What is an e-mandate?

An e-mandate is an electronic version of a mandate, which is a standing instruction (SI) given to a bank or NBFC to periodically debit a fixed amount from the account of the customer authorizing the mandate.

e-mandates are useful tools to enable recurring payments and one time payments alike, and are used for a variety of reasons. Recurring payments for OTT subscriptions, utility bills, loan EMIs, insurance premiums, mutual fund investments, and subscriptions to gaming platforms all involve e-mandates in some form.

Typically, mandates are issued via documents. These are called physical mandates and they’re created when a mandate form is filled and submitted by a client to NPCI. The mandate information in the form is then verified by the bank where the customer holds their account, commonly called the destination bank. The mandate is then verified in 15-20 days and the recurring debits can begin. A Unique Mandate Registration Number or UMRN is also created for every mandate registered, to help keep track of debits and credits.

However, with a success rate of just 30-40%, paper mandates often don’t get the job done and are a major source of friction in payment collection. e-mandates are an improved, digital alternative to physical mandates both due to their high success rate (80-95%) and their ease of usage.

Who clears recurring NACH debits?

Whenever there’s a debit within the formal banking sector, the details of this debit usually need to be approved and cleared by a system that keeps track of all the transfers being made. This is done for due diligence purposes and to keep the entire system running smoothly.

Previously, the Reserve Bank of India( RBI) handled NACH debits through their local clearing centers now called Legacy Electronic Clearing System or Legacy ECS. These were quickly merged by the National Payments Corporation of India (NPCI) into a single unit that’s referred to as the National Automated Clearinghouse or NACH.

e-mandates are built on the infrastructure of the National Automated Clearinghouse or NACH.

Therefore, all e-mandates are cleared by this entity.

Recently, NPCI upgraded the NACH infrastructure to what is called eNACH (Electronic NACH).

eNACH consolidated the frameworks used by several e-mandate providers and created a unified clearinghouse capable of integrating with any bank in the country and clearing the NACH debits registered with these banks.

With the present eNACH framework, e-mandates can be registered in real-time using APIs or within 1-2 days using Aadhaar eSignatures.

How is eNACH different from e-mandate?

As mentioned previously, eNACH is the infrastructure on which recurring payments occur. e-mandates, on the other hand, are the instructions that govern these recurring payments.

To put it simply, think of a piece of software code. The code itself is an instruction for the system to perform certain tasks, but these tasks can only be performed on the software infrastructure of the system. In this example, the code is the e-mandate and the software is eNACH.

Therefore, e-mandates and eNACH are inseparable in that the former requires the latter to work and the latter is built to run the former.

What is eNACH e-mandate?

eNACH e-mandates are e-mandates that utilize eNACH for recurring payments. eNACH e-mandates are completely digital and can be created, registered and managed online via an eNACH e-mandate service provider.

The process of registering an e-mandate is exceedingly simple. While e-mandates can still be registered manually by submitting a mandate form, most e-mandates are registered online.

The information collected when registering a mandate includes –

-

- Personal information – The customer’s name, mobile number and email address

- Mandate details – The mandate variant of choice, the frequency of debits, and whether the amount if fixed or varying

- Bank details – The customer’s personal bank details

The process of registering a mandate depends on the e-mandate variant chosen by the customer or the bank.

