Recurring Investments – What is emandate in SIP

Recurring payments for investments, also known as a systematic investment plan (SIP), refer to a system where investors authorize their banks to make regular contributions to their investment accounts, usually periodically such as weekly, monthly, or quarterly, through an emandate for SIP. This hassle-free system is a popular way for investors to build their wealth over time without worrying about manually making individual investments. It also helps in inculcating a disciplined investment habit.

The purpose of recurring payments is to help investors build their investment portfolios over time in a more convenient and disciplined manner. Instead of making one-time lump sum investments, investors can set up recurring payments automatically deducted from their bank accounts regularly and invested into their chosen investment options.

This approach helps investors avoid spending their money elsewhere and enables them to accumulate wealth over time through compounding. Recurring payments are commonly used for investments in mutual funds, exchange-traded funds (ETFs), and other investment vehicles.

Recurring investment payments are made using eMandate for SIP – a simple and convenient option for investors to periodically send funds to their portfolios. Nach for SIP helps overcome numerous challenges investors and firms face during the payment collection process.

Challenges in Investment Plans and Mutual Funds

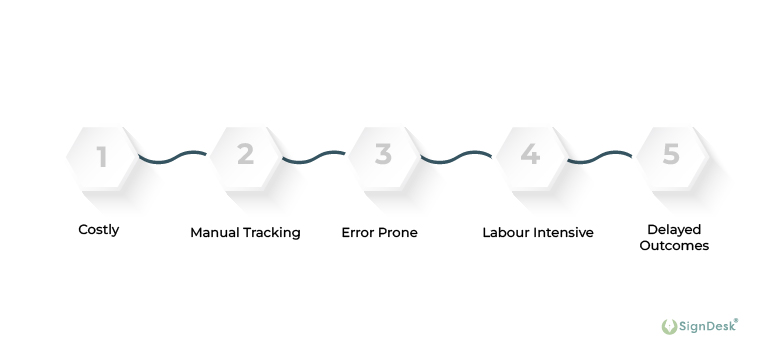

Manual recurring payments cause inconveniences and inefficiencies for investors and businesses. The challenges in making manual payments for SIP include the following:

-

- The biggest problem for investors is the requirement for ongoing vigilance and attention to detail while making each payment. This can be time-consuming and might result in mistakes or missing payments, affecting the growth of their assets.

- Furthermore, manually tracking investments and payments made towards them can be complex and time-consuming.

- The problems of manual recurring payments for businesses include handling a massive volume of payment transactions while guaranteeing that each payment is received on time.

- To monitor and trace each payment, the manual approach necessitates significant labor and resources, which can be costly and inefficient.

- Additionally, manual methods might lead to payment processing delays and mistakes, resulting in unsatisfied clients and lost business.

What Are The Various Types of eMandates for SIP?

Apart from making payments easier, eMandate fulfills various other functions. The most common forms of eMandate are:

- Aadhaar-based eMandate

Customers in an Aadhaar esign-based mandate receive a One Time Password (OTP) in their registered mobile number. The OTP is submitted to the eMandate eMandate service provider’s site to authenticate the mandate and complete the mandate registration procedure.

- API-based eMandate

In this form, an Application-Programming Interface (API) will be built with the assistance of an integrator, allowing businesses to obtain the consumer data they require. Customers must authenticate an API-based using their Netbanking or debit card credentials for the eMandate API.

- Physical Mandate

The physical mandate is the earliest type of mandate since it is filled by hand and validated by the payer who signs it. This is typically a time-consuming procedure in which the mandate documentation passes through several stages and agencies. eMandate service providers make physical mandates more efficient using QR codes for mandate registration.

How To Use eMandates in SIP

Mandates have extensive applications in automating recurring payments for investments. Registering a mandate for recurring investment is typically a long process. Here are the steps involved:

-

- Opt for a mutual fund scheme that accepts SIP investments and enroll in SIP with the fund company.

