Government simplifies telecom rules, permits paper-less KYC

In a series of notifications released on September 21, 2021, the Department of Telecommunications (DoT) informed all telecom service providers of sweeping changes to the onboarding process for new mobile connections.

Broadly, the notifications envisaged the following changes –

- Aadhaar-based eKYC can now be used to issue new mobile connections to individuals, outstation customers, and bulk connections.

- Self-KYC is permitted to verify individual and outstation customers.

- An OTP-based confirmation process can be used for converting prepaid mobile connections to postpaid.

These changes successfully digitize large parts of the onboarding and verification process for issuing mobile connections and could make this process simpler and more expedient for customers.

Let’s take a detailed look at the changes envisaged by DoT and what they mean for customers and service providers.

Aadhaar eKYC for new mobile connections

DoT’s notification concerning eKYC states that telecom service providers can use the Aadhaar-based eKYC procedure to validate customers’ KYC information digitally.

This introduction of eKYC is possible due to an amendment to the Indian Telegraph Act (1885) that allowed for the re-introduction of Aadhaar eKYC for new mobile connections.

According to the notification, the central government can charge telecom service providers a verification fee of Rs. 1 for every eKYC verification performed; additionally, the security aspects of implementing eKYC will be the responsibility of the respective Telecom Service Providers (TSPs).

The notification additionally outlines the process to be followed for eKYC-based issuance of new mobile connections and states that eKYC conducted through a Point of Sale (PoS) can be used for individuals, outstation customers, and to provide bulk connections.

Next, let’s examine the eKYC process envisaged by DoT.

PoS-assisted eKYC process for new connections

The procedure outlined by DoT for issuing new connections following eKYC-based authentication through an authorized Point of Sale (PoS), is as follows.

- The customer visits the PoS of the TSP, or the agent visits the customer.

- The customer authorizes UIDAI to release their demographic information and photograph to the TSP. The authorization must be done online either via Aadhaar OTP or through biometric authentication. UIDAI provides this information to the TSP in a digitally signed & encrypted format.

- The customer must declare and consent to the following before authorizing UIDAI to release their information –

- I am voluntarily using Aadhaar based e-KYC process for acquiring the SlM.

- I hereby give my consent to use my Aadhaar number/ Virtual-lD and biometrics for sharing the eKYC details (demographic data and photograph) to the TSP for issuing of mobile connection to me

- I have been informed by the PoS regarding the two existing alternate processes of acquiring SIM viz. Paper-based process and D-KYC process.

- My biometric authentication can be treated as my signature.

- The information released by UIDAI must be automatically filled in the Customer Application Form (CAF), with just the customer’s name being visible to the sales agent and no customer data being stored on the agent’s device.

- A live photograph of the customer is captured by the agent with the date and time stamps.

- In case of outstation customers –

- The local residential address of the customer is provided

- The name, address, and mobile number of a local reference must be provided

- The reference is validated via an OTP sent to their number 0

- In case of bulk connections –

- An Authorised Signatory is authenticated via eKYC

- A document that establishes the identity and address of the entity is captured

- Authorization letter for the signatory and a list of all end users are both provided to the agent

- Before activating the connection, the customer’s application is checked for errors & matched with information received from UIDAI, either by a representative or by the Licensee’s system.

- The date and time of SIM activation will be captured in the database records and the customer’s application.

- The PoS agent’s identifying information retrieved from UIDAI will be used to activate new mobile connections and must be maintained by the Licensee.