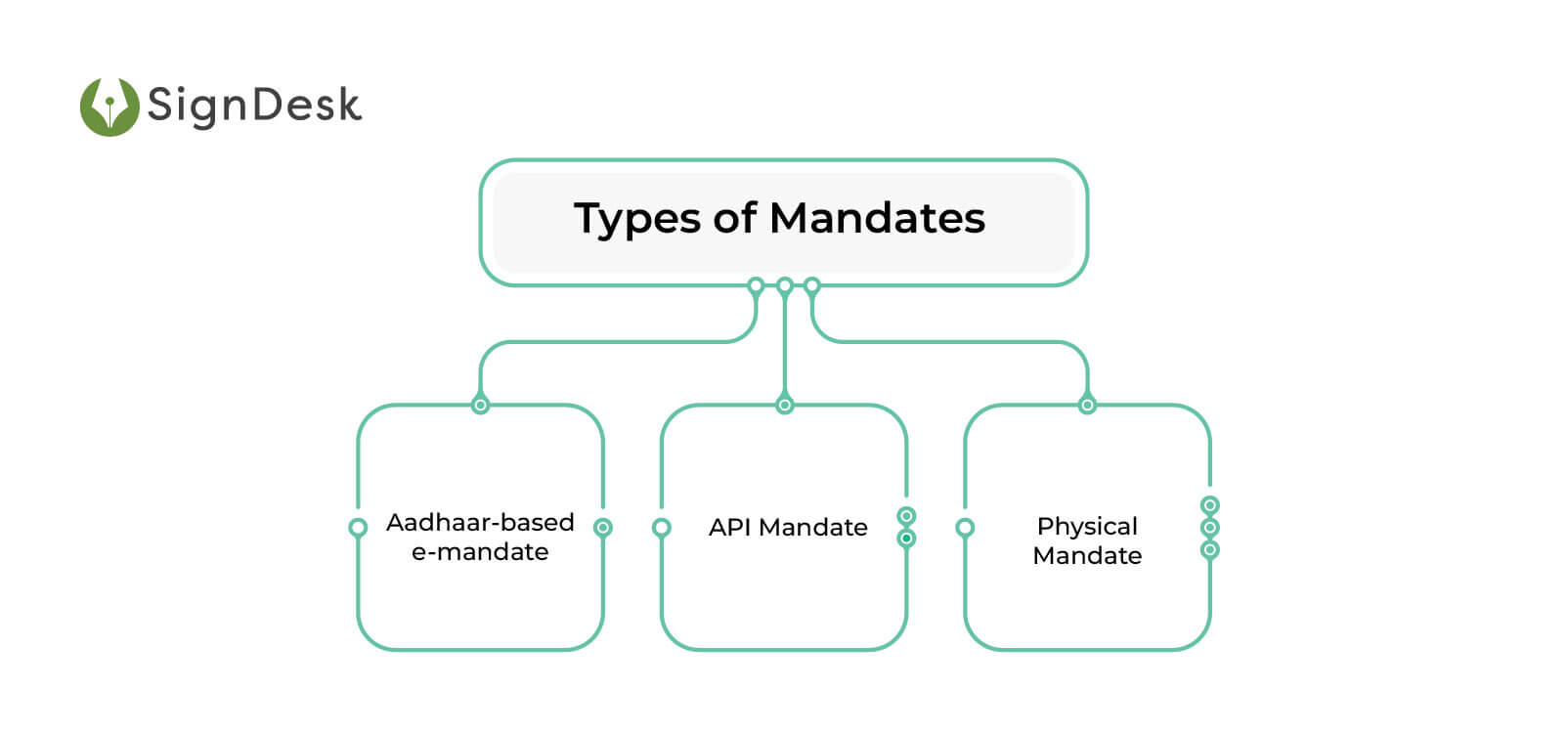

Broadly, there are three types of mandates, also called mandate variants.

Types of Mandates

Mandate variants are distinguished based on how they’re registered. Here are the various types of mandates.

In this variant of e-mandates, mandates are registered following Aadhaar OTP authentication. The customer first enters their registration data on the portal of the e-mandate provider and consents to linking Aadhaar details. Then an OTP is sent to the customer’s Aadhaar-registered mobile number, which is then used to authenticate the information supplied by the customer.

Once this authentication takes place, the mandate details are sent to NPCI, the customer’s destination bank, and back to the e-mandate provider who displays the status of the Aadhaar mandate to both the customer and their destination bank.

In this simple variant of e-mandates, data is collected automatically by the e-mandate provider and shared with the NPCI ONMAGS portal. From here, the mandate details are sent to the customer’s destination bank for confirmation and once this is received, the customer is redirected to the destination bank where they enter their debit card or NetBanking details to authenticate the mandate. Once this is completed, the API Mandate is registered.

As mentioned above, physical mandates involve customers filling up a form with their mandate details. This form is then either submitted manually at the customer’s destination bank or scanned. e-mandate service providers offer OCR-based document scanning to read the information in mandate forms and send these to NPCI and the destination bank for verification. The mandate is registered once the details are verified.

