Vendor KYC Verification In Logistics and Supply Management

Excellent logistics and supply chain management are now widely recognized as a critical component of nearly any company’s competitive advantage. Poor logistics performance, on the other hand, can be the demise of an otherwise successful organization when it comes to vendor KYC verification.

The fraudulent activity becomes increasingly complex as technology advances. The remedy, according to regulatory agencies and authorities, is to establish and impose a variety of obligations and constraints on businesses, resulting in greater security standards and harsher laws.

The Know Your Customer (KYC) Portal enables businesses of any size or type to quickly gather all relevant information about the entities and applications they are evaluating. All of this is stored in a single, secure repository with completely customizable parameters, fields, rules, user rights, and collaboration methods.

What is KYC and How Does It Influence Vendor KYC Verification?

Know Your Customer (KYC) is more than just a business practice; it’s a collection of legal requirements directed mostly at financial institutions (but also other businesses). Its primary goal is to ensure that clients’ activities are authentic and that no identity fraud or money laundering is occurring.

Any seasoned procurement manager will know that meticulous attention to detail and the ability to plan for the unexpected are essential. This includes conducting due diligence before purchasing and implementing new technologies, investing in new facilities, or partnering with or acquiring other companies to improve your supply chain. The repercussions of failing to include due diligence as part of a solid risk management plan could be severe.

Supply Chain Management

The movement and storage of raw materials, work-in-process inventory, and finished items, as well as end-to-end order fulfillment from point of origin to point of consumption, are all part of supply chain management in commerce.

The smooth operation of any organization could be jeopardized if business teams don’t have enough information about the suppliers. This is why it’s crucial to know if they participate in unethical behavior, if their reputation could harm anyone else’s, or if their actions could harm the organization’s financial situation. Background checks can help one gain more control over any particular supply chain link.

Screening, on the other hand, is simply one aspect of the due diligence process, and it is sometimes misunderstood as the entire process. Some practitioners are led to assume that simply verifying names against a blacklist is sufficient due diligence and that the process is complete after this screening is performed.

Purchasing, inventories, transportation, warehousing, and technology are all used in supply chain management to successfully manage the complex supply chain entity. Detecting hazards in any supply chain is a difficult task, especially if one has many suppliers in different regions of the world. The last thing an organization wants is a huge number of potential hits with no system in place to follow up on them. This is where KYC Portal enters the picture.

Challenges in Vendor Onboarding

Procurement directors wear many hats and are responsible for a wide range of tasks, from identifying needs to managing vendors and making payments. In the procurement department, there is never a dull moment.

As a result, a procurement manager’s job is filled with obstacles and hurdles. It also means that recognizing and overcoming procurement difficulties is a good use of time, money, and effort because procurement directly impacts a company’s bottom line.

- Risk Mitigation

In the procurement process, supply risk is always a key issue. The most frequent types of risks are market risks, potential frauds, cost, quality, and delivery hazards. Compliance issues such as anti-corruption, policy adherence, and others keep your procurement leaders awake at night.

- Lack of Transparency

When it came to organizing data, spreadsheets were a great place to start, but when one needs a lot more out of them, they begin to fall apart. The first problem that the user can run into is data access. Finding information and keeping track of it across multiple spreadsheets can be difficult. As the amount of data expands, the speed with which the user can access it also increases.

- Insufficient Data

Organizations require accurate and reliable data in order to make sound procurement decisions. Making purchases based on erroneous procurement data can result in inventory shortages, excess inventory, and other procurement issues that can have a direct impact on a company’s bottom line.

Types of KYC Services

The first step in comprehending KYC is to split it down into its numerous components. KYC can be thought of as a catch-all word that encompasses a wide range of activities and methods.

- Know Your Business (KYB):

KYB (Know Your Business) is a variation of KYC that focuses on businesses rather than individuals. KYB is one of the most crucial procedures for a financial institution that engages with businesses, such as cryptocurrency exchanges.

- The Customer Identification Program (CIP):

It is the foundation of a KYC and establishes the fundamental framework and principles for ensuring your customers are who they claim to be.

