KYC Verification

KYC Verification is an integral part of the customer onboarding process in the BFSI sector due to the widespread occurrence of money laundering & fraud within the banking & insurance industries.

KYC has become an important tool for both the regulatory and industrial sector to mitigate theft & crime but complying with the prescribed KYC workflow & regulations is also a burden for banks and insurers, sometimes resulting in several crores in fines.

KYC verification consists of several pillars but 3 are fundamental to the process.

The main components of KYC Verification

Online fraud is a massive problem in the BFSI sector.

Insurance companies reportedly lost 46,000 crores to fraud in 2018-19 and RBI reports that the public sector banks and private sector banks have seen increases of 234% and 500% respectively in the number of reported fraud cases in 2019-20.

Therefore strong KYC verification is the need of the hour. Here are 3 key components in the KYC verification process –

1. Customer identification

Customer identification is one of the initial steps involved in KYC verification and consists of the customer providing certain preliminary information to the bank or insurer. This information usually consists of –

> Name

> Date of birth

> Age

> Address

This information is usually obtained through documents such as Aadhaar, PAN, DL or passport and is then verified.

Third-party services can also be employed by banks provided that the third party is appropriately regulated and makes the customer’s identification documents readily available.

2. Customer due diligence

Customer due diligence is the process of making sure that the customer is indeed who they claim to be, and lies at the heart of the KYC verification process.

The customer due diligence process can consist of establishing proof of possession of identifying documents through offline verification, online OTP-based verification, valid e-signatures or through the digital KYC process in which the live pictures of the customer and IDs are taken and the information is verified first by the customer via OTP and then by the official conducting digital KYC.

Recently, video-based KYC procedures for due diligence have also been introduced by RBI, IRDAI, and SEBI, in which due diligence is completed without the physical presence of either the customer or the official. Video KYC involves automated document verification using live images of IDs, facial matching to confirm customer identity, and both online or offline Aadhaar authentication.

Banks have separate procedures of due diligence for individuals, proprietary firms, and legal entities. There is also a simplified CDD (Customer Due Diligence) procedure in place for NBFCs and enhanced and simplified CDD procedures for politically exposed persons, foreign students, professional intermediaries, non face-to-face customers, and foreign portfolio investors.

3. Monitoring & reporting

Monitoring the activities of accounts opened after conducting identification and CDD is crucial in preventing fraud, theft, and money laundering.

RBI mandates that a reporting and record-keeping system be put in place according to the Prevention of Money Laundering (PML) Rules, 2005. Rule 3 of PML Rules states that a record should be kept of all cash transactions valued at 10 lakhs or more, all series of transactions valued at 10 lakhs or more, all cash transactions involving forged currency, and all suspicious transactions involving credit or debit cards, money transfers, cheques, or loans and advances.

In such cases, banks are directed to maintain a record of –

1.The nature of the transactions;

2.The amount of the transaction and the currency in which it was denominated;

3.The date on which the transaction was conducted; and

4. The parties to the transaction.

This helps banks prevent fraud & theft before it can happen, and ensures trust between customers and banks.

3 Steps to Automate KYC Verification

The steps involved in KYC verification are traditionally completed using manual and paper-based methods.

This takes a huge toll on operational costs, employee efficiency and prolongs the onboarding process, resulting in customer KYC drop-offs.

Insurers have seen a 40% increase in operating costs, banks spend 90% more on onboarding when using non-automated KYC methods, and organizations spend about 30 days to onboard and verify customers, leading to 1 in 5 customers abandoning the KYC verification process.

Businesses need an automated and digitized KYC verification process to reduce these costs and provide customers with a seamless onboarding experience.

Here’s how businesses can upgrade and enhance KYC verification.

1. Automated data validation

Data validation is a crucial step in customer due diligence and ensures that the customer is who they claim to be. Manual data verification consists of reviewing several paper-based documents and cross-checking details with databases. This process is cumbersome and in most cases takes about 30 days for a single customer.

Automating data validation through OCR-based data extraction and AI-powered data verification using standard databases allows the data validation process to be completed within minutes, saving about 120 hours per customer and boosting productivity of employees by 20%.