Here’s how these three types of mandates compare.

|

API |

Physical |

Aadhaar |

| Number of integrated banks |

55+ |

1000+ |

375+ |

| Registration time |

Real-time |

T + 5*

5 – 15 days on avg |

T + 2*

2 – 5 days on avg |

| Success rate |

70-80 % |

30-40% |

60-70% |

| Bulk data upload |

Yes |

Yes |

No |

*T is the Transaction Date

To see which type of e-mandate is right for your business, read our article here.

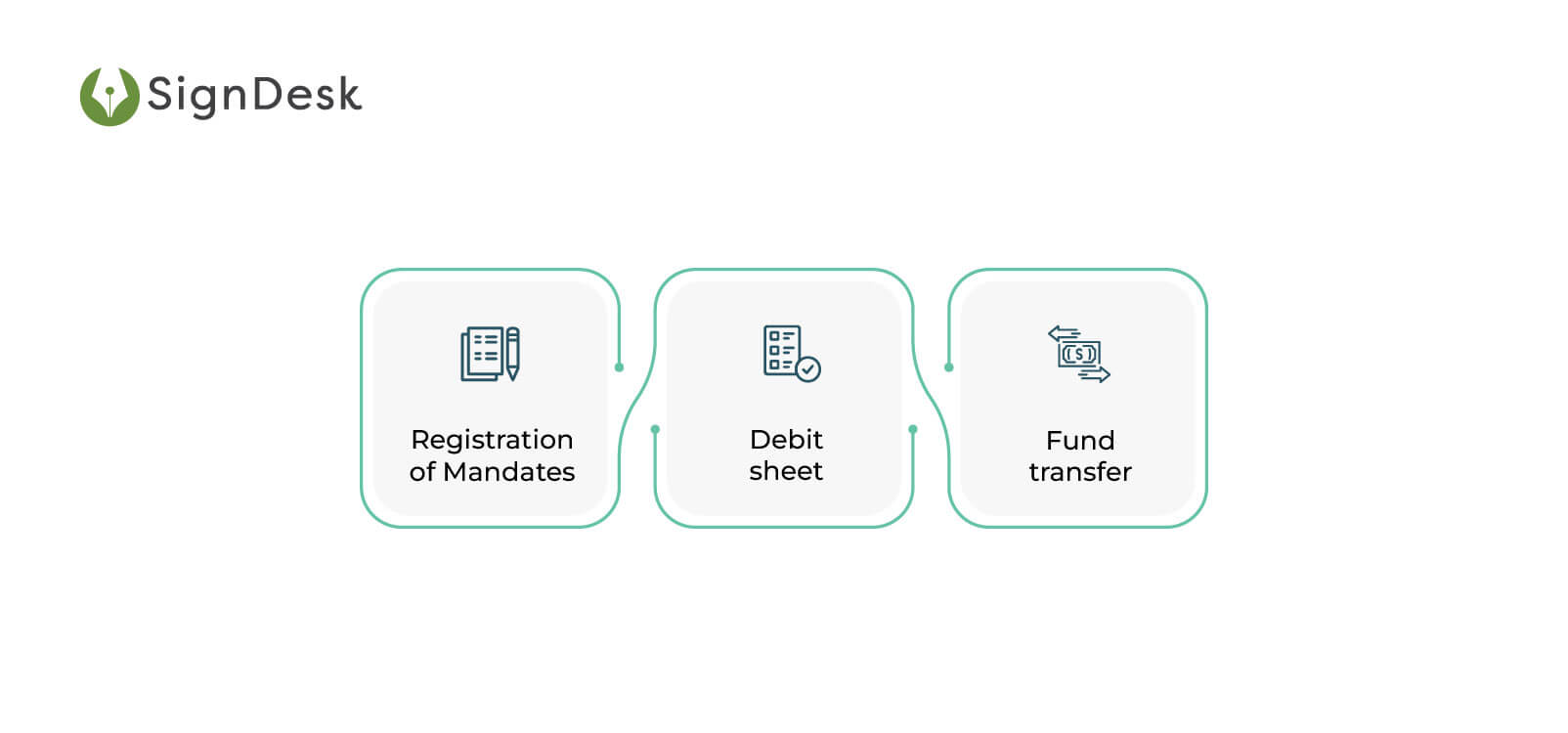

How Do e-mandates Work

The workflow of eNACH e-mandates can be divided into three segments –

-

- Registration of Mandates: Mandates are created & registered as covered above

- Debit sheet: A sheet with all the debit information is presented to NPCI through the sponsor bank and the destination banks will honor the payment subject to availability of funds.

