Introduction

In the world of securities trading and digital investments, having a thorough grasp of managing their digital investment activities is imperative to investors. In the context of Demat accounts, one critical process where franking plays a crucial role is the execution of the PoA or Power of Attorney document. It is only deemed enforceable upon the completion of franking for Power of Attorney.

In the realm of financial operations, PoA is an essential legal document that transfers authority from the account holder to a designated representative. An investor would have needed to sign a PoA in order to register a demat account with a stockbroker. The process of franking plays a pivotal role in validating the authenticity and legality of various instruments.

Franking is a stamp duty payment method that involves imprinting a document with red ink. To be legally valid, the PoA must be embossed with the mark on the first page of the document, indicating that the imposed stamp duty has been paid.

The markings include certain information about the stamp duty payment, such as the serial number, name and address, the value of the purchased stamp, and the authorized entity’s license number. Franking for Power of Attorney is done by government-issued authorized franking equipment.

Overview of Demat Account Opening Process for New Investors

Investing in the stock market involves a systematic process of registration and account creation, particularly for new investors. Individuals must first register with a stock broker, who serves as the intermediary for executing trades on the exchange.

The key procedures in opening a demat account, which is a fundamental prerequisite for stock market participation, include completing two important processes:

- Know Your Client (KYC)

This serves as the initial step in obtaining basic information about the potential investor. It is a critical step for maintaining regulatory compliance and determining the investor’s identity.

It is a critical component in ensuring regulatory compliance and determining the investor’s identity. There are two methods for completing the KYC process.

The KYC procedure can be conducted in one of two ways:

- Physical KYC: This is the conventional method which involves filling out a physical form provided by the stockbroker. Investors must submit personal information such as their name, address, contact information, and other essential information. Supporting documents are usually required and are submitted in person.

- Online or e-KYC: Investors can complete the KYC formalities digitally, eliminating the need for physical paperwork. e-KYC involves providing information online, uploading scanned copies of relevant documents, and, in some cases, a video verification process through Video In-Person Verification or VIPV.

VIPV enhances the investor KYC process by incorporating a secure video verification step, adding an extra layer of authenticity to the investor’s identity.

- Account Opening

Once the KYC process has been completed successfully, investors can proceed to fill out the Account Opening form.

After these procedures are completed, investors are granted access to a demat account, which allows them to purchase, sell, and manage their assets in electronic form.

Significance of PoAs in Demat Accounts

Power of Attorney gives stockbrokers the right to handle a client’s shares. It gives them the authority to debit shares from the client’s demat account.

An investor needs to have one of three types of accounts in order to trade on the securities market.

- Trading account – with a SEBI-registered stockbroker. Used to buy or sell securities.

- Demat account – with a SEBI-registered depository participant. Used to hold shares in demat or electronic mode.

- Savings bank account – can be opened in any bank. Used to transfer funds for buying securities and receive funds from selling securities.

Suppose you are an investor and have granted Power of Attorney to your stockbroker. This means that the broker has the power to

- Buy trades : Debit your linked bank account to purchase shares

- Sell trades : Debit shares from your demat account

Types of Power of Attorney

Here’s a quick rundown of the different types of PoA documents that can be used:

- General PoA : A General PoA gives the nominated person (attorney) extensive authority to manage different financial and non-financial affairs on behalf of the account holder.

It could include managing investments, transactions, and other relevant activities. However, in the context of demat accounts, this type of PoA can offer more authority to the stockbroker and is hence not used for the purpose of investing in the stock market.

General PoA is utilized in asset management, business operations, real estate transactions, and legal proceedings.

- Limited or Specific PoA : Unlike a General PoA, a Limited or Specific PoA grants only particular powers to the stockbroker. It is tailored to address particular actions or responsibilities related to the demat account.

It includes specific instructions for the attorney, in this case, the stockbroker, for pledging or transferring the investor’s shares.

Why Do PoAs Need to be Stamped?

To render a PoA legally binding within the realm of demat account transactions, it necessitates the payment of the prescribed stamp duty. When authorizing a PoA for demat accounts, the PoA has to be franked in order for it to be valid.

- Legal Validity: Stamping the PoA ensures its legal validity and enforceability.

- Compliance Requirement: In order to adhere to government and regulatory requirements, stamping is necessary.

- Smooth Transactions: Stamped PoA allows for smooth execution of financial transactions in Demat accounts.

