DigiLocker: A Gateway to Authentic Digital Documents

DigiLocker is a secure digital platform authorized by the Government of India as the official online digital document repository. The platform was launched in 2015 as a flagship initiative of the Ministry of Electronics & Information Technology (MeitY) under the Digital India Programme.

Indian citizens can use DigiLocker to store a variety of government-issued documents, such as Aadhaar cards, driving licenses, vehicle registration certificates, educational certificates, and more, in electronic format. These documents are linked to the user’s Aadhaar number, ensuring authenticity and security.

The DigiLocker API can be used by authorized entities (banks, insurers, financial institutions & other regulated entities) to view and verify Aadhaar and other uploaded documents. The API is a convenient alternative for customers wary of manually uploading their Aadhaar and also enables onboarding entities to speed up KYC verification.

The issued digital documents in the Digilocker system are equivalent to the original physical documents according to Rule 9A of the Information Technology (Preservation and retention of Information by Intermediaries providing Digital Locker facilities) Rules, 2016, notified on February 8, 2017, vide G.S.R. 711 (E).

The Purpose and Function of DigiLocker

DigiLocker is used for secure and convenient digital storage of important documents issued by the Indian government. It is a centralized platform where Indian citizens can electronically store, access, and share government-issued documents.

According to the latest statistics, Digilocker has 178.56 million registered users and 5.93 billion issued documents and is tied up with 1679 issuer organizations. A total of 631 document types are part of the digilocker platform. Users can easily access digital documents based on different categories.

- Central Government

- State Government

- Ministry of Defence

- Transport Departments

- National Service Schemes

- Identity Documents

- Education and Learning

- Banking and Insurance

- Health & Wellness

- Sports & Culture

- Government & Public Sector

- Industry & Private Sector

Among all categories, the most popular and most issued documents the digilocker platform offers services for include the Aadhaar Card, UAN, policy document, PAN Aadhaar Link verification, Driving License, two-wheeler insurance policy, Covid Vaccine Certificate, Class X & XII Certificates, Registration of Vehicles, Ration Card, Residence Certificate, Caste Certificate, Income Certificate, and so on.

Digilocker plans to broaden the range of its services. It will soon store income-tax returns, Employees’ Provident Fund Organisation statements, and Mahatma Gandhi National Rural Employment Guarantee Act (MGNREA) job cards.

The Digital Empowerment Wave: How DigiLocker is Taking Center Stage

As an initiative by the Government of India, DigiLocker is a trusted and reliable digital document storage platform. The government’s push towards digitalization and paperless vision help DigiLocker to spread its digital services to pan India. It aligns with the Digital India program, which aims to transform India into a digitally empowered society.

DigiLocker documents are widely accepted as valid proofs by various government departments, regulators, institutions, and other organizations, offering a vast scope for interoperability. Documents are issued directly by the registered issuers such as UIDAI, Registrar’s Office, Income Tax department, and other government entities. Thus, DigiLocker receives strong support and promotion from the government, increasing its visibility and credibility.

Users can access digilocker documents anytime & anywhere using multiple devices, ensuring convenience and reducing paperwork. With DigiLocker, users can easily submit digital copies of their documents for various purposes, such as applying for jobs, educational institutions, or government services. This reduces the need for physical copies and minimizes bureaucratic delays and inefficiencies.

DigiLocker API integration with fintech services fosters financial inclusion and supports India’s rapidly growing digital financial sector. Digilocker API is a secure and accessible digital document storage solution that facilitates the country’s digital transformation and administrative efficiency.

DigiLocker API in Action: Step-by-Step Guide to its Functionality

The DigiLocker API allows authorized organizations or entities to verify the authenticity of a user’s documents directly from DigiLocker. This streamlines document verification processes for government agencies, educational institutions, and other organizations.

The API allows authorized applications to access and interact with a user’s documents stored in DigiLocker, facilitating seamless document management and verification processes.

Developers must register their applications on the DigiLocker Developer Portal and obtain API credentials (Client ID and Client Secret). These credentials are used to authenticate and authorize the application to access DigiLocker services on behalf of the user.

The user must provide explicit consent before the application can access a user’s DigiLocker documents. When the application requests access to the user’s records, DigiLocker displays a consent screen to the user, explaining what data the application will access and what actions it can perform.

Here’s how SignDesk’s DigiLocker API works:

- Step 1. Request for Verification – The organization requests document verification of an individual or entity for Digilocker API documentation.

