What is money muling?

Money muling is a form of money laundering. A money mule is someone who receives money in their bank account from a third party and either transfers it to another account or takes it out in cash and provides it to someone else in exchange for a commission. Anti money muling prevents such incidents from taking place.

Money mules are accomplices because they launder the proceeds of such crimes, even if they are not directly involved in the activities that create the money (cybercrime, payment, online fraud, drugs, human trafficking, and so on). Simply put, money mules assist criminal gangs in remaining anonymous while transferring money around the world.

Anti money muling is among the most important objectives of due diligence and anti money laundering regulations. KYC and AML procedures have been put in place to engender strong anti-money muling procedures and ensure regulatory compliance with due diligence processes.

Video-based KYC is now at the forefront of fighting money laundering and establishing comprehensive due diligence processes.

How’s money muled?

Money muling and laundering are conducted in several ways:

- Job postings on online job boards, emails, social media (e.g. Facebook posts in closed groups, Instagram, Snapchat), or pop-up advertisements that appear to be authentic (like ‘money transfer agents’)

- Direct messages transmitted by email or instant messaging programs (such as WhatsApp, Viber, and Telegram)

- Directly on the street, in person

Fraudsters and criminals mostly target newcomers to the country (often as soon as they arrive), as well as unemployed people, students, and those in financial need.

It has also been seen that the population aged below 35 has been the most affected in these cases of financial crime. For money muling and laundering, criminal organizations and setups have been recruiting the younger generations.

Money muling is an integral part of money laundering and therefore falls under the larger purview of Anti-Money Laundering (AML) procedures.

AML, KYC & CDD – Explained

Anti money laundering, or AML, refers to the due diligence procedures that financial institutions and other businesses must follow to prevent criminals from depositing or transferring monies obtained via illegal activities. AML requirements, in particular, are intended to prevent terrorist financing and proceeds from crimes such as human trafficking.

The more familiar Know Your Customer procedure, or KYC refers to the steps taken by a firm to conduct requisite due diligence processes that guarantee that its customers are who they say they are and do not constitute a risk to the organization.

Even though the terms AML and KYC are frequently used interchangeably, KYC falls under the bigger umbrella term of AML.

The primary distinction between AML and KYC is that AML refers to the whole set of regulatory due diligence processes that enterprises must employ in order to conduct authorized business.

KYC (Know Your Customer) is a smaller part of AML that entails businesses validating their customers’ identity. It’s just one of the steps in the overall AML compliance process.

Customer due diligence (CDD), on the other hand, is only one part of KYC requirements. The first phase of any KYC procedure includes procuring new client information as part of the onboarding process. During this process, businesses collect the required information from their clients & store this information securely.

The second phase is CDD, in which the client’s identity to guarantee they are not impersonating someone else. This stage requires biometric identification, real-time ID verification & a liveness check to ensure that the person is physically present. Businesses can also run a watchlist check to make sure the client isn’t a politically exposed person (PEP) or on any sanctions lists.

KYC & AML are crucial aspects of regulatory compliance for businesses in regulated sectors and are key in creating secure anti money muling procedures.

KYC and AML in Industries

For fraud, money laundering, and other financial crimes to be avoided, KYC and AML compliance are essential. If businesses allow consumers to move money anonymously, the company can be a target for money laundering & money muling, regardless of the operating sector. An efficient compliance program ensures that both the organization and their clients can do business with confidence, whether the organization is a bank, fintech, or marketplace.

Banks are among the most powerful & structurally essential financial institutions. Banks are more vulnerable to financial crimes than other institutions because they handle millions of transactions every day. Money laundering is frequently carried out by criminal groups through banks and other financial institutions via money muling or other forms.

Banks must identify risks by complying with their anti-money laundering & anti money muling duties and taking the required steps. The anti-money laundering (AML) process is crucial to a bank’s financial and reputational status and is required by law by auditors and regulators.

Furthermore, the advent of online payments and the technical revolution in financial infrastructure has increased the necessity for more stringent customer identity protection.

Corporate accounts, like individual accounts, require KYC procedures for identification, due diligence, anti money muling processes, and monitoring.

While the process is similar to KYC for individual clients, the requirements are different; also, transaction volumes, transaction amounts, and other risk considerations are frequently more prominent, necessitating more comprehensive procedures. Know Your Business (KYB) methods are commonly used to implement these procedures.

Video-based KYC verification has become indispensable for businesses to fight fraud, de-risk financial transactions, and combat the money laundering efforts of criminals.

Video KYC: An Antidote to Money Laundering & Money Muling

KYC regulations must be followed in the BFSI sector to prevent fraud and money laundering. These were introduced by the Reserve Bank of India (RBI) and are based on the PMLA Law of 2002 of the Government of India (GOI). Aadaahr eKYC verification made the onboarding process easier for banks & customers, and also substantially decreased the time it took businesses in the BFSI sector to onboard consumers.

However, things changed on September 26, 2018, when the Supreme Court declared the use of Aadhaar-based KYC by private players to be unlawful. Subsequently, the RBI announced Video KYC as an alternative tech-driven way of KYC on January 9, 2020.

One of the most important advantages of video KYC is its ability to effectively prevent fraud. Companies can drastically minimize identity fraud instances and secure their operations by using live video interviews, AI, and facial recognition.