- Customer Due Diligence (CDD):

This is the procedure for gathering data on a customer and obtaining more detailed information about them. Simplified Customer Due Diligence and Enhanced Customer Due Diligence are two types of customer due diligence.

- Electronic KYC (eKYC):

Electronic KYC, often known as eKYC, is a method of improving KYC by utilizing digital technology, internet services, and data systems. eKYC / digital onboarding is becoming more common, and we’re gradually moving toward a fully digital KYC landscape.

How’s a Vendor Onboarded via Digital KYC?

The supplier onboarding process consists of several key processes involving various parties.

- After the requester’s purchase order has been opened, approval to onboard a new supplier or vendor has been given, and the supplier has been selected, the supplier onboarding process begins.

- After the supplier has been granted authorization to onboard, it’s time for the vendor to be properly onboarded to the company’s ERP system. To do so, the vendor must fill out a vendor onboarding form that includes general information (company name and address, company ID, tax withholding information, and so on); information about the vendor’s points of contact within the company (including their main point person, finance POC, and contact information for each); and financial information (default currency, bank account details, etc.).

- After the vendor submits the data, a member of the company’s financial team must verify that it is accurate. With 50 or more fields on vendor onboarding forms, this stage frequently raises challenges that must be resolved with the vendor.

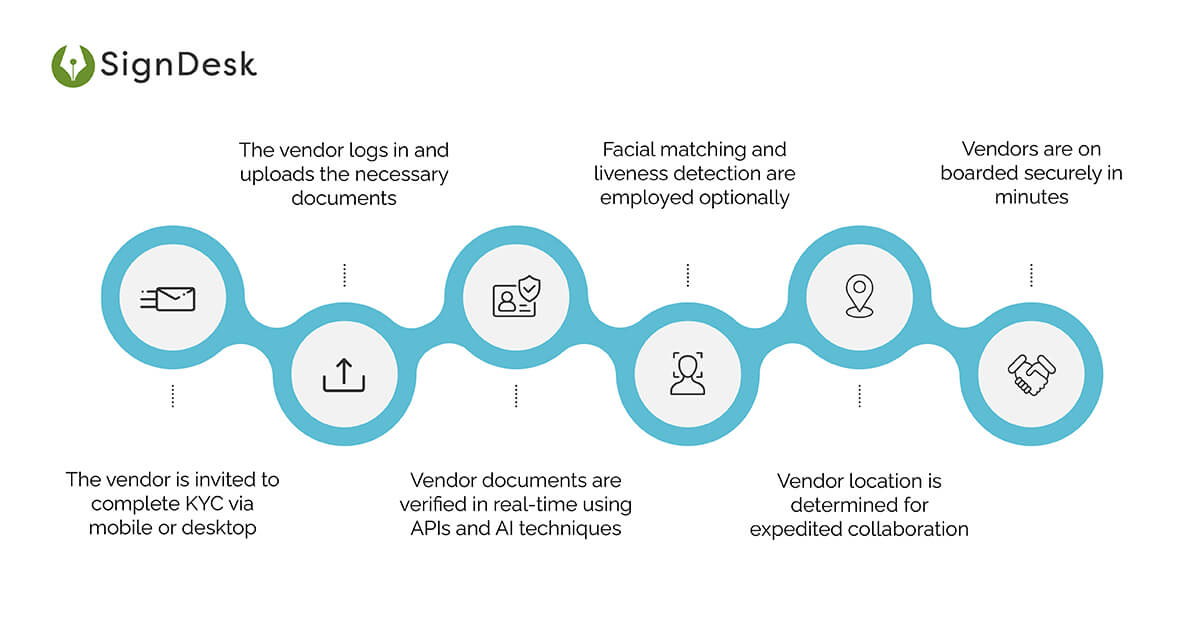

With Video-enabled KYC verification, this process is completed securely within minutes. Here’s how

By leveraging AI-powered KYC verification, vendor onboarding is completed within 5-10 minutes, documents are stored securely for later retrieval, and vendors are verified to a high degree of accuracy and security.

How to Choose a Reliable KYC Provider For Vendor Onboarding?

