Introduction

The Reserve Bank of India (RBI) has released it’s Digital Lending Guidelines 2022, for all commercial and co-operative banks, and NBFCs (Non-Banking Financial Companies).

The guidelines lay out new compliance requirements for digital lenders when it comes to collecting and processing customer data, and the disclosures to be made to borrowers.

The guidelines also make it mandatory for financial institutions (FIs) engaged in digital lending to send digitally signed copies of certain loan documents to the borrower before executing the loan agreement.

These documents are part of the disclosures that are aimed at increasing the overall confidence in the digital lending ecosystem.

For a detailed look at what the Digital Lending Guidelines 2022 mean for banks and NBFCs, read our article here.

List Of Loan Documents To Be eSigned

The RBI has listed the following loan documents to be digitally signed before executing the loan.

- The Key Fact Statements (KFS)

- The summary of the loan product

- Loan sanction letter

- Terms and conditions of the loan

- Account statements

- Privacy policies of the FI & any fintech lending partners

Once eSigned, these documents are to be sent to the borrower’s email address or phone.

What Is Key Fact Statement (KFS)?

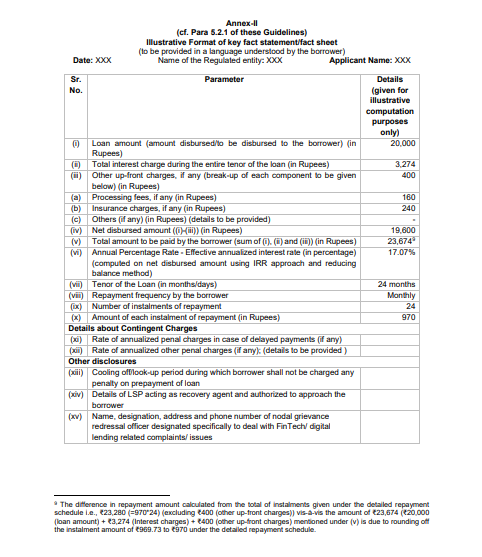

A Key Fact Statement (KFS) is a pre-loan execution document to be disclosed to the borrower as part of RBI’s Digital Lending Guidelines 2022.

Key Fact Statement (KFS) contains several relevant loan details and is meant to offer borrowers clarity about the terms of the loan and act as a comprehensive source of information regarding the loan.

Here’s what a KFS should contain.

- Loan amount

- Total interest

- Insurance, processing & other charges

- APR

- Amount to be paid by the borrower

- Cooling off period

- Loan tenor & other essential details

Template for KFS Document, Source: RBI

Here’s how digital lenders can get these loan documents eSigned on the go

Steps To Digitally Sign Loan Documents

Step 1: Integrate With a Certifying Authority (CA)

Digital signatures can only be offered by CAs who have been authorized to do so by the Comptroller of Certifying Authorities (CCA).

Only registered CAs can create Digital Signature Certificates (DSCs) and offer the resulting public and private keys to clients. These keys are then used to digitally sign the required documents.

For a deep dive into the various types of DSCs, read our article here.

Once FIs have integrated with a CA, they can proceed with digital signatures.

Step 2: Upload Loan Documents

After logging into the digital signature portal, teams upload loan documents in bulk and preview the documents on the portal.

Alternatively, teams can create these documents on the platform using extensive loan template libraries.

The document status is viewed and managed on the smart dashboard.

Step 3: Invite Multiple Signers

Once documents are ready to be signed, stakeholders are invited via email and SMS to eSign.

Signers are invited to sign either in sequence or in parallel. All these touchpoints with respect to the document are recorded in the audit trail for the document. This enables efficient auditing in the future.

Step 4: Sign Several Documents At Once

The signers preview the document and can optionally request changes to the document. Once these changes are made, signers utilize either Aadhaar signatures or their private keys to digitally sign the document.

A signature certificate is generated once all the signers have signed. This contains the information of the signers (names, location, IP address), date and time stamps for signatures, the algorithms used for encryption, and more.

The same can be used to verify the authenticity of the signed document using the public key.

Step 5: Download eSigned Documents

eSigned documents are sent to the email addresses and phones of the relevant stakeholders. They are then downloaded and stored for due diligence purposes.

This completes the digital signature process, within 5-10 minutes.

Why FIs Need To Integrate With E-Signatures

Integrating with eSign workflow solutions has enabled several FIs to automate their loan documentation and reduce the overall costs associated with loans by 2-5%.

Several benefits are associated with digital document execution.

- Faster Loans

eSignatures enable documents to be signed quickly from anywhere and at any time. Stakeholders are invited over mail to sign and the process takes less than a minute to complete.

This helps FIs get loans out faster, with all the required documentation ready and stored for future reference.

- Improved Document Management

All loan documents are digitized, stored securely, and managed easily on a smart dashboard. Client profiles may be created on the dashboard and every loan document is tracked through various stages.

Teams receive real-time alerts when a document is drafted, ready for signatures, and when signatures are completed. This helps streamline the loan documentation process & offers improved visibility and controls to executives.

- Strong Audit Trails

By digitizing loan documentation with digital signatures, FIs can ensure the presence of a virtual audit trail for all documentation activities. This helps FIs comply with the RBI’s digital lending guidelines and improve overall audit efficiency.

- Increased Organizational Efficiency

eSign-enabled documentation platforms help FIs increase productivity and efficiency. Loan documents are created, tracked, signed & managed on a single solution; this helps businesses scale in a way that’s cost-effective.

Additionally, with eSignatures in place, FIs needn’t rely on operations teams to manually handle loan documents. Instead, resources can be allocated toward more crucial tasks and teams can manage all their loan documentation activities on a digital platform.

Start eSigning Loan Documents Today

Banks & NBFCs looking for a lightweight and robust eSign solution needn’t look any further.

SignDesk is a CCA-certified provider of digital signatures, with industry-grade SHA and AES cryptosystems. We offer secure and streamlined eSign workflows that can be customized according to client requirements.

Loan documents are either uploaded in bulk or created using template libraries, and then multiple stakeholders are invited to eSign. The document status is tracked in real-time and documents are all managed on a smart dashboard with real-time alerts for activities.

Signers can affix their eSignatures either using Aadhaar or the public/private keys. Once eSigned, document authenticity is verified using the digital signature certificate. A virtual audit trail is recorded for all document-related activities.

Book a free demo with us and digitize your loan documentation today!