Onboarding with GST Verification API – A Brief Overview

The onboarding processes implemented across today’s businesses are built on the concept of KYC, i.e “know your customer” or “know your client.” Due diligence procedures make up the bulk of KYC verification – collecting preliminary client details, checking various identifying documents & monitoring financial activities are the prerequisites for customer due diligence.

When it comes to verifying business entities, GST verification is a convenient option.

Most businesses register for GST (Goods & Services Tax), registration is mandatory for businesses exceeding a turnover of Rs. 40 lakh. Once businesses are registered, each one obtains a unique identification number canned GSTIN.

The GSTIN can be used to identify registered businesses and verify certain key details including – Business name, address, date of registration, and more.

Integrating with a GST verification API enables businesses to conduct KYC using the GSTIN or a GST certificate. The API uses the GSTIN as input to obtain & verify business KYC; alternately the API can extract data from the GST certificate and validate these data instantly.

Are API Integrations Necessary For Modern Enterprises?

Studies have shown that 83% of companies consider API integration a critical part of their business strategy.

Automating KYC verification with APIs not only saves time but also helps businesses manage to onboard more effectively. Companies can use API integrations to seamlessly integrate digital KYC into their client journeys and databases.

Document verification APIs, such as the GST number verification API and the Aadhaar XML generation API, is used to validate data from uploaded or scanned documents following image data extraction.

APIs are functional and lightweight alternatives to the bulky paperwork typically involved in KYC verification. Businesses don’t have to rely on third parties for integration and can get their onboarding operations up & running in days.

The back-end process for verification APIs is intuitive and leverages state-of-the-art technology:

- Once a document image is uploaded, OCR technology is used to scan the relevant data and convert these into machine-readable text

- An identifying characteristic (DL number, GSTIN, Passport number, etc) is then used to retrieve stored data from a trusted database

- These two sets of data are then compared and matched using data aggregate match algorithms to determine if the KYC information supplied is accurate.

- If the two sets are a match, KYC is verified.

APIs digitize the onboarding process, making it quick and efficient. The client profiles verified using APIs can then be accessed on a smart dashboard, with digital copies of KYC documents also available.

Digital KYC solutions such as APIs are crucial for businesses looking to expand their operations and streamline onboarding. A GSTIN verification API is particularly useful when onboarding vendors or client businesses.

What is a GST Verification API?

A GST Verification API is a digital solution enabling businesses to complete KYC by verifying a registered company’s GSTIN number.

The API typically accepts the GSTIN as the API request and responds with validated data such as the GSTIN, Business Name, Constitution of Business, Address, and so forth. The GST extraction API use OCR features to retrieve information from the front of the GST certificate and verify this information. Hence, businesses can verify GST numbers using this API.

Top Three GST Verification APIs for Digital Onboarding

Businesses can verify GST numbers using these three GST number verification APIs. These APIs help businesses accelerate client onboarding by automating document verification and data management.

Here are the top three APIs for GST number verification. The GST Verification API functions by sending a request and receiving a response.

GST Verification API

This API takes the GSTIN of a business as the input. The following validated data is included in the output of the API:

- GSTIN

- Business Name

- Constitution of Business

- Address

- Date of Registration

- Taxpayer Type

GST Extraction API

Using OCR, this API reads the front side of the GST Certificate and extracts pertinent information. The following extracted data is included in the API response:

- GSTIN

- Business Name

- Constitution of Business

- Address

- Date of Registration

- Taxpayer Type

API for GST Extraction and Verification

Using OCR, this API also reads the front side of the GST Certificate and extracts KYC data such as GSTIN, date of registration, and Business Name. Following extraction, the data is checked using standard databases.

The API response includes the following validated data:

- GSTIN

- Business Name

- Constitution of Business

- Address

- Date of Registration

- Taxpayer Type

Linking with GST verification APIs has assisted firms in reducing onboarding TAT by up to 50% and lowering paperwork costs. The GST verification API’s seamless workflows have also helped organizations boost efficiency and productivity.