- Only one mobile connection per day can be issued to a customer using eKYC

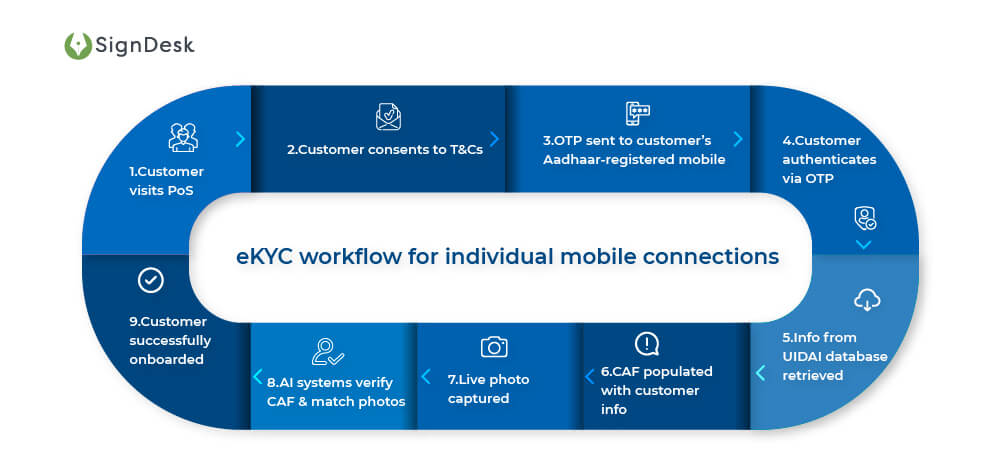

eKYC workflow for new connections – How it works in practice

While the steps for the eKYC process envisaged by DoT appear to be numerous and slightly complicated, KYC verification systems automate the KYC workflow to ensure complete compliance with the DoT’s regulations.

Here’s how onboarding a customer via eKYC will work when using a digital KYC workflow.

The eKYC-based onboarding process is superior to the paper-based KYC process and D-KYC process, both of which involve turnaround times of 5-10 days. eKYC authentication is completed instantly and is paper-free, enabling a hassle-free customer experience and improved onboarding efficiency.

Next, let’s look at the Self-KYC process for obtaining mobile connections.

Self-KYC for local and outstation connections

The DoT has approved an aptly named Self KYC (S-KYC) process for issuing individual customers at local and outstation levels.

The Self KYC process will involve the customer using an app or a portal to apply for new mobile connections remotely and delivery of SIM cards directly to the customer. The documents to be verified in Self KYC will be retrieved from UIDAI or DigiLocker following validation from the customer.

Again, the security aspects of S-KYC will be the responsibility of the respective TSPs.

What steps will the Self KYC process involve?

Self-KYC process for Individual mobile connections

The steps in the procedure envisaged by DoT for the Self-KYC process are as follows.

- The customer must use an alternate mobile number to register on the app or portal provided. This number will be validated via OTP.

- Only information and documents obtained from UIDAI or via DigiLocker will be used for customer verification.

- In case the customer opts for Aadhaar-based verification, they must consent to the following –

-

-

- I am voluntarily using Aadhaar based authentication for acquiring the SlM.

- I hereby give my consent to use my Aadhaar number/ Virtual-lD verified by OTP received on my Aadhaar linked number by UIDAI for sharing the KYC details (demographic data and photograph) from my Aadhaar to the TSP for issuing of mobile connection to me.

-

-

- All the fields in the customer application form are filled automatically using the information obtained via UIDAI or DigiLocker, or directly by the customer on the app or portal.

- The customer captures a photo and video in which they’re clearly visible.

- For outstation customers, the mobile number of a local reference provided by the customer will be validated via OTP.

- Before SIM delivery, an authorized representative or the Licensee’s system will make sure that there are no errors in the information provided by the customer, the customer’s picture matches with the photo received from UIDAI or DigiLocker, and that the customer’s location is within the boundaries of the country.

- The SIM delivery will be authenticated via an OTP sent to the customer’s alternate number and the location where the delivery takes place will be captured.

- SIM activation will take place after due verification either by an authorized representative or the Licensee’s system at the backend.

- The SIM will be activated only after the customer’s application form has been digitally signed by an authorized representative of the Licensee. In case the verification was automated, the digital signature will not be applicable.

- The date and time of SIM activation will be recorded in the database records and the customer’s application.

- TSPs are encouraged to use AI techniques to improve S-KYC and protect against its misuse.

Therefore, the S-KYC process enables customers to apply for and receive new mobile connections from the comfort of their homes; while also ensuring high security and a paper-free process.

Let’s look at how S-KYC will work in practice.