- Risk Mitigation: Stamping acts as evidence of the agreement, mitigating the risk of legal challenges or objections in the future.

How to Frank a Power of Attorney Document? – Stamping Process for PoA

The PoA franking procedure for demat accounts entails stamping the document to show that the required stamp duty has been paid. Here’s an overview of the process:

- Draft the PoA: The first step involves creating a comprehensive PoA document outlining the specific rights and responsibilities granted to the authorized stockbroker.

- Determine Applicable Stamp Duty:The next step is to determine the stamp duty that applies to the PoA for demat accounts. Stamp duty rates differ by state or jurisdiction, so it’s essential to understand the guidelines that apply to your specific case.

- Visit Authorized Franking Center: To initiate franking for Power of Attorney visit an authorized franking center to pay stamp duty. This involves affixing of a stamp or impression on the document to indicate that the required stamp duty has been paid.

- Submit to Demat Service Provider: The investor has to then submit the stamped PoA document to his demat service provider along with any other required documents. This is typically done at the time of opening the demat account.

By following these steps one can successfully get his/her PoA stamped. Whenever the investor sells shares from their demat account or pledges them, the POA is used to debit the shares from their demat account.

However, the manual process of getting the PoA stamped is often time consuming and involves dependency. The investor needs to visit authorized banks or designated franking centers in person.

The franking machines are also not commonly available and technical issues with the machine can lead to further delay. This can be a challenge for those in remote locations or those with time constraints.

How to eStamp PoA for Demat Accounts?

As of now, the process of physically stamping PoAs persists, but leveraging technology in the payment stage can result in considerable improvements in terms of convenience and speed.

Online stamp duty payment platforms have emerged to be an invaluable tool in terms of streamlining the stamp duty payment process. Platforms like SignDesk offer document franking services, enabling investors to get their PoAs stamped and pay stamp duty online.

