In Maharashtra, stamp duty errors can cost you ₹50 lakh or more. One missed date- one error, and you lose lakhs. This is the harsh reality of an unpaid stamp duty penalty landing on your desk.

Maharashtra allows the simultaneous payment of stamp duty and registration fee via eSBTR (Electronic Secure Bank & Treasury Receipt). A secure, bank-integrated alternative to eStamping, available only in this state. Both eSBTR and eChallan facilitate digital payments. But should you opt for eSBTR or eChallan when making stamp duty payments?

Used by 85% of top Indian enterprises, eSBTR ensures faster compliance, lower risk, and zero paperwork. SignDesk, India’s trusted digital documentation platform, enables compliant and secure stamp duty automation with zero delays.

In this article, we decode eSBTR vs eChallan and simplify the process. Check how SignDesk enables enterprises to stay fully compliant in under 10 minutes.

Stamp Duty in Maharashtra: eSBTR vs eChallan—What’s Legally Safer for Your Business?

Stamp duty is a mandatory tax levied on certain types of legal documents. It ensures official recognition of transactions between two or more parties. It validates agreements and makes them legally enforceable.

As per Section 3, Indian Stamp Act, 1899, stamp duty must be paid in full and on time. Delays or shortfalls can lead to penalties and legal disputes. Such delays impact project timelines and business credibility.

Stamp Duty Varies by State, Region & Demographic

Stamp duty changes based on geography and even gender.

For example, in urban Haryana, men pay 8%, while women pay 6%. However, in rural Haryana, men pay 6%, and women 4%. These stamp duty variations support state-specific fiscal policies.

Why Is It Still Relevant Today?

Before the introduction of income tax and GST, stamp duty was a primary source of revenue for state governments. Even today, it funds infrastructure, public services, and development projects, making it an essential compliance item for all legal and property-related transactions.

Traditional vs Digital Stamp Duty Payments: Key Differences

Traditional stamp duty methods—such as franking or using physical stamp paper—are slow, insecure, and compliance-heavy. They require manual steps, physical visits, and offer little to no audit trail. In today’s fast-moving and risk-sensitive business environment, this just won’t cut it.

|

Factor

|

Traditional Payment

|

Digital Payment (eStamping/eSBTR)

|

|

Processing Time

|

2–3 days with manual steps

|

Instant or same-day

|

|

Fraud Risk

|

High (fake papers, tampering)

|

Negligible (bank-issued, secure)

|

|

Legal Validity

|

Often questioned without proof

|

Fully compliant with audit trail

|

|

Access & Reach

|

Limited to physical offices

|

24×7 online availability

|

|

Operational Cost

|

High (travel, delays)

|

Low (faster TAT, digital efficiency)

|

Today, digital methods like eStamping are preferred for their speed, traceability, and cost-effectiveness. eStamping is recorded and managed by SHCIL, India’s central record-keeping agency, ensuring data security and reducing turnaround time.

Maharashtra eStamping

Maharashtra does not allow eStamping, as the SHCIL license wasn’t renewed. Instead, the state has introduced the eSBTR process as a robust, secure, and legally equivalent alternative. Maharashtra officially launched the Electronic Secured Bank and Treasury Receipt (eSBTR) system on July 26, 2013.

eSBTR Meaning: Why It’s a Game-Changer for Compliance

eSBTR full form is abbreviated as Electronic Secure Bank & Treasury Receipt. It is an online stamp duty payment Maharashtra service.

eSBTR is printed on secure stationery paper provided by the Indian Security Press. It comes with built-in security features that include a watermark, background tint, perforated document logo, micro security threads, and more.

Only the following authorised banks are integrated with eSBTR stamp duty payment Maharashtra: IDBI Bank, Canara Bank, Punjab National Bank, and Bank of Maharashtra. However, eSBTR is offered by eSBTR service providers who have integrated with these banks.

What is eChallan in the Context of Stamp Duty?

eChallan is an electronic challan, considered a simple online receipt. It is collected upon paying the registration fee online for the documentation process. The Registration Act, 1908, consolidates the validity related to the registration of documents.

The eChallan for registration procedure involves providing the following documents –

- Identification documents of both the seller and the buyer

- Original deed document with two photocopies to the sub-registrar’s office

- Stamp duty payment Maharashtra proof

- Details of the transaction payment

- Khata certificate with the tax receipts paid

When the customer provides the above documents, they are issued a receipt containing a unique serial number, which concludes the Maharashtra stamp duty registration process.

eSBTR vs eChallan – Choose the Right Stamp Duty Method in Maharashtra

The choice between eSBTR and eChallan is a strategic decision. Selecting the right payment method is critical for speed, security, and compliance.

