NACH – Definition & Variants (Physical Nach, API Nach, Aadhaar Nach)

NACH, or National Automated Clearing House, is a mechanism that assists and acts as a payment gateway for Indian financial institutions, such as banks and NBFCs, as well as other government organisations, in providing automated payment services. NACH was created by merging all of the Electronic Clearing Systems (ECS) that lenders previously used to automatically debit funds from borrowers.

Users sign the NACH form and generate a Unique Mandate Registration Number while using NACH for debit or credit (UMRN). Once launched, NACH serves as the user’s consent to the relevant authorities to debit an agreed-upon sum on a regular basis.

The NACH platform is a rather developed and standardised platform used by all of the country’s main banks, including public and private sector banks.

In contrast to ECS mandates, NACH is well covered by even minor banks and gives quick confirmation of mandate or NACH registration, whereas ECS takes a few days.

NACH mandates are carefully controlled by the RBI and have a better success rate than card mandates, which are still being developed and are not available from all banks in the nation. Credit card requirements are still being worked on by the industry.

There are predominantly three variants of NACH mandates existing in the current scenario:

The available NACH variants include:

- Physical Mandate

A manually completed mandate form that is validated by the payer’s physical signature. When simplified, bank or physical mandate meaning comes down to a permission granted to a bank or financial institution to debit your bank account for periodic payments.

- API e Mandate

API captures mandate information, which is subsequently authenticated using the payer’s net banking or debit card information.

- eSign Mandate

In this situation, customers use Aadhaar eSign to authorise requirements. NPCI approved this method of mandate or NACH registration in 2020 after putting it on hold in 2018.

In layman’s terms, a NACH mandate is an authorisation that consumers provide to financial institutions to credit or debit monies. The primary goal of the NACH mission is to enable the movement of funds in high or low volumes.

Physical NACH Mandate – Meaning and Features

A physical NACH mandate or pNach is a standing order issued to a bank or NBFC to debit a specified sum from the account of the client approving the mandate on a regular basis. This order is registered using a Nach form, to be filled and signed by the client, and submitted to the client’s destination bank (where his/her account is held).

These NACH mandates often handle both bulk and recurrent payments. For example, if an individual obtains a personal loan, he or she will be required to repay the debt in predetermined monthly instalments. Traditionally, he or she will have to personally visit a bank location and settle the outstanding balance there.

However, owing to NACH, the cash may be deducted automatically from the borrower’s bank account every month. The effort is confined to retaining a specific amount in the account so that the bank can transmit the funds on schedule. In most banks and NBFCs, this process is automated until the loan term expires.

As mentioned, customers fill out a form with their mandate specifics to register physical mandates. This form is then either manually or scanned at the customer’s destination bank.

In contrast, e mandate service providers use OCR-based document scanning to read information from mandate forms and submit it to the NPCI and the destination bank for verification. Once the details are validated, the mandate is registered.

Charges for physical NACH may range between banks. Depending on the amount, banks often impose a processing fee. If a NACH mandate or payment request fails owing to an inadequate amount, the bank may levy a penalty.

Physical NACH mandates are accepted by over 1000 banks. This covers even the most recent ones, which makes it considerably easier for clients to make and receive payments.

Given the vast number of monetary transactions that occur on a daily basis, pNACH consolidates all ECS systems in the country to eliminate local obstacles and make way for a more efficient, quicker clearing system.

NACH facilities are feature-rich, benefiting both consumers and businesses. They are used to simplify some of the most typical transactions. Some of the features of physical nach mandates include:

- Dividend Transactions via NACH

Periodical payments, such as salary, pension, and interest dividends, can be primarily handled through NACH, making the entire process smoother. RBI has now made the facility available even on weekends. When done using NACH, these require little manual involvement and are settled within 24 hours.

Additionally, NACH can be executed for a systematic investment plan (SIP) is a strategy in which a set quantity of money is gathered each month and put in the investment vehicle of choice. The procedure is automated, ensuring that the money being transferred is not jeopardised. This is made possible in great part by the real-time tracking system built into the NACH structure which enables both customers & stakeholders from banks to monitor mandates and fund transfers. Most fund firms and brokers use NACH to set up automated investments for their consumers.