- Fund transfer: NPCI will complete the settlements between sponsor and the destination bank as an ECS clearing process. The funds collected from the destination bank are then transferred to the creditor.

All three of these steps are quite involved. For a full account of how e-mandates work, scroll down to the eNACH e-mandates – Deep Dive section.

Functionally and from the customer’s perspective, eNACH e-mandates have been made exceedingly simple to use by e-mandate service providers.

Here are two ways for customers to leverage e-mandates for digital payments.

Quick eNACH e-mandate

As the name suggests this is a lightweight and streamlined version of eNACH e-mandates and involves minimal effort from the customer. Here’s how it works.

- A business creates a mandate request via APIs and the e-mandate provider (here, SignDesk) creates a mandate ID.

- The mandate details are collected automatically by the provider and an invite sent to the customer to verify these details.

- The customer clicks the invite, previews the information and submits the same.

- The customer is then redirected to the NPCI ONMAGS page where they enter their debit card or NetBanking details to authenticate the mandate.

- The destination banks validates the customer credentials and accept/reject responses to NPCI who routes this response on to the merchant’s page.

- The customer will then be informed of success or failure of mandate registration by receiving a notification. The destination banks also will send an alert to ensure compliance with NPCI guidelines.

- The Beneficiary of the mandate (here, the corporate entity requesting the funds) can raise debit sheet and proceed for collection.

Merchant e-mandate

This is the type of e-mandate process customers who make recurring payments to merchants will be most familiar with.

- The customer logs into the merchant site and enters their mandate details including the name of their destination bank and how they’d like to authenticate the mandate.

- Next, this information is transferred to NPCI and then the destination bank for authentication. The customer is redirected similarly.

- Once at the destination bank’s website, the customer logs in using their debit card or NetBanking information, views the mandate details and approves them.

- This information is passed through NPCI back to the merchant site where it’s displayed for the customer and the merchant.

- Funds are then transferred periodically according to the e-mandate details.

Customers can make digital payments with ease by setting up either quick e-mandates or merchant e-mandates. The registration process takes place in real-time whenever customers register with API mandates, and the fund transfer can begin in earnest.

However, the e-mandate process is a bit more complicated at the back end, where mandate details & NACH debit amounts need to be shuffled between various stakeholders including NPCI, destination banks, sponsor banks and more.

Here’s how eNACH e-mandates enable recurring payments in full.

eNACH e-mandates – Deep Dive

As mentioned previously, the e-mandate process consists of mandate registration, debit sheet presentation, and fund transfer.

Step 1: Mandate Registration

Mandates are registered either physically, via API mandates or through Aadhaar mandates. The process of registering mandates in these three ways involves –

- Physical mandate – Mandate details are entered in a form, which is then sent manually to the destination bank or scanned via an e-mandate service provider.

- API mandate – Mandate details are collected by the service provider and shared with NPCI where it’s viewed by the customer. Then these details are directed to the destination bank where the customer authenticates these details using debit card or NetBanking credentials.

- Aadhaar mandate – Here, mandate details are entered and verified by linking the customer’s Aadhaar via OTP-based verification.

Step 2: Debit Sheet Presentation

A sheet consisting of a list of all mandate IDs and the amounts to be debited is either compiled by the e-mandate provider or the business client receiving payments.

This sheet is sent to various destination banks through NPCI. These banks check their records and provide a positive confirmation when the mandate IDs are in order and there’s enough money in the respective customer accounts for transfers to be made.

The responses of these destination banks are received along with acknowledgements of the registered mandates. If everything is in order, the e-mandate provider initiates the fund transfer process.

In case of failed transactions and a negative response from a destination bank, the transfer is delayed by a day.

Step 3: Fund Transfer

Once a positive response is received, the e-mandate provider begins transferring funds.

The required amount is transferred from the destination bank to NPCI’s sponsor bank. Once here, the amount is transferred again to the e-mandate provider’s nodal account. This accounts acts as a throughway for mandate debits.

