Introduction

Environmental, Social and Governance (ESG) standards have progressed from a niche concept to a mainstream standard for investors, stakeholders, and businesses. Investors now seek to align their investments with companies that exhibit strong ESG practices.

The world is facing several global challenges, such as climate change, social inequalities, and ethical governance concerns. Beyond this, there is an increased awareness that organizations with high ESG performance tend to outperform other businesses in the long run.

ESG compliance has gained importance as an integral part of corporate responsibility, emphasizing that companies must align what they do with these principles.

What is ESG?

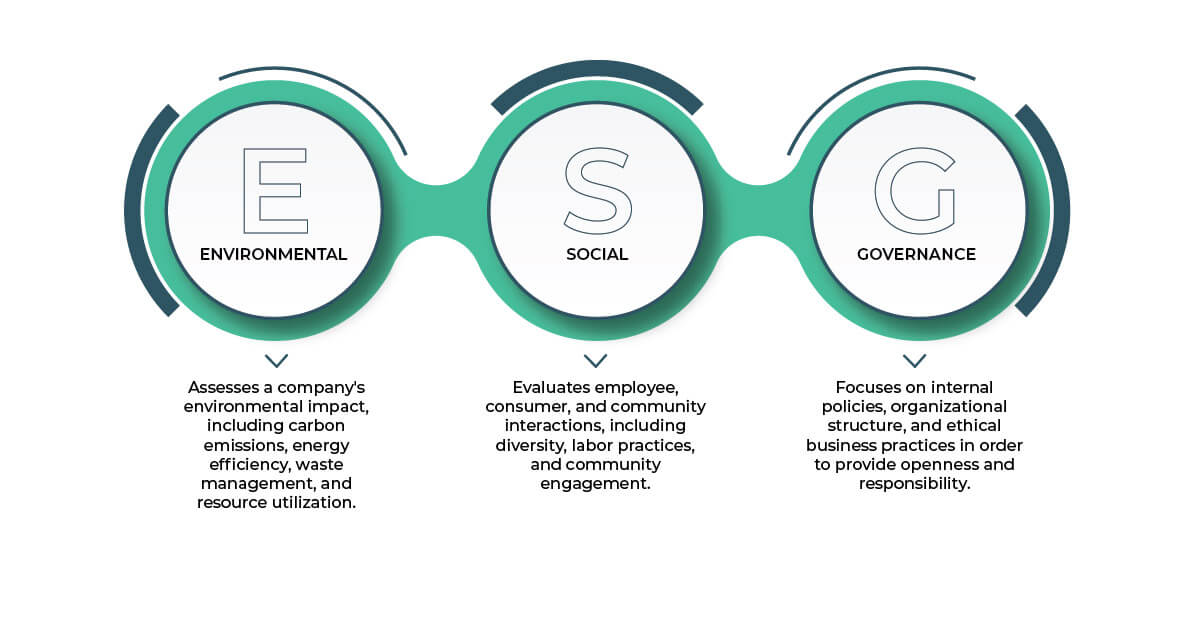

ESG Meaning – ESG stands for Environmental, Social, and Governance. These components represent the three primary areas that firms are expected to comply with. It represents a set of criteria that investors, stakeholders, and companies utilize to analyze and measure a company’s impact and performance in these three crucial areas.

ESG factors are impacting investment decisions, changing corporate strategy, and developing a more sustainable and socially responsible business landscape. Companies are recognizing the importance of incorporating ESG concepts into their operations not only to meet legal requirements, but also to improve their reputation, attract investors, and positively contribute to the communities and the environment in which they operate.

This development reflects a larger cultural understanding of the interdependence between the activities of businesses and global concerns such as climate change, socioeconomic bias, and ethical business conduct.

A Deep Dive into the Components of ESG

To assess a company’s sustainability, ethical standards, and long-term resilience, investors and stakeholders look for specific indicators and behaviors under each component of ESG. Companies are expected to demonstrate commitment and action across all ESG (Environmental, Social, and Governance) components. Here are some of the key aspects they consider:

- Environmental (E)

- Sustainability Practices: Stakeholders seek environmentally responsible practices such as waste minimization, energy efficiency, and sustainable material sourcing.

- Carbon Footprint: Investors evaluate a company’s greenhouse gas emissions and commitment to lowering its carbon footprint.

- Resource Efficiency: Companies need to demonstrate efforts to use resources efficiently, reduce waste, and embrace environmentally friendly practices throughout the supply chain.

- Social (S)

- Diversity and Inclusion: Companies that promote diversity in their workforce and demonstrate inclusive policies, including fair representation at all organizational tiers, are valued by both investors and stakeholders.

- Community Impact: Stakeholders evaluate the company’s contributions to local communities by their active participation through social welfare projects and philanthropic activities.

- Employee Welfare: Investors look at the company’s workplace conditions that foster employee wellbeing and workplace safety and ensure fair labor practices.