How To Onboard Clients Using GST Verification APIs

GST authentication can be completed by entering the information found on the GSTIN or by uploading a photograph of the front side of the GST certificate, which is then scanned using an AI-based OCR.

Once a business has integrated with a GST verification API, the KYC verification process becomes quick and simple.

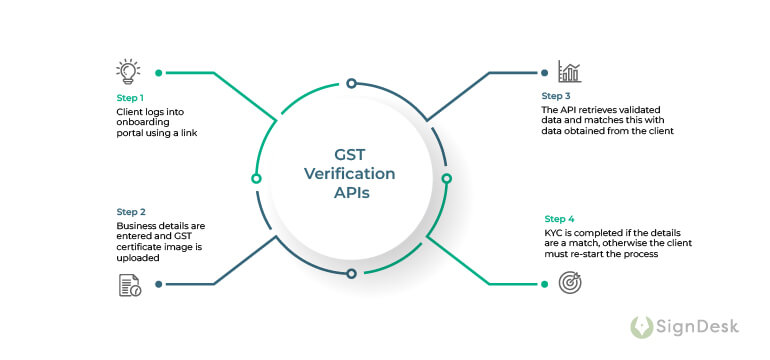

The steps involved are as follows:

Step 1: The client logs into the onboarding portal using a link

Step 2: Business details are entered and the GST certificate image is uploaded

Step 3: The API retrieves validated data and matches this with data obtained from the client

Step 4: KYC is completed if the details are a match, otherwise the client must re-start the process

SignDesk’s workflow may be linked with any application to provide instant access to our AI-powered solutions.

Once onboarding is completed, invite clients to eSign documents online with eSign API and minimize the dangers associated with wet signing and physical documents, such as fraudulent signatures, manual errors, delays, and more.

Clients in the banking and financial industries have seen 45% faster onboarding rates and an increase in productivity as a result of API-based seamless documentation workflow.

Why Should Businesses Leverage the GST Verification API?

To evaluate credibility, all financial institutions must check the GSTINs of clients and partner businesses before starting commercial activities. The GST Verification API makes this process simple and reliable. This will assist in determining the customer’s genuineness while preventing any fraudulent acts.

Furthermore, most regulatory organizations recommend that specific institutions and entities use online GST verification API tools to verify their clients’ identities and that their account is valid. All that’s required for this process are the client’s selective credentials.

The Advantages of using the GST Verification API

- The API is robust, lightweight & requires zero third-party assistance for integrations

- It’s quick and reliable – GSTIN verification is completed near instantly with a high success rate

- APIs can be easily integrated into key touchpoints in any process, not just onboarding. In case client verification is required for account changes, APIs can do the job.

- APIs help businesses scale up and digitally transform crucial client-facing activities such as onboarding. By integrating with APIs, businesses can move resources away from client KYC and towards achieving growth.

- GST verification APIs produce clean KYC data and enable efficient documentation. The data received are easily managed on a smart dashboard and secured by adhering to the most stringent international protocols.

Scan.It: SignDesk’s AI-Powered KYC Verification Solution

SignDesk’s APIs can be integrated with any organization’s website or application via Scan.It creates seamless onboarding experiences.

Our video-enabled KYC verification solution offers customizations for VCIP, VBIP, and VIPV; enabling real-time customer authentication using smart verification algorithms. We also offer customizable KYC workflows, bulk KYC upload, and a separate auditing portal during KYC.

Enterprise-ready KYC is guaranteed with SignDesk’s verification APIs for PAN, UPI, DL, Udyam Aadhaar, Bank account, FSSAI Verification, Pan Aadhaar Link Verification, Aadhaar & more.

Over 80 of India’s biggest private banks use our API-integrated solutions including GST verification APIs. Book a free demo of the GST verification API and start your digital journey today!