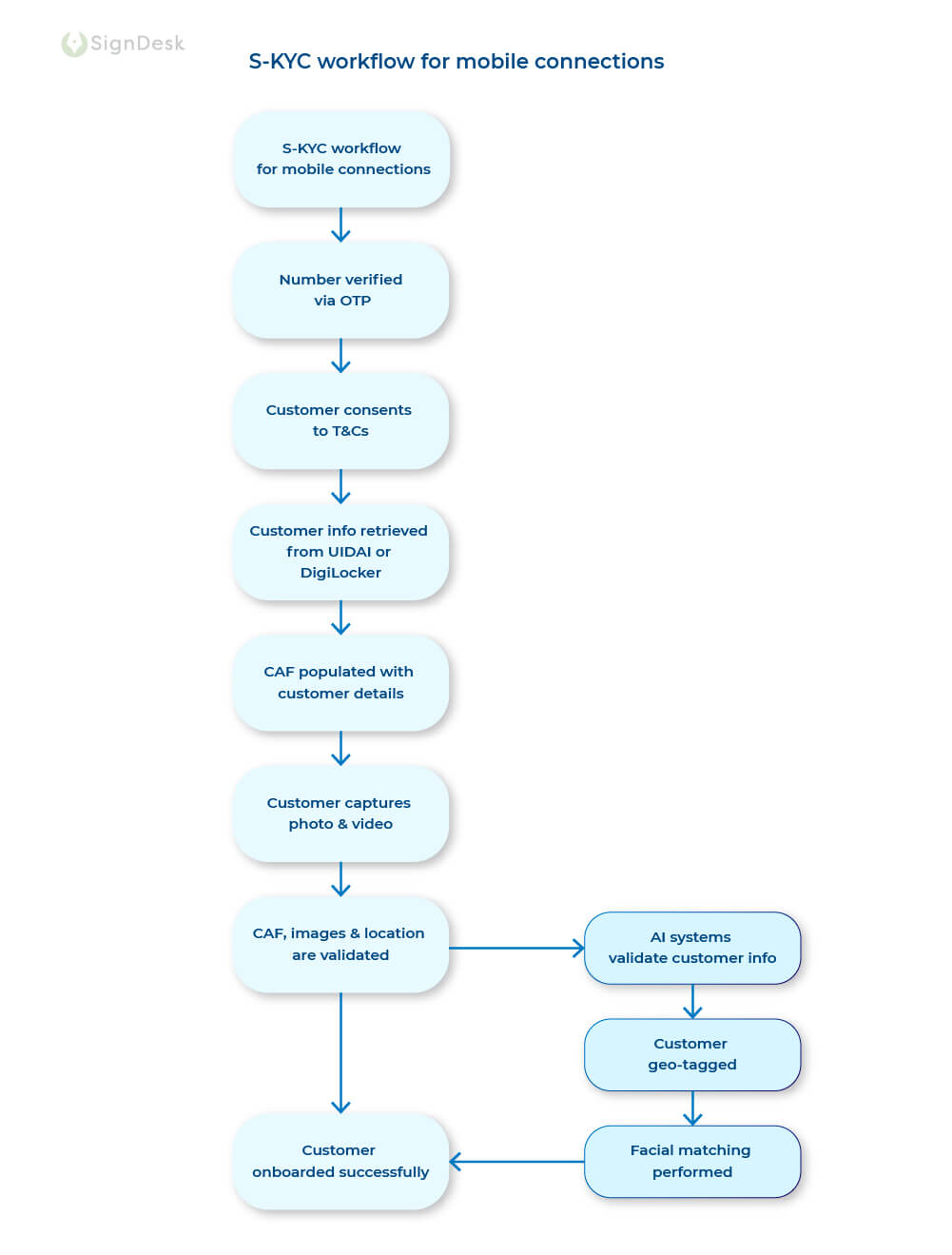

Self-KYC workflow for new mobile connections

The Self-KYC process is quite similar to the non-assisted KYC verification model in use by several banks to onboard new customers. By using AI-powered KYC verification services, TSPs can ensure a seamless & error-free S-KYC for customers.

Here’s how S-KYC will work.

The Self-KYC process enables the completely remote issuing of new SIM cards to customers and will enable TSPs to increase the number of new mobile connections at lower operating costs and with greater efficiency.