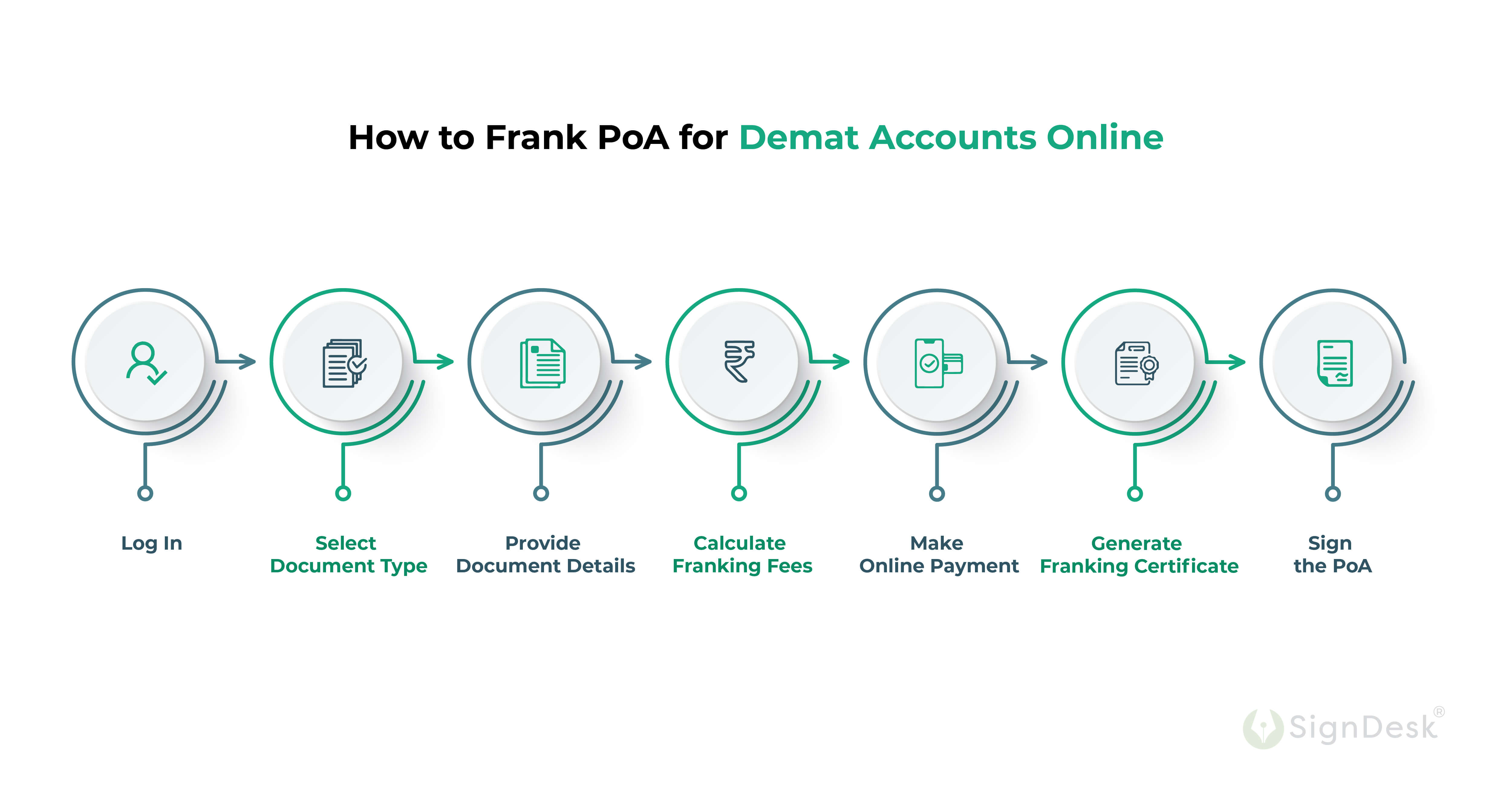

Steps to Frank PoA for Demat Accounts Online:

- Log In : Access the online franking platform

- Select Document Type :Choose the specific document type as “Power of Attorney” for Demat Accounts.

- Provide Document Details :Input the necessary details of the PoA, including names of parties involved, property details, and any other required information.

- Calculate Franking Fees:Utilize the platform’s tools to calculate the applicable franking fees based on the document’s value and prevailing rates.

- Make Online Payment: Proceed to make the online payment for franking fees using the platform’s secure payment gateway.

- Generate Franking Certificate: After successful payment, generate the franking certificate affixed with the PoA, which serves as legal proof of franking

- Sign the PoA:Ensure all parties involved sign the PoA document, which is now legally franked. Using SignDesk, parties can sign their documents electronically.

This brings efficiency to an otherwise slow manual process of franking for Power of Attorney as investors need not have to spend time visiting the franking center and waiting in line to get their PoA stamped.

Benefits of Online Stamp Duty Payment

Investors can pay stamp duty online and get their PoA franked easily. For stock intermediaries, this digital transition not only streamlines processes but also enhances overall operational efficiency. Online franking offers numerous benefits including:

- Enhanced Convenience: Investors can pay stamp duty online from anywhere. It removes the necessity for actual visits to stamping centers, resulting in unparalleled convenience for investors.

The convenience contributes to an enhanced customer experience, allowing stock intermediaries to provide efficient and modern services to their clients.

- Quick Process: Paying stamp duty online and getting PoAs franked saves investors time that would otherwise be spent on physical visits to franking facilities and waiting in lines. Investors can initiate stamp duty payment for their PoA at their convenience by paying it digitally.

By cutting down on processing time, online stamp duty payment allows stock intermediaries to complete transactions quickly and without the hold-ups that come with traditional stamping.

- Real-Time Updates:Stock intermediaries receive real-time updates and notifications on stamp duty payments, allowing for better monitoring and management of financial transactions.

- Cost-Efficiency: Online stamp duty payment reduces expenses related to travel and paperwork. The online mode of stamp duty payments minimizes manual intervention, leading to cost savings in administrative processes for stock intermediaries.

- Compliance and Accuracy:By ensuring accurate documentation and adhering to stamp duty laws, digital stamping reduces the possibility of errors occurring during manual processing.

Stamp PoAs For Demat Accounts With SignDesk

With SignDesk, investors can bid farewell to the traditional hassles of physically visiting franking centers to complete the process of franking for Power of Attorney. The online franking process for PoA is quick, accessible, and cost-efficient. Investors can conveniently pay stamp duty online, securing the necessary franking for Power of Attorney of their demat account.

Discover the seamless process and benefits of PoA stamping with SignDesk by scheduling a quick online demo. Investment companies, in particular, can unlock enhanced efficiency in their operations through this innovative solution.