It’s no wonder that businesses want to delegate this tough but crucial element of their business process to KYC providers. The KYC landscape is quite competitive right now. Let’s get right to the point and discuss what one should be looking at in the first place:

- Jurisdiction:

Once the user has determined which nations’ consumers he/she will be dealing with, the user must see if the chosen KYC provider has direct access to local registries in those countries and what papers they can examine there. The best option is to request a list of countries covered.

- Regulation:

Investigate the legal arena in which the vendor operates and the KYC standards that must be met. The results of the study will help in limiting the options greatly. The user can choose between a basic ID verification and an all-in-one client due diligence method that includes AML, anti-fraud, KYC, and KYB.

- Storage of Data:

Records about residents and citizens of specified countries may be required to be processed and retained in line with the law on a regulatory level. When interacting with consumers from certain countries, the initial collection and storage of personal data must take place within the respective national borders.

To keep in compliance with the law, the user needs to ask a salesperson where their servers are situated and how they manage clients’ data from such nations.

Role of KYC Verification & AML in Distribution and Procurement Processes

What assurances do fintech vendors have that the suppliers they’re financing have undergone a KYC check? Of course, databases like the Office of Foreign Assets Control, PEP, Company Ownership, and others can help, and many people will simply use sanction lists from government sources to incorporate into their system.

However, some forward-thinking Fintech companies have gone a step further and used two-factor authentication throughout the contract signing process, as well as checking to determine if the person is authorized to sign for the organization. They can check with local authorities to see if the person has the authority to sign for the company using an extract from a commercial registry.

Global companies should also look into potential AML issues with their partners and suppliers. Global companies’ AML risks in their supply chain are less significant than in their distribution channel, where they receive money because there is a lower risk than a supplier’s supplier (or vendor’s vendor) is involved in criminal activity and attempting to launder proceeds through the sale of a product or service.

Global businesses are exposed to AML risk due to two main methods of money laundering:

- Trade-based money laundering, in which criminals conceal the source or destination of funds through cross-border transactions.

- Money is sent to or received from a different entity than the services were obtained from or provided to in order to move funds without going via regular banking routes, which are subject to tougher financial controls.

Clear & well-defined processes are critical when adopting KYC. A consistent way of onboarding third parties shows that a company is serious about vendor KYC verification. To provide a strong audit trail of decisions made, all processes should be thoroughly recorded. To avoid duplication of work, a corporation should establish an internal database containing permitted and rejected third parties, vendors, and suppliers.

Beneficial owners sanctions list screening of beneficial owners and relevant entities, politically exposed individuals (“PEP”) involvement, and other government database checks should all be included in due diligence.

To determine whether a customer’s owner is a PEP, worldwide corporations should first identify the customer’s owners, do reference checks, evaluate database sources and Internet searches, and, if necessary, conduct interviews with the individual and maybe additional owners.

EDD on all customers is inconvenient and counterproductive to the goal of a risk-based AML program. Some consumers will, by definition, present lesser risks than others.

The feature of monitoring oversees financial activities and accounts based on risk thresholds established as part of a customer’s risk profile while doing a vendor KYC verification.

Transaction monitoring systems and updating due diligence information every six to twelve months are two best practices for financial organizations.

Adherence to regulations and norms is critical for organizations, particularly for FMCG and retail businesses who contract hundreds of vendors for distribution and procurement on a daily basis. As we’ve seen, rapid and secure vendor onboarding is a necessity for businesses to reduce complexities in their supply chains and ensure compliance with international standards.

FMCG businesses and retailers need a robust and lightweight vendor KYC verification solution to streamline their operations and ensure good vendor onboarding practices.

Scan.it: SignDesk’s AI-Powered KYC Solution

SignDesk’s verification solutions, which use cutting-edge compliance technology, have helped our 400+ clients save onboarding expenses, reduce KYC drop-offs, reduce TAT by up to 99 percent, and safeguard against fraud.

Our efforts to automate KYC have been acknowledged with multiple accolades, the most recent being the Best AI/ML Product at InnTech 2020 and the Best Digital Onboarding Product of 2020 from the Global Banking & Finance Review.

Are you ready to join 400+ major businesses and leverage Video KYC to quickly & securely onboard vendors via the procedure of vendor KYC verification? Schedule a free demo with us to get started.