Faking a video is far more difficult, especially if the user is required to match certain conditions, such as holding a piece of paper or repeating a specific phrase. This enables compliance teams to onboard users with confidence.

How Video KYC Bolsters AML Procedures

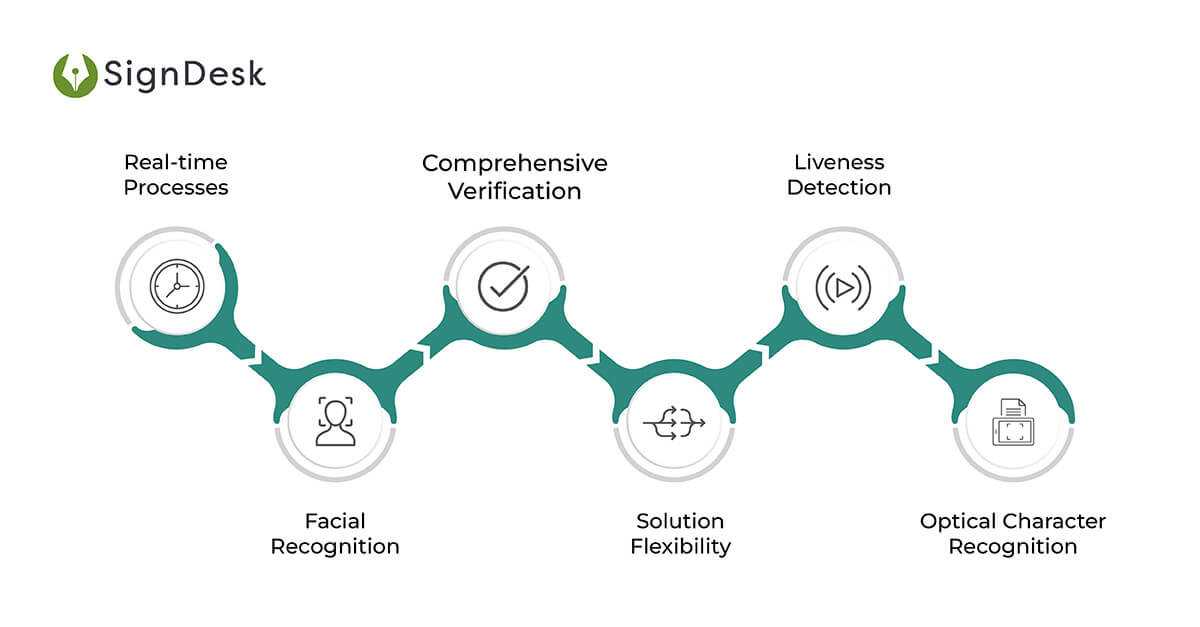

Video KYC solutions leverage a number of features & capabilities to enable financial institutions to fight financial crime, prevent money laundering and establish anti money muling procedures.

- Real-time Processes: Customer identities are verified in real-time using AI-powered verification algorithms with a high level of accuracy, reducing risks of identity fraud and consequently, financial crime and money laundering

- Facial Recognition: Live images of customers are matched with photo-based IDs to a high match percentage, further reducing risks of identity fraud and bolstering anti money muling.

- Comprehensive Verification: APIs run live customer photos across multiple publicly available government databases and use GPS coordinate mapping to verify the person’s identity

- Solution Flexibility: Video KYC solutions support all types of KYC documents including PAN, Aadhaar, Driver’s License (DL), Voter ID, and Passport

- Liveness Detection: To authenticate consumers’ identities, machine learning-based eye-pattern detection that leverages face liveness recognition is used and anti money muling procedures are strengthened

- Optical Character Recognition: The information from various KYC documents is accurately scanned using OCR (Optical Character Recognition).

AI-powered KYC solutions enable a slew of competitive advantages for financial institutions. Smart verification capabilities help banks & NBFCs digitally transform their onboarding process and ensure compliance with AML procedures.

Advantages of Leveraging Digital KYC

- Fast-paced onboarding

According to the Thomson Reuters study, 30% of respondents said it takes more than two months to onboard a new client, while 10% said it takes more than four months. Client relationships are being harmed, the brand is being harmed, and revenue growth is being harmed as some consumers exit the process. All of these criteria benefit from faster eKYC processes.

- Guaranteed Authenticity

Errors slow down the process and increase costs; KYC verification solutions can check for errors automatically and quickly correct them. The anti-fraud capabilities of Video-based KYC verification solutions additionally ensure client authenticity and regulatory compliance with KYC & AML procedures.

- Cost-effective verification

Video KYC enables faster speeds, improved accuracy, and better utilization of compliance resources to provide more value for money and increase scalability.

Switch to Paperless Workflow Today

With cutting-edge compliance technology, SignDesk’s verification solutions have helped our 400+ clients save onboarding costs, reduce KYC drop-offs, shorten TAT by up to 99%, and protect against fraud.

Our efforts to automate KYC have been acknowledged with multiple accolades, the most recent being the Best AI/ML Product at InnTech 2020 and the Best Digital Onboarding Product of 2020 from the Global Banking & Finance Review.

Are you ready to join 60+ major banks and begin using Video KYC for onboarding? Get started by scheduling a free demo with us.