Real money gambling – An Overview

Gambling is undoubtedly one of the oldest activities that have continuously been carried out by people the world over for millennia, and it doesn’t look like it will run out of steam anytime soon. Since the dawn of the digital age, the gambling and betting industries have started going online.

The global online gambling market, valued at USD 64.13 billion in 2020, is expected to grow to USD 112.09 billion by 2025. This growth is due to several factors, including – rapid internet penetration, increasing adoption of smartphones, a rise in companies adopting freemium models and creating cost-effective mobile applications, and more recently, the growing number of partnerships between betting companies.

The number of gamblers worldwide stands at 1.6 billion, while 4.2 billion say they gamble at least once a year. This is around 26% of the world’s population, indicating that there’s a lot of money going around.

However, the relatively obscure nature of the gambling industry precipitates real money laundering risks. With casinos and betting companies turning over millions of dollars daily, the susceptibility of this industry to money laundering must be seriously considered.

AI-powered KYC verification solutions offer companies a safeguard against money laundering and are quickly becoming a staple for the online betting industry. But before getting into how, let’s look at the online sports betting industry in the Indian context.

Online sports betting in India

With real money investments pouring in at 20% a year and an annual user growth rate of about 50%, the Indian betting industry will be valued at an excess of USD 1 billion by the end of 2021.

According to surveys, 40% of India’s internet users have placed online bets in 2020. This means that around 220 million Indians are gambling and betting online in a given year.

Cricket-related gambling takes the lion’s share of the “Indian betting” pie, with gamblers betting between USD 50-60 million per match. Horseraces are a close second, with around INR 35,000 crores being bet on any given race.

These numbers are even more sobering after considering the fact that around 80% of illegal betting takes place on cricket and that 60% of all global bets are illegal. This would value the illegal gambling industry in India at a little less than USD 1 billion.

Therefore, sports betting companies in India must attempt to combat several challenges, including those that arise from illegal betting and gambling.

What are these challenges?

Challenges In The Online Betting Industry

The online betting and gambling industry has worked hard to shed its reputation as the dark underbelly of finance, and to good effect. The rise of online gambling as a force has coincided with a large-scale reclamation of gambling as a legitimate industry.

However, the very nature of the industry makes it susceptible to various challenges.

- Attacks from fraudsters

The prospect of winning money attracts spoofing and phishing attacks from fraudsters. These attacks attempt to take advantage of security risks in the app or website of the betting service provider and compromise users’ identifying and financial information.

- Money laundering risks

The gambling and betting industry has long been on the radar of regulators and authorities due to the ubiquity of money laundering in the industry. Due to a high cash turnover, organizations associated with betting and gambling make exceedingly good fronts to launder money.

- Conditional legality

In India, a lack of clarity in gambling laws are another challenge for betting and gambling companies. The legality of gambling is left to the states, and most states make this decision based on whether they deem the betting to be “skill-based” or “chance-based.” Betting of the former type is legal in all the Indian states.

- Slow and exhausting onboarding process

Indian laws require age and identity verification before allowing anyone to gamble on online platforms. The ID verification process usually takes several days, primarily due to document verification, and has been reported to be extremely clunky and frustrating.

This leads to a significant drop-off rate among users and additionally deters users from attempting to sign up again.

Some of these challenges have a quick fix – strong KYC verification.

Why Online Gambling Needs Digital KYC Verification

The rise of online finance in the early 2000s coincided with a surge in money laundering and online fraud until strong AML (Anti-Money Laundering) and KYC verification procedures started being used to curb these threats.

The case of online betting and gambling appears to be quite similar.

Money laundering activities are facilitated by the ability of fraudsters to falsify their identities and create fake accounts; therefore, employing any procedure designed to make this as hard as possible will be a win for the online gambling industry.

AML and KYC verification procedures were created to do exactly this.