- Step 2. Digilocker API SDK – The organization receives SignDesk’s integrated DigiLocker API SDK and API credentials via email.

- Step 3. Input Data – The user is directed to the verification portal to log in to the system using the registered mobile number. Once the user grants consent, the application can use the API to access the user’s documents.

- Step 4. Retrieve and Match – The user’s request for specific document verification is processed by quickly retrieving and matching the same document stored in the Digilocker database.

- Step 5. Document Verified – Organizations can verify an individual’s identity using any ID document. Based on the verification status, the user gets confirmation of legitimacy. In affirmative verification, the individual’s name, gender, DOB, and address are fetched as output data.

Understanding the Differences Between DigiLocker and Aadhaar API

Both DigiLocker Verification API and Aadhaar API play crucial roles in digital authentication and verification in India. But the methods and coverage differ based on their functionalities.

- DigiLocker-based Verification API – With an encrypted API SDK, the clients can access the verification portal, where they must input the Mobile Number of the registered user & an OTP sent to the registered number associated with the digilocker account. The Digilocker API retrieves user data from the DigiLocker database.

The intelligent platform matches the data, and the user can get the verification status instantly. After successful authentication, the system also provides specific demographic information regarding the verified individual, such as name, gender, DOB, and address.

SignDesk provides two types of Aadhaar API solutions:

- Aadhaar OCR Extraction API: This service takes a soft copy of an Aadhaar document as input and uses OCR technology to extract key details such as Name, Gender, Address, and Date of Birth (DOB). These extracted details can be used to streamline user onboarding and eliminate manual data entry.

- Aadhaar Verification with OTP API: This service requires users to input their Aadhaar number, client ID, and OTP received on their registered mobile number. The API verifies the authenticity of the Aadhaar number and OTP, checking if they are valid and correctly matched. The output includes details like verification status, gender, address, face score (if biometric data was verified), profile image, mobile number hash, zip data (postal code), care of (C/O) information, Share code(for consent-based data sharing), and Date of Birth (DOB). This process enables secure identity verification for e-KYC, financial transactions, and government schemes while maintaining user privacy and consent.

| Comparison Factors | DigiLocker API | Aadhaar API |

|

Document Verification is based on data available on the DigiLocker database. | Identity Verification based on Aadhaar number and biometric data. |

|

API Credentials (Client ID & Encrypted Password Key). | Aadhaar card & number |

|

Explicit consent to access DigiLocker Documents | Permission to share biometric data |

|

Data is retrieved from the Digilocker database for cross-verification | Data is extracted, retrieved, and matched from the UIDAI database |

|

Verification of government-issued official documents | Mainly used for eKYC verification process |

Paperless Efficiency: How DigiLocker API Simplifies Document Verification

DigiLocker’s growing popularity can be attributed to several key factors which set it apart from traditional storage and document management platforms.

DigiLocker provides numerous benefits, such as easy remote access to documents, secure storage, reduced paperwork, and faster document verification processes. It eliminates the need for physical copies of documents and promotes a paperless ecosystem. The platform is widely accepted by various government departments, organizations, and agencies as valid proof of identity and address for official purposes.

- Convenient Access : Users can access their documents anytime and anywhere using DigiLocker’s web mobile application, reducing the need for physical document handling.

- Secure Cloud Storage: DigiLocker ensures the security and privacy of documents with advanced encryption and authentication measures. Document data is securely stored in built-in cloud storage in DigiLocker, reducing the risk of loss or physical damage.

- Authenticity : Government-issued documents in DigiLocker are electronically signed and linked to the user’s Aadhaar, ensuring their validity and allowing users to share documents online conveniently. It adds an extra layer of security to the platform and reduces the likelihood of unauthorized access.

- Paperless Interaction : DigiLocker promotes a paperless ecosystem by allowing users to electronically store and manage their important documents and eliminating the need for physical copies. This not only reduces paper wastage but also contributes to environmental conservation.

- User-Friendly Experience : DigiLocker API integration offers a simple and intuitive interface that caters to users of varying digital literacy levels. This user-friendly experience encourages a broader audience to adopt the platform by providing a convenient and efficient way to digitally access and manage important documents & Digilocker API documentation workflow.

Empowering Citizens with DigiLocker

- Easy Access to Important Documents Citizens can access their essential documents anytime, anywhere through the DigiLocker platform.