- QR Code Scanning API

Enterprises may provide clients and merchants with the opportunity to produce all three forms of Mandates – physical, API-based, and Aadhaar eSign – by interacting with a single API. The API allows organisations to scan physical NACH forms with QR code capabilities, and the mandate information is then submitted to NPCI and the target bank for verification.

- Real-Time Alerts

Enabling physical NACH or mandate helps in providing real-time alerts and updates. Real-time payments add value in a variety of ways. The first is self-evident: they are fast. Really quick. Payments that settle instantly are also readily accessible. Instant access may be a game changer for people or enterprises who want money quickly.

End-to-end communication is also enabled through real-time payment rails. Communication has always gone in just one direction: from payer to payee. If the two parties choose to trade information, they must do it outside of the payment system. Real-time payments combine payment and payment data into a single transaction.

- Bulk Upload

Making NACH payments electronically is safer, more convenient, and entirely secure using the bulk upload function. Businesses may experience faster response times by submitting many mandates at once, which helps streamline lending and investment operations.

The single file upload also aids with the many payment methods. Allowing several recipients to receive payments in bulk via a single file upload boosts NACH payment efficiency while reducing time and effort.

- Easy Purchase of Lump Sum

With NACH the lump sum purchase is easier than ECS. The investor has to register with NACH by submitting the One-Time Mandate Registration Form of NACH, to validate the relevant bank details for the subsequent payment process.

After the registration process, the mandate needs to avail the additional purchase, SIP purchase and such kinds of purchases which will be the lump sum purchase for the investors.

- Seamless Maker Checker Flow Integration

Maker-checker is an authorisation workflow that guarantees at least two individuals are engaged in a transaction that is facilitated effortlessly by using NACH. A Maker is in charge of making the request, while a Checker is in charge of approving it. The partition of roles in the maker-checker aids in maintaining rigorous control over the usage of software and data.

How Does Physical NACH Work?

The one-time NACH mandate form that the user must fill out in order to register with NACH should include:

- Bank information includes the following: bank name, branch, account number, and IFSC/MICR code.

- Personal information: mobile phone number, email address, and signature as it appears on your bank statement

- Folio Specifications: Folio and application numbers

- Limit Specifications: daily maximum limit

- Period: The mandate’s effective time frame. From the beginning to the conclusion.

Incorrect information, such as your bank account number, folio number, and so on, might cause your NACH to be refused. If the investor’s bank is not a member of NACH, NACH may be denied. Apart from that, in case anyone wants to cancel NACH at any time, that person just has to fill out the cancellation form. There is no limit to the number of NACH mandates that can be registered. The default NACH requirement has been set until December 31, 2099.

Streamlining Recurring Payments With SignDesk Physical NACH

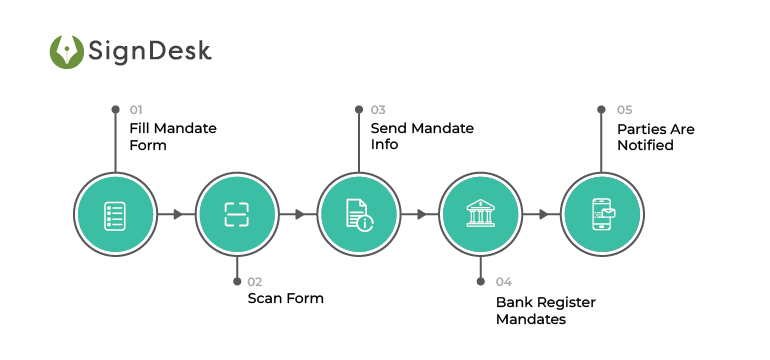

Here’s how the Physical NACH payment workflow operates:

- Step 1: The client completes mandate forms.

Borrowers must complete and sign the NACH challan.

- Step 2: Forms are scanned with the SignDesk software.

The form’s QR code is scanned, and the challan picture is submitted. SignDesk uses Maker-Checker concepts to check that the image information is valid.

- Step 3: Send bulk mandate information to NPCI

The challan picture is zipped and submitted to NPCI, which forwards it to the banks where the borrowers have accounts.

