Recurring Payments Made Hassle-Free: The Benefits of eMandate for Financial Institutions

Technology-based solutions have transformed the finance industry by offering convenient procedures such as eNACH/eMandate. Using eNACH, institutions like banks can effortlessly automate their recurring payments.

The eMandate process is simple, quick, and easy to carry out. The process facilitates high volume periodic customer mandate transfers over the internet to provide a simple yet effective solution for banks.

In addition, the electronic-mandate process offers a high level of reliability, ensuring customers experience a smooth and convenient experience.

By integrating eMandate for financial institutions into their systems, banks and NBFCs can expect smoother transaction cycles, enabling recurring payments on time. The convenience offered by the process can help customers make small value recurring payments digitally, positively impacting financial institutions.

What is eMandate?

To understand what eMandate is, we first need to know what mandate stands for. Mandates are standing instructions you issue to your banks or other financial institutions to automatically debit a certain amount from your account regularly. Such systems are used for payment of loans, maintaining active subscriptions to certain services, etc.

eMandate is a more convenient form of debiting such payments. It is a recurring payment service that enables financial institutions to collect periodic payments digitally. This service was initiated by the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI).

This digital process eliminates the need for businesses and financial institutions to send out reminders to customers. In addition, customers can steer clear of late penalty charges as a result of delayed payments. eMandate for financial institutions thus serves as a win-win solution for banks and their customers.

eMandate Working Process

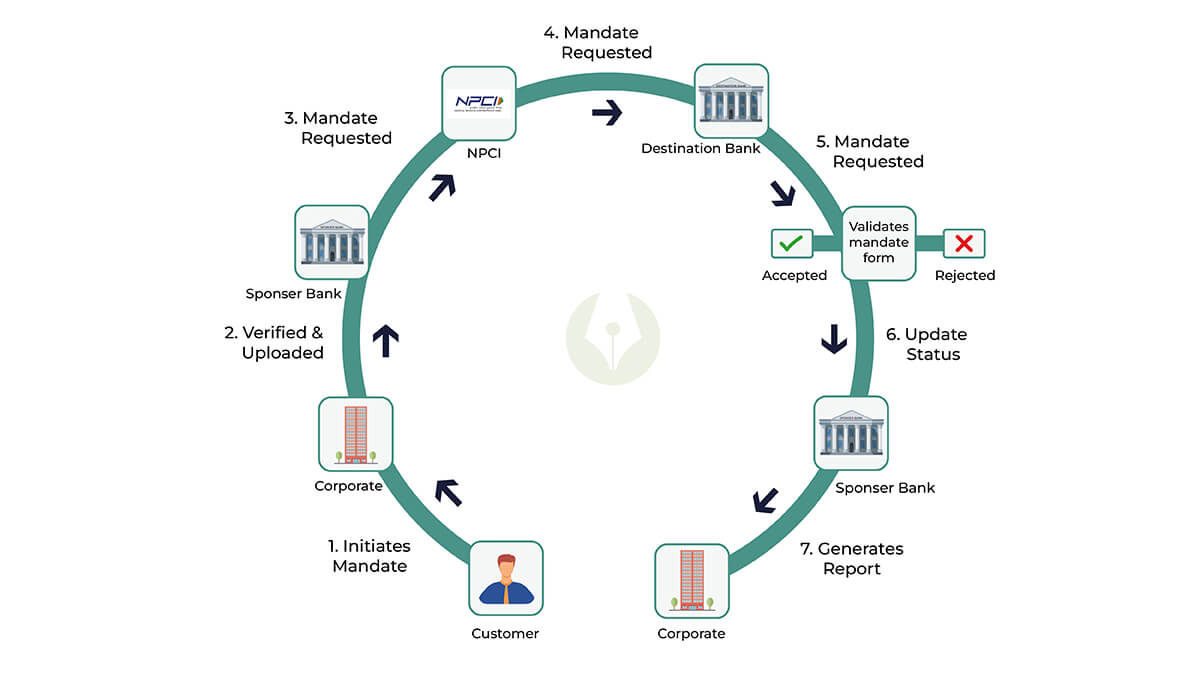

The procedure for carrying out the eMandate process across financial institutions is detailed below. It offers a convenient recurring payment module involving the customer, financial institutions, and the NPCI.

-

eMandate Registration Process

- To initiate the eMandate registration process, the customer needs to raise a request using an eMandate form.

- The business or financial institution sends an authorization request to the customer. Institutions can carry out this process via eMandate portals or digital eMandate solution providers like SignDesk.

- The customer authorizes the request by providing thier debit card details or net banking credentials.

- The obtained details are sent to the sponsor bank i.e., the financial institution that offers a platform for the eNach eMandate.

- The sponsor bank forwards the customer’s eMandate details to the NPCI.

- The NPCI sends the electronic-mandate requests to the issuing bank i.e., the destination bank which holds the customer’s account.

- The issuing bank either accepts or denies the authorization request at this point.

- After that, the issuing bank shares the response status with the NPCI, which in turn shares it with the sponsor bank.

- The response of the eMandate request is then shared with the solution provider, activating the digital mandate request.