However, here’s how they differ –

|

Factor

|

eChallan

|

eSBTR

|

|

Security

|

Printed on plain paper; vulnerable to tampering

|

Printed on secure, tamper-proof stationery with embedded security features

|

|

Purpose

|

Acknowledges registration fee payment only

|

Legally valid proof of stamp duty payment

|

|

Mode of Issuance

|

Generated online or at bank counters

|

Issued only by authorized bank officers after treasury confirmation

|

|

Usability

|

Only for compulsorily registrable documents

|

Valid for both optionally and compulsorily registrable documents

|

|

Issuing Authority

|

Participating bank or online banking portal

|

Designated officer at the participating bank branch

|

|

Compliance Proof

|

Must be defaced by the Registration Authority

|

Must be defaced in the SARITA (Stamp and Registration Information Tech. Admin) system

|

How Enterprises Pay Stamp Duty via eSBTR in Maharashtra: A Fast, Secure & Compliant Workflow

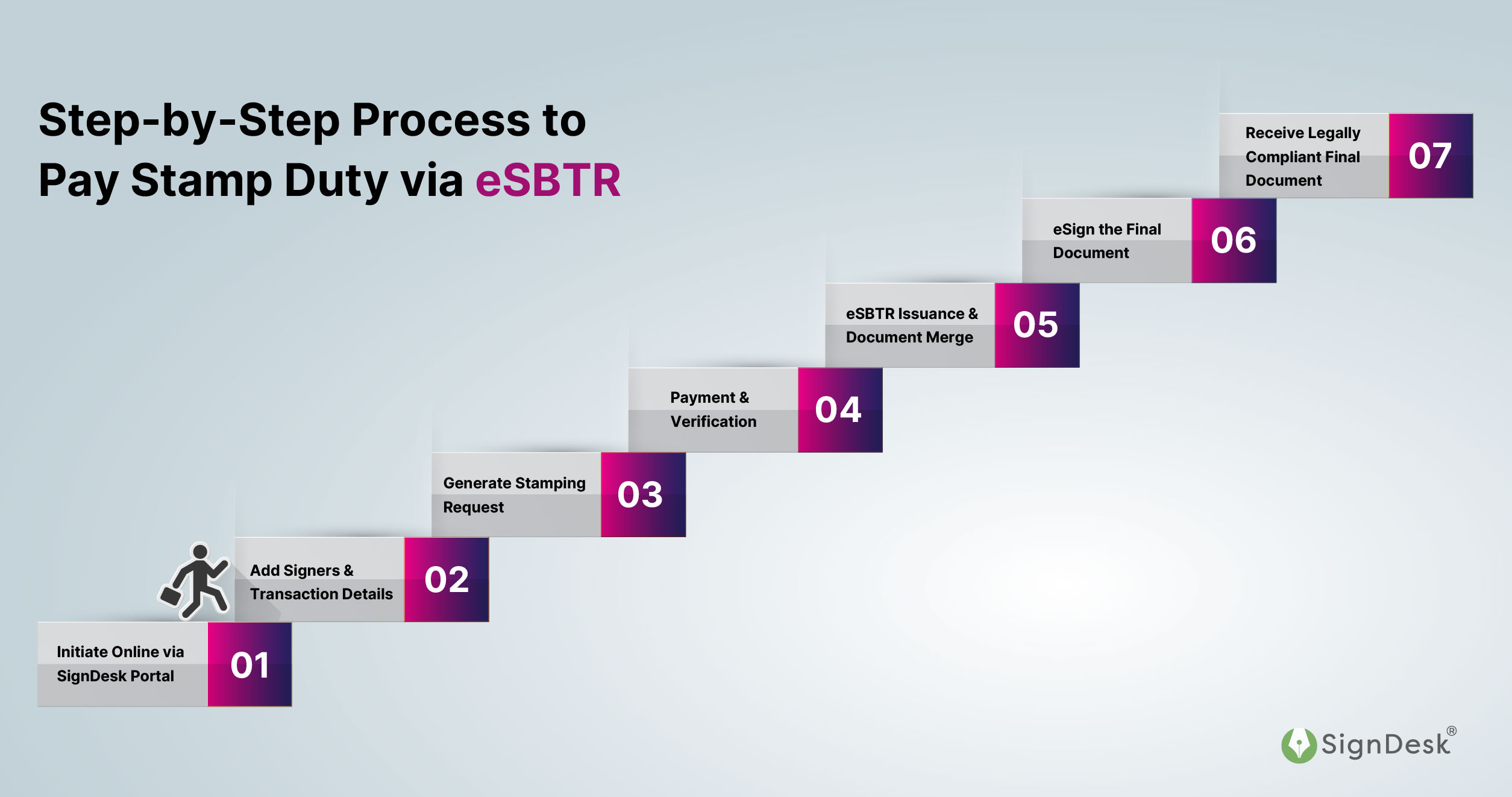

Stamp duty payments no longer require long queues, physical paperwork, or legal ambiguity. With SignDesk’s eStamping solution, paying stamp duty via eSBTR is entirely digital, auditable, and completed in minutes.