2. Video-based KYC

Obtaining verifying information from customers in real-time is important for the customer due diligence procedure to fulfill its purpose. Real-time verification has also been shown to mitigate fraud as it involves a face-to-face interaction with the customer to gauge KYC.

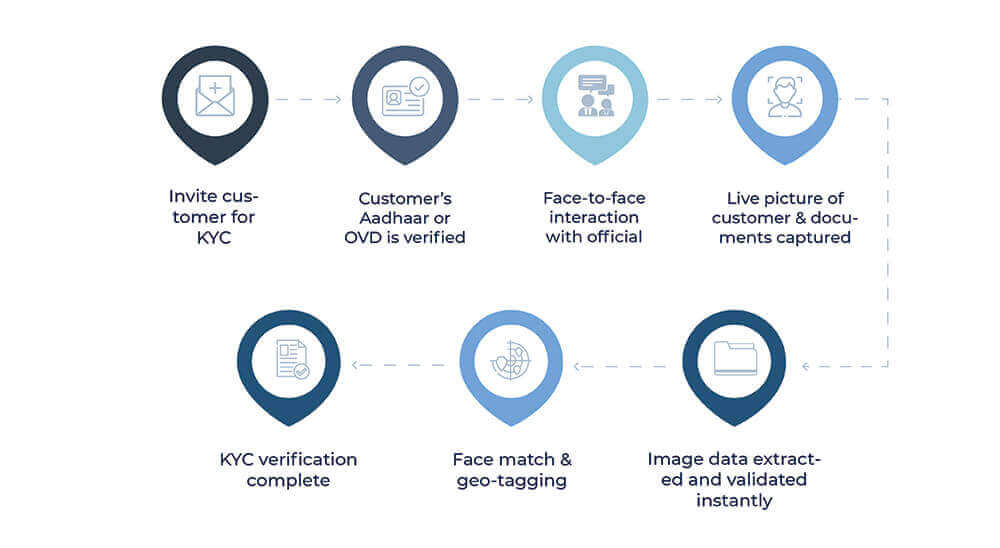

RBI & IRDAI have mandated a video-based KYC verification process in this spirit, to expedite onboarding while placing anti-fraud measures into the process. Video KYC involves a real-time questionnaire-based interaction between a trained official and the customer, in which images of IDs and the customer are captured to aid customer due diligence.

SignDesk uses a smart interface and AI-powered data verification mechanisms to further expedite the video-based KYC process and helps reduce the turnaround time on KYC verification by 99%.

3. Real-time document verification with anti-fraud filters

Verifying the KYC documents of a customer is an important and deeply involved step in customer due diligence, especially since 20% of all reported frauds in the Indian banking sector is due to fraudulent documentation.

However, this process is time consuming and painstaking when conducted manually, resulting sometimes in 30 days for a single customer verification and manual verification errors.

SignDesk automates KYC document verification using OCR technology to read information from IDs and smart AI to extract and verify this information using standard databases. Additionally, ML-based anti-fraud filters mitigate the threat of identity theft.

This allows banks and insurers to reduce the turnaround time for KYC verification to 10 minutes, boost efficiency by 20%, and save crores in fraud-related costs.

SignDesk incorporates all these features into our video KYC and AI-powered verification solution. Here’s how the KYC process will go on our KYC verification platform.

AI-powered KYC Verification

SignDesk uses cutting edge ML and AI to provide businesses with an award-winning and cost-effective KYC verification solution.

Several major banks and insurers have used our video KYC product to –

- Reduce onboarding expenses by 90%

- Cut turnaround time for KYC verification to 10 minutes

- Reduce KYC drop-offs by 20%

- Boost productivity by 20% by saving 120 hours per customer

We have also been awarded the Global Banking & Finance Review’s Best Digital KYC/Onboarding Product of 2020 in India.

Our KYC verification solution uses AI for data validation, ML-based filters to mitigate identity fraud, all on a smart workflow-based interface.

Are you ready to automate your KYC verification process and reap the benefits? Book a demo with us now!