-

eMandate Fund Transfer Process

Once the eNACH/eMandate is activated, customers can expect a preset amount to be debited periodically from their accounts. Financial institutions can experience a hassle-free payment cycle that takes place on time.

- The fund transfer for the eMandate is initiated by the solution provider post receiving the response.

- The amount allocated for the eMandate is debited from the customer’s account in the issuing bank.

- The NPCI would then transfer the amount to the sponsor bank.

- The sponsor bank pushes the amount to the eMandate solution provider’s nodal account.

- The received amount is transferred to the financial institution’s account that had requested the eMandate.

How is eMandate Used in Financial Institutions?

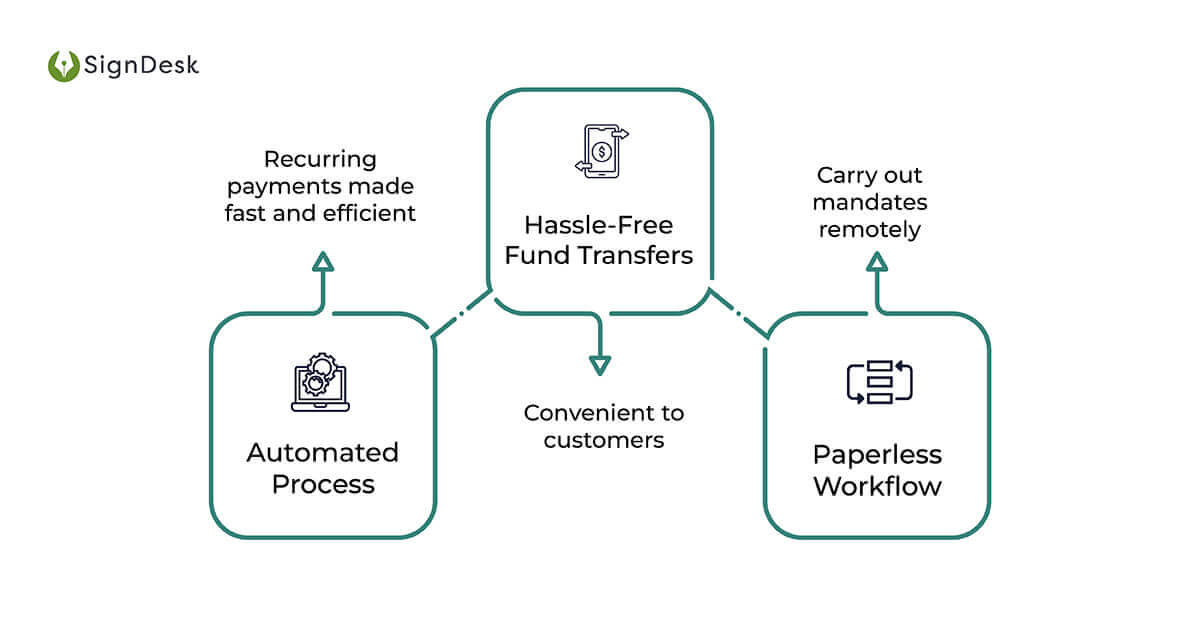

- Automated Process: eMandate is a fast, secure, and reliable way for financial institutions to automate their high volume of debit transactions. Banks & NBFCs can implement this digital process to ensure timely payments and make EMI’s more convenient.

- Hassle-Free Fund Transfers: As one would not have to visit the bank multiple times a year for payments, the customer would prefer to take out a loan from banks and NBFCs that offer convenient EMI payment methods. This module would be highly suitable for customers to manage their active subscriptions to various goods and services.

- Paperless Workflow: The entire eMandate/eNACH procedure is paper-free, from registration to execution. The customer can complete the process remotely just with the presence of a phone/computer and an internet connection.

Top Banks in India Utilizing eMandate/eNACH

Below is an eMandate bank list of the major banking institutions offering eMandates to their customers.

- Yes Bank

- Kotak Mahindra Bank Ltd.

- ICICI Bank Ltd.

- IDFC First Bank Ltd.

- Axis Bank

- Citi Bank

- Bank of India

- IDBI Bank

- Union Bank of India

- Bank of Baroda

You can check out the NPCI eMandate Bank List to learn more about the various banks using eNACH/eMandate services in India.

Role of NPCI in eNach eMandate

The NPCI or National Payments Corporation of India is a governing body that regulates eMandate procedures in the country. It plays an important role in overseeing the various activities pertaining to eMandates. Some of its responsibilities include,

- Maintaining eMandate records for future reference and use

- Amending and canceling eMandates

- Amending procedural guidelines surrounding the eMandate process

- Levying membership and transaction charges

- Notifying member banks

- Imposing penalties for non-adherence to the eMandate procedural guidelines

- Terminating/suspending NACH memberships in the case of non-compliance or violation from the member banks or businesses.

Conclusion

The benefit of implementing eNACH procedures is that financial institutions can observe a reduced turnaround time concerning their customers’ debit payment transactions. Bulk transactions would become much easier to manage, as the process of eNACH/eMandate for financial institutions is safe and reliable. This digital recurring payment model can also aid in reducing operational costs, making it a desirable proposition for the finance industry.

Contact one of our sales professionals to learn more about how eMandate works.

Book a free demo with us now!