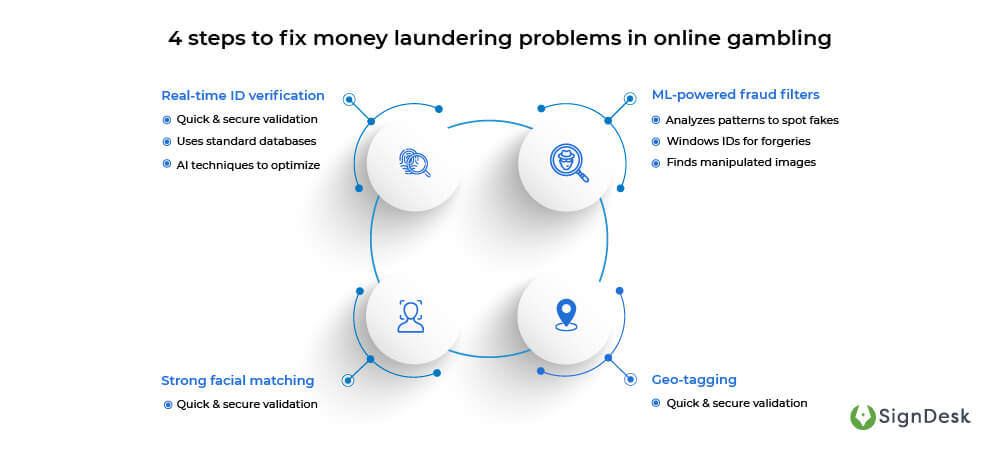

Recent advances in technology have allowed KYC verification service providers to leverage OCR technology to extract image data from IDs and AI technology to verify ID details against standard databases in real-time.

Geo-tagging capabilities protect against location spoofing, and PAN verification enables quick AML checks.

Service providers like SignDesk also employ ML-based fraud filters to filter out fake profiles and fraudulent IDs to mitigate the threat of identity fraud.

So how exactly does KYC verification help the online gambling industry?

Role of KYC Verification In Online Gambling

KYC verification solutions, especially Video-based KYC solutions, are set to play a huge role in the online gambling industry.

Here’s what industry players can expect from an AI-powered KYC verification solution –

-

Lower risks of money laundering

A strong KYC verification solution will identify and flag fraudsters before they can get their foot through the door. SignDesk’s Video-based KYC verification solution utilizes high-level facial matching techniques to ensure that all users are who they say they are.

-

Fewer fake profiles

ML-enabled KYC verification systems are capable of spotting fake IDs, manipulated images, and forged documents. The high degree of accuracy of these KYC solutions makes it nearly impossible for fraudsters to attempt a crime.

-

Quick & cost-effective onboarding

Automated KYC verification enables users to be onboarded securely within 5-10 minutes. The streamlined nature of the onboarding process also reduces the number of user drop-offs during the signup process by about 60%. Finally, digital KYC verification costs gambling operators 85% less than the usual KYC process.

-

High retention rates

Identity verification is a massive problem for players in the online gambling industry due to the disorganized nature of the process. Digital KYC verification enables a smooth and customer-friendly onboarding process, allowing companies to boost retention.

-

Automated due diligence

A digital or video-based KYC verification solution is secure and customizable, ensuring that companies can automate large parts of their due diligence procedures. User records, along with ID documents and details, are stored securely to facilitate audits and due diligence.

KYC verification, therefore, has a huge role to play in the online gambling industry – in preventing crimes, enabling better due diligence, and saving expenses.

SignDesk: AI-Powered KYC Verification

AI-powered KYC verification has emerged as a benchmark in the BFSI sector, which shares many of its challenges with the online gambling industry. Money laundering, ID fraud, and cybercrime are all obstacles that the BFSI sector is overcoming using Video-based KYC solutions.

SignDesk is a seasoned and award-winning provider of document automation and KYC verification solutions to 350+ clients, including 60+ major banks. Our solutions verify user identities securely in real-time, precipitating massive productivity and security benefits for our clients.

Our KYC verification solution has allowed clients to reduce onboarding expenses by 85-90%, boost audit efficiency by 60%, and save up to 120,000 hours per customer.

Curious to see how our KYC verification can help players in the online gambling industry onboard safely and securely?

Book a free demo with us now!