- Legal Equivalence:: Documents stored in DigiLocker are legally recognized and considered equivalent to their physical counterparts.

- Controlled Document Sharing : Citizens can securely share their digital documents with authorized entities using DigiLocker’s consent-based system.

- Expedited Service Delivery : DigiLocker facilitates faster service delivery for government benefits, employment, financial inclusion, education, and healthcare.

- Enhanced Convenience : DigiLocker streamlines document management, reducing the need for physical copies and paperwork.

Advantages of Using Digilocker API for Government Agencies

- Streamlined Administration: DigiLocker promotes paperless governance, reducing administrative overhead and minimizing paper usage.

- Digital Transformation: Trusted issued documents are available in real-time through DigiLocker, directly fetched from the issuing agencies.

- Secure Document Gateway : DigiLocker is a secure document gateway, facilitating exchange between trusted issuers and Requester/Verifier with user consent.

- Real-Time Verification : The platform includes a verification module enabling government agencies to verify data directly from issuers after obtaining user consent.

- Enhanced Efficiency : DigiLocker API integration streamlines document verification, leading to faster service delivery and improved operational efficiency.

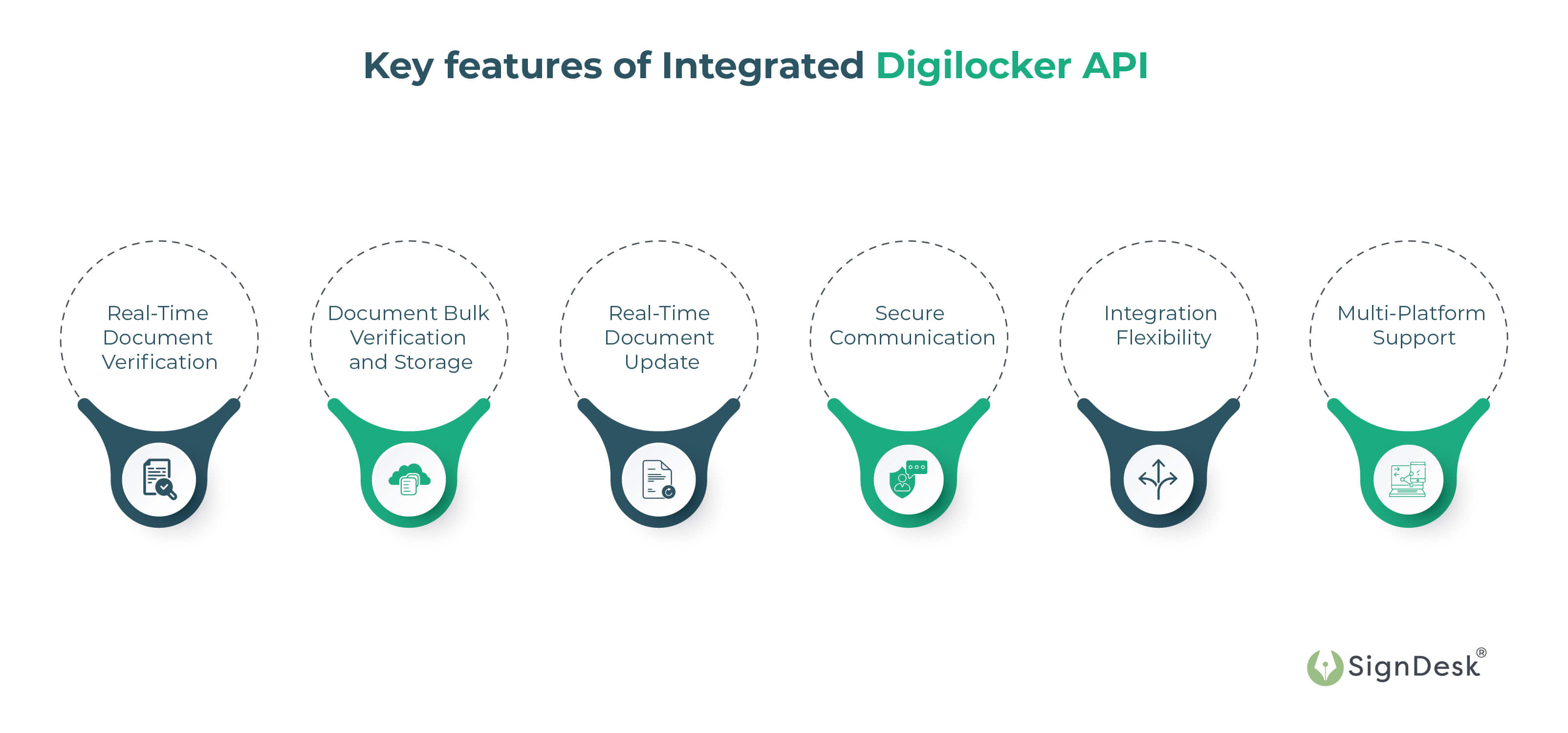

Key features of Integrated Digilocker API

We offer low-code easy integration of the DigiLocker API into the systems of organizations to offer features like document storage, retrieval, verification, and Digilocker API documentation. Here are some unique aspects that make it a preferred choice among users.

- Real-Time Document Verification : DigiLocker API allows authorized applications to instantly verify the authenticity of government-issued documents stored in a user’s DigiLocker account. The API enables direct communication with issuing agencies to perform real-time checks on the smart API platform, ensuring secure and real-time verification of documents and enhancing trust and efficiency in document exchange processes.

- Document Bulk Verification and Storage : The API lets users store and access documents remotely in their DigiLocker account and share them securely with authorized entities, ensuring a smooth document exchange process. With the DigiLocker API, applications can verify and handle multiple verification workflows.

- Real-Time Document Updates : Users and organizations can receive real-time updates for their document verification status during the authentication process. The user gets instant error codes and failure notifications if there is any error during the verification.

- Secure Communication : Our Digilocker API platform ensures high security and data privacy, which is essential for handling sensitive documents. All interactions with the DigiLocker server through the API are conducted over secure HTTPS connections, guaranteeing the confidentiality of data during transmission. It uses stringent security protocols, encryption techniques, and user authentication to protect the data stored within the platform, giving users confidence in its reliability.