- Step 4: Destination banks register mandates

Within 5-10 days, the destination banks approve or reject the mandates given by NPCI.

- Step 5: The applicant and his clients are notified.

All stakeholders are notified when mandates are authorised or denied.

Physical mandate vs API and Aadhaar e Mandate: Which One To Choose?

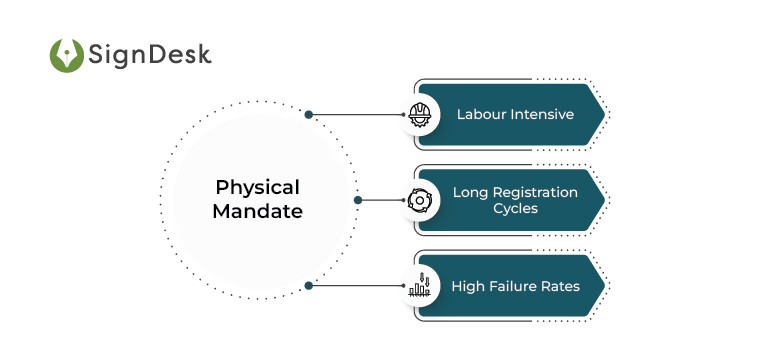

Although NACH represents a substantial improvement over the former ECS system, the physical mandate mandatory registration procedure still has flaws when compared to its Aadhaar API variants. Compared to APIs physical mandates have a few drawbacks

- Labour Intensive

Businesses using physical mandates will have to send teams out at some point. Before being digitalized, the mandate form needs to be collected by the client from a bank/NBFC and then collected from them by the corporate entity. Since the mandate is still in physical form at these stages, transporting & cataloging these forms involves several logistical challenges.

- Long Registration Cycles

The Sponsor Bank must verify that the mandate picture and data sent to the NPCI fulfil the NPCI’s pre-defined standards. This is prone to human errors and may result in delays or the mandate being rejected.

- High Failure Rates

The payer (client) or an agent appointed by the company in collaboration with the payer manually fills out the mandate form. This, like other manual procedures, is susceptible to human mistakes. Incorrect data submission or quickly signed forms can lead to further delays and registration failures.

While the physical Nach procedure can be completed within 5 to 15 business days, this depends on a variety of circumstances and could take longer resulting in fragmented payment processes. Furthermore, the frequent business delays for the company or bank create a poor experience for customers and drive up expenditures.

API or eSign e Mandates speed up these Nach debit and credit operations, allowing payments to be completed in 3-4 days with a high success rate.

Here are the significant distinctions between physical, API, and Aadhaar eSign regulations that financial institutions should be aware of:

Read more about the different NACH variants here.

Link.It: Automated Mandate Payment Solutions by SignDesk

SignDesk’s product Link.It provides comprehensive digital solutions for mandate administration, addressing all NPCI versions from registration through money collection and payment.

The eNACH eMandate procedure consists of the following steps:

- Registration of Mandates

- Through an eNACH eMandate service provider, the client registers their eMandate at the destination bank (i.e., the bank where the customer has an account).

- The mandate information is then forwarded to the sponsor bank, NPCI, and the numerous recipient banks. The answer is communicated with the eNACH provider once the destination bank verifies the eMandate.

- Transfer of Funds

- Following receipt of this response, the assigned money is deducted from the destination bank and sent to NPCI, following which it is delivered to the sponsor bank and subsequently to the eNACH service provider’s nodal bank account.

- Finally, the designated sum is deposited the next day to a corporate account.

Customers may safely authenticate e-mandates online using a debit card, NetBanking, or Aadhaar eSign. Every time a debit is scheduled, Mandates are further safeguarded with Additional Factor Authentication (AFA).

On the smart dashboard, mandates may be created, registered, updated, monitored, and removed. Transaction histories, as well as mandatory failure rates, are available, allowing organisations to construct a reliable audit trail for payments.

E mandates enable businesses to digitally scale up their payments, automate efficiently, and substantially reduce operating expenses, unlike physical mandate. Schedule a free demo now to enjoy the advantages and accelerate payments with SignDesk’s leading e-mandate solution.