By leveraging AI-powered KYC verification, TSPs can ensure quick and comprehensive customer verification, secure onboarding, and a seamless experience for new customers.

OTP-based conversion from prepaid to postpaid

Finally, customers desirous of changing from prepaid to postpaid mobile connections can do so through OTP, according to another notification from the DoT.

According to this intimation, customers must send a request to the licensee via SMS, IVRS, website, or an authorized app. Once the request has been received, the customer will receive a message on the concerned mobile number, which will include a transaction ID and an OTP.

After this OTP is validated via SMS, IVRS, website, or an authorized app, the validation will be taken as consent to change the customer’s mobile number from prepaid to postpaid.

Following this conversion, a confirmation message will be sent to the customer.

eKYC-based verification – What it means for TSPs

Digital and remote customer verification offers numerous benefits for both TSPs and customers.

Here’s what the telecom sector can expect as a result of DoT’s notifications.

- Massive reductions in onboarding & KYC expenses

Several reports estimate that automating KYC procedures can entail a minimum of 50% reduction in expenses.

Digital KYC & eKYC, in particular, has been shown to reduce onboarding costs by 90%, due to the digital nature of the process, the absence of paperwork & the utilization of automated verification methods.

- Shortened turnaround times

The total duration of a non-digitized KYC verification process for new mobile connections can stretch from 10 to 20 days.

Automated KYC demonstrably reduces the turnaround time for KYC verification by automating the validation process, instantly verifying KYC details & digitizing the documentation involved.

eKYC verification procedures have been shown to reduce TAT from 10 days to within 10 minutes.

- Increased productivity & fewer documentation errors

eKYC boosts worker productivity by removing the inefficiencies associated with paper-based documents & manual workflows.

Reports estimate that digitizing paperwork can boost productivity by 20%, and using AI-powered verification techniques further boosts efficiency by reducing potential verification errors.

- Seamless onboarding journey with fewer drop-offs

Previous paper-based KYC procedures were often too fragmented & slow, resulting in about 40% of customers abandoning the KYC verification process.

Automating KYC ensures a smooth & seamless onboarding process for customers by making the process entirely digital & automated, which is directly in line with customer demands since more than 55% of customers prefer a digital method of identity verification.

Surveys have further indicated that automating KYC procedures reduces KYC drop-offs by 20%.

- Usage of cutting edge technology

All the circulars released regarding eKYC and Self KYC encourage the use of AI & other emerging technology to enhance the Video KYC process.

SignDesk has taken this as an opportunity to strengthen our KYC verification solution with cutting-edge AI-powered document verification, OCR-based image data extraction, facial matching capabilities & ML-enabled fraudulent profile filters.

Reports have shown that automating KYC procedures using AI technology massively reduces expenses & boosts ROI.

- Safety & security are prioritized

Fraud has been a huge problem for TSPs and result in the illicit usage of mobile numbers for criminal purposes. The usage of secure KYC procedures with facial matching and geo-tagging ensure that no criminals can use mobile number for terroristic and other illegal activities.

The notifications sent out by DoT and the KYC procedures envisaged therein, will undoubtedly play a favorable role in allowing TSPs to remotely, securely & cost-effectively onboard new customers for mobile connections.

TSPs can now leverage AI-powered KYC verification to scale their operations and optimize onboarding while securing their verification processes using the latest technology.

SignDesk – Seasoned & Award-winning KYC Verification

SignDesk is an award-winning provider of AI-powered verification and documentation solutions to businesses.

We use real-time AI-powered document verification techniques, OCR-enabled image data extraction, facial matching & ML-based fraud filters to automate and expedite the KYC verification process.

Our verification solutions have helped 350+ clients reduce onboarding expenses, cut down on KYC drop-offs, reduce TAT by 99%, and safeguard against fraud using cutting-edge compliance technology.

Our efforts to automate KYC have been recognized in the form of numerous awards, the latest being the Best AI/ML Product at InnTech 2020 and the Global Banking & Finance Review’s Best Digital Onboarding Product of 2020.

Are you ready to join 60+ major banks & several enterprises and start onboarding with automated KYC? Book a free demo with us now, and let’s get started!