- Governance (G)

- Transparency: Companies need to keep business operations, financial reporting, and decision-making processes transparent and communicate openly and ethically, ensuring accountability and trust.

- Board Independence and Accountability: Stakeholders seek an independent board of directors capable of providing effective supervision. They look for companies that establish a responsible and impartial board of directors to supervise business strategy and risk management.

- Ethical Conduct: Adhering to ethical business practices, including anti-corruption measures, to build trust among investors and stakeholders.

Significance of ESG for Businesses

Embracing ESG principles not only contributes to sustainable practices but also enhances brand reputation, attracts responsible investors, and fosters long-term resilience for a company.

- Market Perception and Investor Interest:Sustainable and socially responsible practices are increasingly being recognized by investors as contributing factors to long-term value generation.

Positive ESG performance can improve a company’s market perception, potentially leading to higher valuation and increased investor interest.

- Regulatory Compliance: The regulatory landscape is changing around the world, with many jurisdictions incorporating environmental, social, and governance factors into corporate governance and disclosure standards.

Adhering to ESG standards assists organizations in navigating regulatory changes, ensuring compliance, and preventing legal risks related to environmental effects, labor practices, and governance structures.

- Stakeholder Expectations: Businesses that adhere to ecological and ethical standards gain consumer trust, which can lead to higher market share and customer loyalty. Positive ESG practices also lead to increased employee satisfaction and retention.

- Risk Mitigation and Adaptability: ESG frameworks assist businesses in identifying and addressing possible risks connected with climate change, supply chain disruptions, and social issues, making them more resilient to unforeseen obstacles.

Proactive ESG practices operate as protection against reputational risks and preserve a company’s brand and goodwill in the event of environmental or social crises. Anticipating and addressing ESG concerns helps organizations respond to changing market dynamics, regulatory constraints, and stakeholder expectations.

- Innovation and Market Authority: ESG considerations drive organizations to innovate and develop sustainable products or services, positioning them as market leaders in the industry.

A strong ESG commitment distinguishes a company by attracting environmentally and socially conscious consumers looking for products that align with their beliefs.

Driving Sustainable Practices: Unlocking Potential with RegTech

Adopting ESG principles not only adds to sustainable practices but also improves brand reputation, attracts responsible investors, and develops long-term resilience in the face of changing market dynamics.

Meeting ESG requirements has become essential in today’s business landscape for organizations aiming to illustrate their commitment to sustainability and responsible corporate practices.

Regulatory Technology, or RegTech, is a key partner for businesses in this path, providing innovative technologies to streamline ESG implementation. It employs cutting-edge technologies to enable firms to navigate the intricate landscape of ESG requirements efficiently.

RegTech encompasses a variety of solutions like compliance and risk management software, automated regulatory reporting, AI for compliance, KYC and AML solutions, and transaction monitoring systems that can aid organizations with ESG compliance.

Here’s how RegTech simplifies adherence to ESG regulations:

- Compliance Process Automation: RegTech tools automate compliance-related procedures, decreasing manual burden while minimizing the risk of errors. This ensures that businesses can meet ESG reporting obligations efficiently.

- Risk Management: ESG compliance is intrinsically linked to risk management. RegTech assists businesses in effectively identifying, assessing, and managing ESG-related risks. This proactive risk management strategy strengthens a company’s resilience in the midst of evolving regulatory environments.

- Real-time Monitoring and Reporting : RegTech systems offer real-time monitoring and reporting capabilities, allowing companies to continuously track their ESG performance. Timely data availability allows for quick decision-making and modifications that correspond with growing ESG criteria.

- Enhanced Data Analysis : The sheer volume of data related to ESG requires advanced analysis. RegTech platforms evaluate big datasets using advanced analytics, delivering significant insights into a company’s ESG performance. This data-driven strategy promotes strategic decision-making and long-term planning.

- Reporting Standardization: Maintaining consistency can be difficult with diverse ESG reporting systems and standards. RegTech solutions help standardize reporting processes, ensuring that firms follow required frameworks and convey their ESG governance efforts effectively.

- Efficiency and Cost Savings: RegTech contributes to operational efficiency by automating compliance operations and enhancing reporting accuracy. This, in turn, can lead to cost savings, making ESG compliance a more sustainable and economically viable undertaking.

RegTech, in essence, not only streamlines the difficulties of ESG sustainability compliance but also empowers businesses to embrace sustainability as a competitive advantage.

Empower Your ESG Initiatives With SignDesk

SignDesk is a leading RegTech solution provider, enabling businesses across the world to improve compliance operations, increase transparency, and strengthen their commitment to ESG goals.

Our cutting-edge products for video based KYC and document verification, KYC and AML, eSignature, eStamping, and contract lifecycle management enable companies to not only simplify ESG management and meet regulatory obligations but also actively contribute to a more sustainable and ethical business environment.

Book a free demo to understand how SignDesk’s solutions can help your company align with ESG principles and pave the road for a more responsible and sustainable future.