The Key Facts Statement (KFS), a standardized document mandated by the Reserve Bank of India (RBI), is a crucial tool for promoting transparency and protecting the interests of borrowers. Providing a clear and concise overview of loan terms and conditions, the KFS empowers individuals and businesses to make informed financial decisions.

The KFS summarizes the essential details of a loan agreement between regulated entities (REs) and borrowers. It is designed to provide legally significant information straightforwardly, ensuring that borrowers fully understand the financial implications of their loans. Key facts included in the KFS are loan amount, interest rate, fees, charges, and repayment terms, enabling borrowers to assess their financial commitments effectively.

Purpose of the Key Facts Statement (KFS)

The primary purpose of the KFS is to promote transparency in the lending process by ensuring that borrowers have access to all relevant information before committing to a loan. The KFS helps to:

- Enhance transparency by providing clear and concise details about loan terms and costs.

- Reduce information asymmetry between lenders and borrowers, allowing borrowers to make better-informed financial decisions.

- Standardize the disclosure of loan terms across all regulated entities, ensuring consistency in how loan information is presented.

- Protect consumer interests by clearly outlining all loan fees, charges, and penalties.

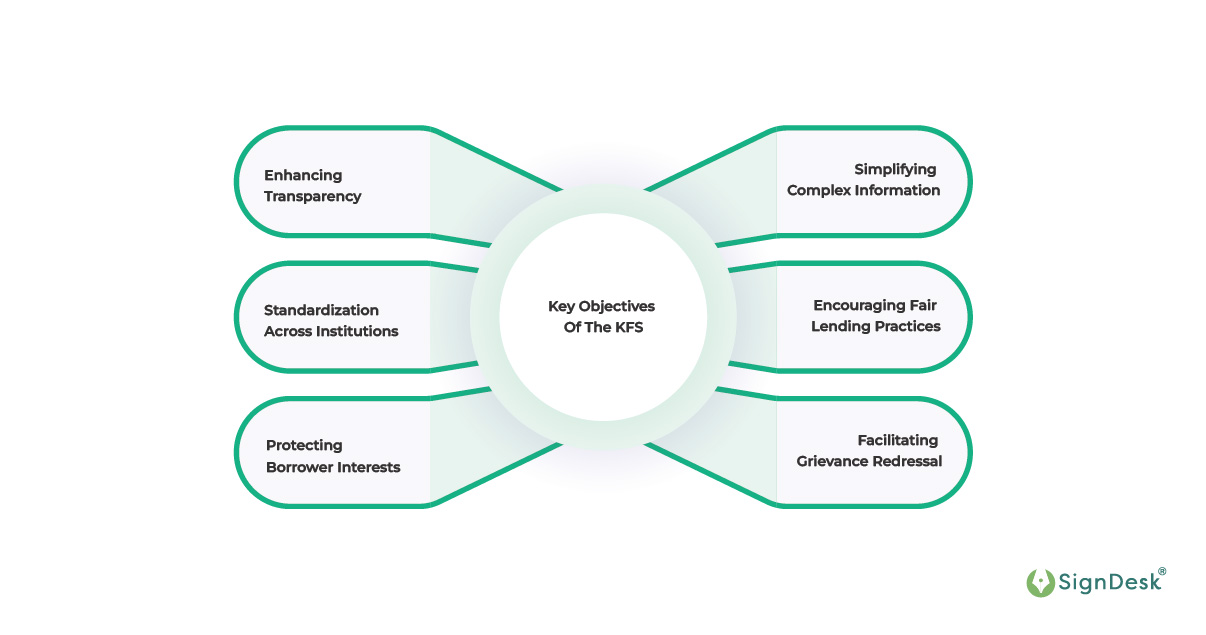

Key Objectives Of The KFS

Understanding the KFS’s objectives is crucial for both borrowers and lenders. This section discusses the KFS’s primary goals, including enhancing transparency, protecting consumer interests, and standardizing loan information across all financial institutions. The key objectives of the KFS include:

- Enhancing Transparency: The KFS aims to provide borrowers with a clear and straightforward summary of the key aspects of their loan, including costs, terms, and obligations. This transparency helps to prevent misunderstandings and disputes between borrowers and lenders.

- Standardization Across Institutions: The KFS standardizes the presentation of loan information across all regulated entities. This uniformity ensures that borrowers receive consistent information regardless of the lender, facilitating easier comparisons and a better understanding of loan terms.

- Protecting Borrower Interests: The KFS is designed to protect borrowers from potential exploitation by clearly outlining all relevant fees, charges, and conditions associated with the loan. This protects borrowers from hidden costs and ensures they are fully aware of their financial obligations.

- Simplifying Complex Information: Loan agreements can be complex and filled with legal jargon that is difficult for the average borrower to understand. The KFS simplifies this information, presenting it in a way that is accessible and easy to comprehend, thus reducing the risk of borrower confusion or misinterpretation.

- Encouraging Fair Lending Practices: By mandating the disclosure of crucial loan terms through the KFS, the RBI encourages fair lending practices among financial institutions. This ensures that borrowers are treated fairly and that lending practices are consistent and transparent.

