eMandate For Easy Automation

Convenience is clearly at the centre of everything we do these days. Not so long ago, you’d have to visit multiple centres to make repetitive payments for utility bills, house rent, insurance premiums, donations, EMIs etc.

Not anymore though.

Now all you’ve got to do is authorize the bank/concerned organization to automate these payments. The document used for authorization is called the Mandate. In its digital and simplified form, it is the eMandate.

An individual or a business traditionally employs an exclusive resource to process and manage repetitive payments, and eMandate saves the efforts and cost of that resource. Any person or a business with an active Aadhaar-linked bank account can present an eMandate to their bank and automate their repetitive payments. There is no limit to the number of eMandates one may present to the bank.

Let’s look at how eMandate works.

How does eMandate Work?

A business or an individual can automate recurring payments like salaries, pensions, donations, utility bills, dividends, EMI’s or virtually any payment that needs to be automated by filling the necessary information in the eMandate webpage offered by the organization.

Once the organization receives your eMandate form, it goes through the following scrutiny:

- The eMandate is sent to one of the sponsor banks recognized by NPCI.

The Sponsor Bank is a financial institution recognized by the National Payment Corporation of India to facilitate the eMandate process. When a customer opts to use the eMandate facility, the business forwards the eMandate document to the sponsor bank from where it would receive periodic payments. These funds are collected from the Destination Bank (customer’s bank)

Currently, there are 40 sponsor banks registered with the NPCI. ‘

- The sponsor bank processes it to the National Automated Clearing House (NACH) – the regulatory authority for automated payments in India.

- After approval, eMandate is sent to the Destination Bank

The destination bank is the bank where the funds get auto-credited. It is the business’s bank account.

Since there is no limit to the number of eMandates you can present from NACH, you may proceed to use the eMandate in whichever payment process you may need to automate.

Advantages of eMandate

1. Easy Investing Experience

The benefits of long-term investments being well-stated, eMandate allows you to seamlessly commit to a Systematic Investment Plan (SIP). It hardly takes 2-3 working days to process your eMandate for this purpose. In contrast, the previous manual process would take around 3-4 weeks.

In a welcome move, the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) have introduced the eMandate for a simplified investing experience.

2. Cost Saving

There is no need for an individual to visit various centres to make recurring payments anymore. Businesses do not need a resource to process such payments as well.

3. Convenience to Customers

A customer who is offered an added convenience is likely to feel more delighted than otherwise. For all the simplicity and convenience it offers, the idea of not having to make a repetitive effort or spend for the same is indeed enticing.

4. Assurance to Businesses

A business that offers its customers the facility of automating their periodic payments is likely to be benefitted in multiple ways. While it offers its customers an upfront convenience, it is more likely to get paid on time without having the hassle of reminding or collecting the payments from the customer manually.

5. Easy to Initiate

Previously, initiating the Mandate would require one to manually fill a form, sign and present it to the bank/business organization, and wait for about 2 to 3 weeks to find out if the document has been accepted.

With eMandate one can digitally fill this form using just an internet-enabled device and expect approval in no more than 3 working days.

6. Approval using Aadhaar eSign

A recent NPCI decision to allow customers to approve their mandates using Aadhaar eSign has made eMandate even more convenient. Customers can now approve auto-debits simply using a device with an internet connection, as opposed to using NetBanking details as was the case earlier.

Remote and instant mandate approval saves time and effort for the customer, significantly lowers the TAT on payments for banks and businesses, and provides numerous other benefits.

The fact that the eMandate can be accessed from any part of the world and its considerably quick turnaround time makes a great case for its wider adoption. Also, a customer’s data is much more secure thanks to the digital nature of documents in eMandate.

Constraints To eMandate In India

Convenient as it is for large recurring payments, an eMandate will not be approved by the National Automated Clearing House (NACH) in the following instances:

1. Lack of express information on the eMandate form

All the information in the eMandate form must be duly filled and insufficient information will lead to the rejection of the eMandate.

2. Aadhaar not linked to a bank account

Conditionally, the Reserve Bank of India has mandated that every bank account shall be linked to the account holder’s Aadhaar. Bank accounts being linked to Aadhaar is indeed non-negotiable to avail of most government services. Hence, it goes without saying that linking Aadhaar to your bank is a mandatory requirement without which the eMandate document will not be approved.

Additionally, linking Aadhaar to your phone number helps you seamlessly eSign the eMandate (or any document for that matter) without any hassle whatsoever and is also mandatory to process the eMandate.

3. Transaction limit of one lakh per day

At the time of writing, a transaction through eMandate is limited to one lakh rupees per day by NACH.

For instance, if you intend to automate your EMIs, you cannot process payment of over one lakh rupees per month (or a pre-defined period) for that particular payment.

4. Variable Payout and Timeline

An eMandate requires you to stipulate a certain amount of money that gets deducted from your account periodically. Payments of variable sums of money or payments at irregular intervals is not possible when you choose to automate your payments with the eMandate.

These limitations are indeed a deterrent to automation; however, the advantages of the same facility cannot be discounted.

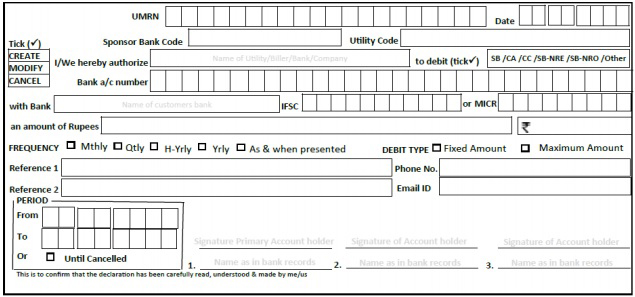

Particulars In The eMandate Form

Any organization that seeks to simplify its customer’s recurring payment can do so with an eMandate form. The document will contain the following information:

1. UMR Number

Unique Mandate Reference Number is an auto-generated number from NACH. The unique number identifies each mandate and is an imperative feature in all stages of the transaction. UMRN is also essential to amend a mandate or even cancel it.

2. Sponsor Bank Code:

The sponsor bank is the bank that is recognized by the NPCI – National Payments Corporation of India, to facilitate the eMandate. This code helps identify the bank and its location.

3. Destination Bank Details

Destination Bank is the bank from where funds are auto-debited. It validates the customer details and signature, and either accepts or rejects the eMandate.

4. Frequency of Payments

The customer and the business will both know how frequent the recurring payments are. They could be fortnightly, monthly, quarterly or any predefined time within the understanding of the business and the customer.

5. Time Span

The ultimate limit set by NACH to automate recurring payments is 31 December 2099. The customer will specify the time span of his/her recurring payment in the eMandate form.

6. References

Two reference fields are to be filled in the eMandate form. The client can leave these blank as the Mandate Reference number is entered here by NACH.

Clearly, the eMandate facility has considerably simplified the process of automating a recurring payment. The manual process which would require about 3 weeks to get approved now takes not more than 2 working days.

Any organization or an individual to automate and thereby simplify his recurring payment can utilize the Electronic Mandate document to conveniently process and track their repetitive payments.

Our NPCI-compliant eNACH eMandate solution has allowed our 350+ clients to reduce TAT on recurring payments by up to 99% and was the first eMandate service to be approved for Aadhaar eSign by NPCI.

We use the best in AI technology to automate recurring payments, digitize mandate-related documentation, and boost the efficiency of your business.

Start automating recurring payments now by booking a demo with us!