is sent via mail or SMS. The customer accepts the invite and consents to the terms and conditions.

Following this, the customer is redirected to the PAN verification portal.

- Upload

Once in the portal, the customer uploads a scanned copy of their PAN card. This copy is only stored for KYC or PAN verification, after which all traces are deleted from the server.

- Capture

After uploading their digital PAN, the customer captures a live image of their original PAN card.

- Verify

The information extracted from this live image by OCR technology is used to verify the details in the PAN in real-time. APIs are leveraged for this purpose, and AI-powered KYC verification algorithms validate PAN verification to a high degree of accuracy.

- Onboard

Once the customer’s PAN has been verified, their identity is confirmed, and the customer is successfully onboarded.

Streamline Digital Onboarding With PAN Verification

These steps enable businesses across regulated sectors such as finance, securities, insurance, telecom, and more to onboard customers securely and at high speed.

PAN verification solves numerous challenges inherent to easy onboarding for customers. Here are the advantages of leveraging PAN KYC for businesses.

- Scalable KYC workflows

PAN verification enables FIs to onboard customers en masse and consequently upscale operations for their business and loan units.

- Cost-effective and secure verification

Digital PAN verification is several orders cheaper for FIs to conduct than manual ID & KYC verification, which takes employees several days to complete. Additionally, online PAN KYC is much more secure than employees manually collecting and verifying PAN IDs. PAN verification helps prevent ID fraud and financial crime.

- Reduced man-hours and increased productivity

Automating customer onboarding with PAN card KYC verification enables FIs to onboard customers faster and at scale. This allows employees to spend less time on wasteful tasks such as KYC document collection, making copies, and manually verifying KYC details. Instead, knowledge workers can focus on enhancing customer experiences and business processes with improved productivity.

- Enhanced customer experience with remote onboarding

When offered PAN verification facilities, customers needn’t travel to bank branches for KYC verification. Also, bank officials needn’t make trips to customer residences or offices. Instead, onboarding can be completed remotely with enhanced customer experience. This boosts both customer satisfaction and helps FIs reduce customer churn rates.

- Easy and efficient customer documentation

Digital PAN verification enables FIs to keep extensive digital records of all KYC documents and onboarding activities on a smart dashboard. KYC status can be tracked in real-time, and important ID documents such as PAN, Voter ID, Aadhaar & more can be retrieved instantly in case of any errors in the process or for due diligence purposes.

SignDesk’s KYC Verification Solution: Scan. It

SignDesk‘s verification solutions Scan.It employs cutting-edge compliance technology and has assisted our 400+ clients in lowering onboarding costs, reducing KYC drop-offs, reducing TAT by up to 99 percent, and safeguarding against fraud while helping in the easy onboarding of the customers.

Our efforts to automate PAN verification with easy-to-use PAN verification APIs and AI-powered authentication have been recognized with several awards, the most recent of which was Best AI/ML Product at InnTech 2020 and Best Digital Onboarding Product of 2020 from the Global Banking & Finance Review.

Are you ready to join 400+ enterprises leveraging Video KYC to rapidly and safely enroll vendors via the vendor KYC PAN verification procedure? To get started, schedule a free demo with us.