- Integration Flexibility : The DigiLocker API can seamlessly integrate into various applications and systems, providing a flexible verification solution. The API allows easy integration into many applications, including government services, financial institutions, educational platforms, and more. Users can access and share their official documents directly with government agencies and educational institutions. Digilocker API integration saves time and effort in accessing and submitting documents for various purposes.

- Multi-Platform Support : Digilocker API is designed to work across different platforms, including web and mobile applications. The API is designed to handle large volumes of data and traffic, ensuring reliability and scalability for all users.

DigiLocker API’s innovative document management approach focuses on security and privacy, government services integration, and commitment to sustainability. By incorporating these features into organizational applications, developers can harness the full potential of the DigiLocker API integration, providing users with a seamless and secure digital document management experience.

DigiLocker API: A Secure and Efficient Identity Verification Solution for Banks and Insurers

In the 2023-24 Budget presentation, Union Finance Minister Nirmala Sitharaman proposed the establishment of an “Entity DigiLocker” to cater to MSMEs, large businesses, and charitable trusts. This expansion aims to facilitate secure online storage and sharing of documents with various authorities, banks, and business entities.

The government also plans to create a one-stop solution for identity and address reconciliation using DigiLocker and Aadhaar as foundational identity. Additionally, the scope of documents available in DigiLocker for individuals will be broadened to support more fintech services.

A risk-based approach will replace the ‘one size fits all’ method to simplify the KYC verification process. These measures aim to strengthen India’s digital infrastructure, promoting financial inclusion, digilocker API documentation, and digitization for institutions and consumers.

Banks, insurers, and financial institutions can follow a simplified KYC process under digital public infrastructure leveraging digilocker API to execute KYC verification. The software solution providers act as a third-party platform or requestor integrated with the Digilocker system and retrieve user data to authenticate documents.

Ensure Document Integrity with SignDesk’s Integrated DigiLocker API

SignDesk is a SaaS-based software and application solution provider, helping business organizations in various industry segments with digital documentation solutions.

SignDesk provides API-based solutions for individual & entity verification, such as Identity Verification APIs (Aadhaar Verification API, PAN Verification API, Passport Verification API, Driving Licence Verification API, UPI Verification API, GST Verification API), Aadhaar Masking API, DIN Verification API, CIN Verification API and Digilocker API to verify any government-issued documents.

Leap towards digital transformation and integrate your business applications with smart document verification management using Digilocker API for fast and secure authentication.