- Initiate Online via SignDesk Portal – Log in to SignDesk’s secure eStamping platform. Upload an existing agreement or generate a new document using templates.

- Add Signers & Transaction Details – Add party details for eSign. Input transaction info: stamp state (Maharashtra), document type, stamp duty value, etc.

- Generate Stamping Request – Click to submit; the system sends a secure request to the authorized partner bank.

- Payment & Verification – Pay stamp duty digitally via net banking or UPI. The bank confirms payment and verifies transactions with the virtual treasury.

- eSBTR Issuance & Document Merge – A tamper-proof eSBTR is generated and digitally merged with the agreement.

- eSign the Final Document – Signers receive a link via email. The document is executed with Aadhaar-based eSign.

- Receive Legally Compliant Final Document – The final, signed document is SARITA-ready, audit-traceable, and legally valid.

Why CXOs, Legal Heads & BFSI Teams Prefer SignDesk’s eSBTR Workflow

|

Benefit

|

Why It Matters

|

|

Fully Digital & Remote Workflow

|

Skip bank visits and paperwork; save 2–3 working days per transaction

|

|

Legally Compliant & SARITA-Ready

|

eSBTR is accepted by courts & authorities; ensure 100& compliant stamping documentation

|

|

Secure & Tamper-Proof Documents

|

Bank-issued, non-editable eSBTR prevents fraud, unlike regular eChallans

|

|

Faster Turnaround

|

From payment to executed document in under 10 minutes

|

|

Digital Audit Trail

|

Enables transparent, timestamped digital recordkeeping for internal audits & compliance

|

|

Integrated with Government Systems

|

Direct sync with Maharashtra’s SARITA system ensures seamless backend compliance

|

|

Seamless Workflow Integration

|

Works with CLM, loan origination, DMS & ERP tools; simplifies enterprise operations

|

eStamping Alternatives in Maharashtra: Why They’re Holding You Back

As eStamping via SHCIL is unavailable in Maharashtra, businesses often consider traditional alternatives. However, both franking and non-judicial stamp paper come with limitations that can expose organizations to delays, risks, and compliance issues.

Stamp Duty Methods in Maharashtra: A Quick Comparison

✅ eSBTR (via SignDesk): Tamper-proof, secure stationery with watermark & SARITA-linked

⚠️ eChallan: Printed on plain paper; higher risk of tampering

⚠️ Franking: Physical stamping; risk of misuse or damage

✅ eSBTR (via SignDesk): <10 minutes (fully digital)

⚠️eChallan: 1–2 days, depending on manual steps

❌Franking: Manual, branch-dependent; often delayed

✅eSBTR (via SignDesk): Low operational cost; no branch visits

⚠️eChallan: Low fee but added time & error risk

❌Franking: Travel, admin effort, and follow-ups add hidden costs

✅eSBTR (via SignDesk): Court-admissible, SARITA-compliant

⚠️eChallan: Valid for registration fee only, not for stamp duty

⚠️Franking: Valid if done properly, but often questioned

✅eSBTR (via SignDesk): Ideal for high-volume enterprise use

⚠️eChallan: Limited use cases

❌ Franking: Not suitable for large-value documentation

Franking: Limited Access, Capped Quotas

Franking involves stamping documents with a franking machine after payment of stamp duty, typically via cash or direct debit.

How does it work?

- Document is printed on plain paper → submitted to the authorized bank/agency

- A franking machine imprints the stamp duty value

| Pros |

Cons |

|

Convenient for small-value transactions

|

Only a few banks are authorized; franking licenses are limited; large transactions require advance notice

|

|

Quick, if paying via cash or a demand draft

|

Requires in-person visits; no remote or automated process

|

💡Enterprises executing high-volume agreements face delays and quota-based roadblocks, increasing operational friction.

Non-Judicial Stamp Paper: High Risk, Low Control

Stamp duty is paid by executing a transaction on pre-printed stamp paper — the most common yet outdated method.

How does it work?

- Details are written or attached to the stamp paper

- Signed by all parties

|

Cons

|

- Papers above ₹700 or below ₹100 are hard to find

- Multiple papers are needed for large-value transactions

- Counterfeit risk from unverified stamp vendors

- No audit trail or digital recordkeeping

|

💡Highly vulnerable to fraud, inefficient for corporate workflows, and non-compliant with digital-first mandates.

Drive Faster Closures & Zero Legal Risk With SignDesk Digital Stamping

SignDesk’s stamp.it platform is India’s leading eStamping solution. It helps you manage, execute, and complete stamp duty workflows entirely online.

Why enterprises trust stamp.it:

✔️85%+ of the market uses SignDesk’s digital stamping

✔️68% reduction in TAT with automated processing

✔️Built-in legal and security compliance across states

✔️Integrates seamlessly with eSign, CLM, ERP & loan origination systems

✔️Digital audit trail for every transaction

Book a free demo to learn how it works, or contact our sales team for more information.

Stop Putting Your Business at Risk