- Download the eMandate mandate form from the mutual fund’s website or ask the fund house for it.

- Fill out the eMandate form with your bank information, investment information, and other pertinent information.

- As verification of your bank account, attach a canceled cheque or a copy of a bank statement to the mandate form.

- Complete the mandate form and return it to the mutual fund firm.

- The fund house will commence an eMandate auto debit facility for the amount provided in the mandate on the date specified in the mandate after the mandate is processed.

- SIP investments are automatically deducted from your bank account on the designated date each month, and the money is invested in the mutual fund plan of your choice.

It is critical to remember that one must have adequate cash in the bank account on the SIP investing date for the eMandate debit to be successful. Furthermore, it is critical to frequently check the SIP investments and make modifications as needed to ensure that they fit with the financial goals.

With eMandates, setting up instructions for recurring payments is simpler and can be completed in fewer. Here’s how to leverage eMandates for SIP.

- Step 1: The investment firm sends a mandate API request with the mandate details

- Step 2: The investor reviews these details and is redirected to their bank’s page to authenticate these details

- Step 3:Once authenticated, the mandate details are sent to NPCI for confirmation

- Step 4:Investment amounts are auto-debited regularly after obtaining confirmation from NPCI

Alternatively, investors can leverage Aadhaar mandates to register mandates quickly using Aadhaar eSign.

Another option for investment firms operating within semi-urban or rural areas is the physical nach mandate with QR-codes for mandate registration.

Benefits of Utilizing eMandate for SIP

The eMandate facility offers numerous critical advantages due to its efficiency and quickness.

-

- Since the method is purely digital, no physical forms or signatures are required. Investors simply need their Aadhaar data and an Aadhaar-registered cellphone number to enroll for an eMandate in SIP. This speeds up mutual fund investing, resulting in quick payouts and short turnaround times.

- It takes 2-3 days to register Mutual fund eMandates in SIP, and investors may begin their SIP in less than 7 days. This is a considerable improvement over the present system, which takes around a month, and is much more cost-effective for securities intermediaries.

- The eMandate for SIP procedure reduces the need for mutual fund salespeople and distributors to use manual document processes, increasing overall company efficiency. eMandate-based payments automation also generates a virtual audit trail for investment operations, facilitating collaboration during company audits.

Before registering an eMandate for SIP, investors and firms must remember that:

- This service is only available to mutual fund investors whose funds are held in a single mode. Joint mode SIP holders are now unable to use the eMandate feature.

- Aadhaar must electronically sign and validate the eMandate. It is necessary to validate that the cellphone number used to register for the eMandate is the same as that used for Aadhaar. Also, the bank mandate provided for the eMandate for SIP purposes must be Aadhaar authenticated.

- Only banks approved by the National Payments Corporation of India can use the eMandate function (NPCI). The bulk of India’s significant banks is already NPCI-registered.

- The largest amount that can be invested regularly using the eMandate option is now Rs. 1 lakh.

Link.It: SignDesk’s Solution for Simple Investment Plans

Link.It offers comprehensive digital mandate administration solutions, addressing all NPCI versions from registration to money collection and payment.

Consumers can use a debit card, NetBanking, or Aadhaar to authenticate eMandates securely online. Mandates are further protected using Additional Factor Authentication (AFA) during auto-debits.

Users can create, register, modify, monitor, and cancel mandates on a smart dashboard. The dashboard also displays transaction histories and obligatory failure rates, allowing firms to build a trustworthy payment audit trail.

Businesses may use eMandates to digitally scale up their payments, automate them efficiently, and significantly decrease operating expenses. SignDesk’s API-based eMandates support bulk mandate data uploads and have a 95% success rate.

Our clients have reported a 50% decrease in TAT due to our solutions of eMandate in SIP, which has increased production and efficiency.

Schedule a free demo now to gain the benefits of eMandate for SIP and speed up monthly payments with SignDesk’s industry-leading eMandate solution.