Finally, the amount is transferred to the business client’s account the next day, completing the eNACH e-mandate process.

With eNACH e-mandates, digital payments can be set up with ease and smooth payment flow is ensured.

Advantages of eNACH e-mandate

With features for real-time mandate tracking, user roles and access, and integrations for Aadhaar eSign, e-mandates are among the most convenient tools for automating recurring payments.

eNACH e-mandates offer several advantages for both customers and businesses:

eNACH e-mandates streamline business processes by enabling hassle-free and easily manageable payments. Mandates are registered and tracked on a smart dashboard, edited and deleted as needed, and managed online.

The e-mandate procedure enables clients to keep a record of every transaction. One can monitor and review all of your Previous transactions can all be monitored and reviewed, and transaction history is maintained to improve audit efficiency.

eNACH e-mandates are designed for customers to create and register mandates with zero friction. Customers can create mandates straight from the website of any OTT platform, merchant, or subscription provider. Mandates are viewed on an intuitive dashboard where the status of all mandates can be tracked for business purposes. Customers can also edit or delete their mandates with ease on the eNACH e-mandate platform.

- Cost-effective Payment Automation:

It costs businesses more to not automate recurring payments, than it does to automate. This is because payment automation massively reduces operational expenses and the overall time taken to manage and collect payments. Additionally, recurring payment automation reduces manual dependencies, freeing up resources for efficient usage.

- Convenient Digital Workflows:

The automated workflows of e-mandates are incredibly convenient for business to integrate with and customers to utilize. The bulk of the e-mandate process is taken care of by the e-mandate service provider, and the end users simply have to register mandates, sit back and receive payments.

Industries That Require eNACH-enabled Recurring Payments

eNACH e-mandate has made the recurring payment process easy for several industry segments. This has resulted in several businesses across sectors adopting e-mandates for smooth recurring payments.

The industries that have benefitted from this mode of digital payment automation are:

Banks and NBFCs are among the biggest beneficiaries of recurring payment automation via eNACH e-mandate. Mandates have helped FIs quickly automate bulk recurring debit transactions and streamline their payments.

Banks can set up multiple e-mandates for loan EMI repayments, track and manage these mandates online, and ensure timely payments.

Payments for numerous life, health, auto, and travel insurance policies are a daily and even hourly occurence at insurance companies. With the help of e-mandates, these policy payments are automated and made regularly to ensure the stability of the policy.

Policyholders simply use their NetBanking credentials or Aadhaar details to authenticate these e-mandates and insurers collect policy payments with ease.

- Non-government Organizations (NGOs):

Several NGOs have begun adopting e-mandates to streamline the donation process. With e-mandates, NGOs can take a hands-off approach to donation collection and let the e-mandate system periodically debit donations from the accounts of donors.

This frees up the time and resources NGOs need to broaden their donor base, manage donations, and ensure the presence of a strong audit trail for donations.

By offering its customers an automatic periodic payment solution, OTT platforms and entertainment subscription services can make recurring due payments easier. Since the e-mandate occurs automatically as and when a subscriber’s subscription expires, customers may enjoy watching their favourite movies and television shows without missing out on new releases.

Link.It: SignDesk’s One-Stop Solution for Recurring Payments

From registration to fund collection and payment, SignDesk offers complete digital solutions for mandate administration that address all NPCI variants via its product Link.It.

Customers can utilize debit card, NetBanking, or Aadhaar eSign to securely authenticate e-mandates online. Mandates are further secured via Additional Factor Authentication (AFA) every time a debit is set to take place.

Mandates may be created, registered, edited, tracked, and deleted on the smart dashboard. Transaction histories with mandate failure rates are also viewable, enabling businesses to create a strong audit trail for payments.

e-mandates give businesses the ability to scale up their payments digitally, automate efficiently, and drastically save operating costs. API-based e-mandates from SignDesk enable for bulk uploads of mandate data and have a success rate of about 95%.

With the help of our eNACH e-mandate solution, our clients have seen over 50% reduction in TAT, increasing production and efficiency.

To reap the benefits and expedite recurring payments using SignDesk’s top e-mandate solution, schedule a free demo now.