- Facilitating Grievance Redressal: Including grievance redressal information within the KFS ensures that borrowers know where to seek help if they have any loan issues or disputes. This promotes accountability and responsiveness among financial institutions.

The screenshot below of the RBI circular dated April 15, 2024, clearly illustrates its objective as explained in this section:

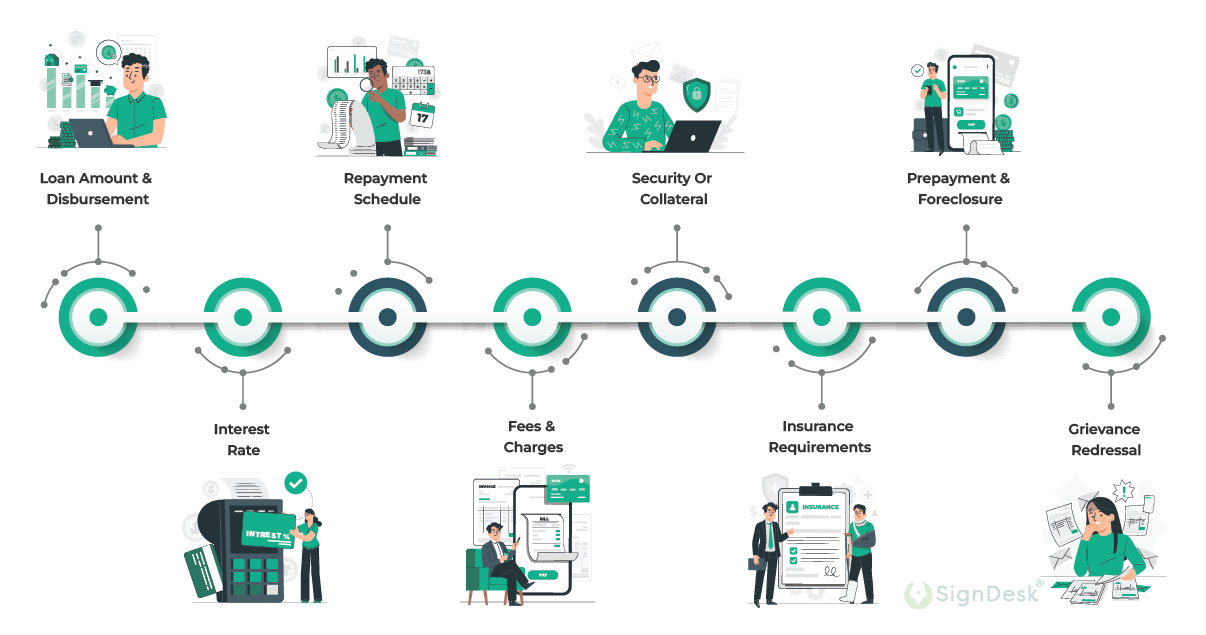

Components Of The KFS

The KFS comprises several key elements collectively providing a comprehensive loan or financial product snapshot. This section outlines each component and explains its importance in helping borrowers understand critical aspects such as loan amounts, interest rates, fees, repayment terms, etc.

By breaking down these components, the KFS ensures borrowers have all the information to make well-informed financial decisions. Here are some of the critical elements of KFS:

- Loan Amount and Disbursement: The KFS must have details of the sanctioned loan amount and disbursement schedule details.

- Interest Rate: It should contain the applicable interest rate, whether fixed or variable, and the basis for changes in variable rates.

- Repayment Schedule: The repayment tenure, periodicity, and installment amount must be made available.

- Fees & Charges: The statement must contain a comprehensive list of all fees, charges, and penalties associated with the loan, including processing fees, late payment penalties, and other relevant costs.

- Security Or Collateral: Information on any security or collateral required for the loan must be collected.

- Insurance Requirements: Information on any mandatory insurance policies linked to the loan must be listed.

- Prepayment and Foreclosure: The FKS should mention the terms and conditions for prepaying or foreclosing the loan, including any applicable charges.

- Grievance Redressal: Information on the grievance redressal mechanism is available to the borrower.

The KFS must be provided at the time of the loan sanction and before the disbursement of funds, ensuring that borrowers have ample opportunity to review the information.

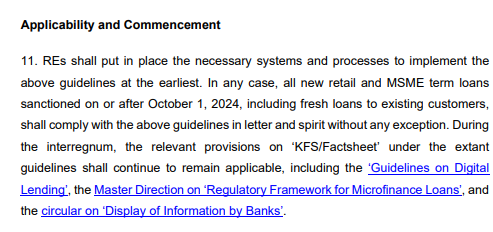

Applicability & Target Segments

The KFS guidelines apply to all retail and MSME term loans offered by regulated entities, including:

- Commercial Banks (excluding Payments Banks)

- Non-Banking Financial Companies (NBFCs) including Housing Finance Companies

- Urban Co-operative Banks, State Co-operative Banks, and Central Co-operative Banks

These guidelines apply to new retail and MSME loans sanctioned on or after October 1, 2024, including fresh loans to existing customers. The KFS is required for all loan agreements except for credit card receivables, exempt from these provisions.

Refer to the image of the RBI circular below for more details on the applicability of this guideline:

Language Requirements

To ensure accessibility and understanding, the KFS must be provided in a language familiar to the borrower. Key language requirements include:

- Bilingual or Multilingual Formats: The KFS should be provided in English and the local language of the region where the loan is disbursed.

- Simple and Clear Language: The document should be straightforward and free from complex jargon to make the information understandable

- Explanation and Acknowledgement: The KFS contents must be explained to borrowers, and an acknowledgment must be obtained to confirm their understanding.

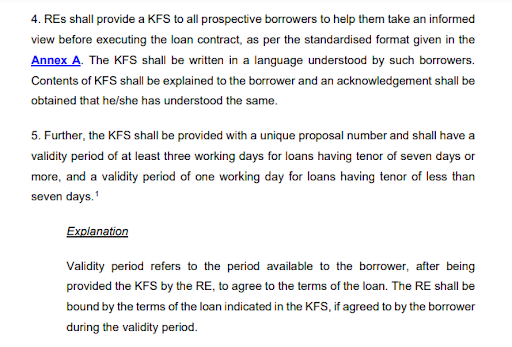

Validity of KFS

The Key Fact Statement (KFS) has specific validity periods outlined in Clause 5 of the KFS guidelines, depending on the loan tenure. For loans with a tenure of 7 days or more, the KFS must remain valid for at least three working days. For loans with a tenure of less than 7 days, the validity period is at least one working day.

The lender calculates this validity period from the date the KFS is provided to the borrower, serving as a protection measure to ensure the borrower has sufficient time to review and either accept or reject the terms. While these are the minimum requirements, lenders can offer borrowers additional time if needed, as the rules do not restrict extending the validity period beyond the minimum.

Non-Compliance and Penalties

Non-compliance with KFS guidelines can result in severe consequences for financial institutions, including:

- Financial Penalties: Regulated entities may face fines for failing to provide or inaccurately present KFS documents.

- Operational Restrictions: Regulators may restrict companies from lending until they achieve compliance.

- Reputational Damage: Public disclosure of non-compliance can harm the institution’s reputation and customer trust.

Compliance Requirements

All regulated entities must have systems and processes to implement the KFS guidelines effectively and ensure full compliance. This includes providing the KFS in a standardized format, ensuring accuracy in the information disclosed, and adhering to the guidelines for language and presentation.

Enhancing Compliance with SignDesk: Adhering to RBI’s KFS Guidelines

SignDesk provides comprehensive features designed to help lending institutions comply with the stringent Key Facts Statement (KFS) guidelines issued by the Reserve Bank of India (RBI). Here’s a detailed overview of how SignDesk facilitates adherence to these regulations, ensuring a streamlined and compliant documentation process.

1. Standardized Document Templates

SignDesk incorporates RBI-compliant standardized templates for KFS documents. These templates are meticulously formatted according to RBI’s specific annexures, ensuring that all necessary loan details are presented. This standardization is essential for maintaining uniformity across all documents, thus ensuring that every borrower receives the required information consistently.

2. Multilingual Accessibility

Recognizing India’s diverse linguistic landscape, SignDesk supports multiple languages. This feature ensures the KFS is accessible in the borrower’s regional language, enhancing understanding and compliance. Multilingual support is crucial, as it helps overcome linguistic barriers and ensures that borrowers fully understand their financial obligations.

3. Pre-Agreement Availability and Acknowledgment

SignDesk strictly adheres to the RBI mandate that the KFS must be provided to borrowers before the loan agreement is signed. The platform ensures advanced presentation of the KFS and captures digital acknowledgments from borrowers, confirming their understanding of the document. This process is vital for legal compliance and safeguards lenders and borrowers by confirming informed consent.

4. Error Handling and Document Linkage

SignDesk’s advanced error handling prevents common documentation errors, such as duplicate agreement numbers. The platform also ensures accurate linkage between KFS and loan agreements, essential for maintaining document integrity and continuity throughout the loan processing workflow.

5. Bulk and API Workflow Integration

SignDesk offers robust features for bulk operations and API integrations to accommodate high-volume loan processing. These features enable the processing of multiple KFS and loan agreements simultaneously, ensuring compliance at scale. Bulk processing optimizes efficiency for large datasets, while API integration facilitates seamless system connectivity, enhancing workflow automation.

6. Digital Stamping and Real-time Updates

The platform supports digital stamping required for certain loan documents under Indian law, ensuring all stamp duties are paid and recorded electronically. Real-time updates on document status keep all parties informed of progress and necessary actions, further enhancing regulatory compliance and operational transparency.

These features showcase SignDesk’s commitment to simplifying financial regulation compliance, aiding institutions in providing a transparent, efficient, and legally compliant borrowing experience.

Conclusion

The Key Facts Statement (KFS) is critical in ensuring transparency and fairness in the lending process. By providing borrowers with clear, standardized information, the KFS helps to protect their interests and promotes a more informed and transparent financial environment. Regulated entities must prioritize compliance with KFS guidelines to foster trust and maintain high standards in their lending practices.