What is Aadhaar Verification API?

The process of customer verification, with the advent of technology and the passage of time, has become an important part of any onboarding or recruitment process. Contact centers employ customer verification procedures to confirm the accuracy of the client’s information and their identification.

Identification via document verification, face verification, document verification using utility bills as proof of address, and biometric verification along with Aadhaar verification APIs are all part of the KYC process.

Aadhaar verification API is a simple API (Application Programming Interface) with a call and retrieve function. It is is a user-friendly interface that allows you to input a customer’s Aadhaar number and OTP to fetch essential KYC information, including their full name, date of birth, address, gender, and more.

Aadhaar verification API is an easy way to conduct customer KYC verification and validate demographic information before conducting business with the customer.

Banks, insurers, and other financial institutions (FIs) may also leverage DigiLocker KYC via APIs to verify Aadhaar details without making customers upload individual documents or submit a hard copy of Aadhaar.

With DigiLocker, customers store all their crucial KYC documents in one place and simply give FIs access to view & verify these documents whenever the need arises.

What is Know Your Customer or KYC?

A series of protocols for confirming a user’s identification before or while conducting business with banks and other financial organizations is known as KYC, sometimes known as “Know Your Customer” or “Know Your Client.” Following KYC regulations can assist prevent the funding of terrorism, money laundering, and other common fraud schemes.

Financial institutions can more precisely identify suspicious actions by first confirming a customer’s identity and intents at the time of account opening, then understanding their transaction patterns.

KYC is a crucial procedure for assessing client risk and deciding whether the customer can fulfill the requirements of the organization to use their services. Additionally, adhering to anti-money laundering (AML) legislation is required by law.

The types of KYC employed by businesses are as follows.

Physical copies of the address and identification documents that have been self-attested are used for this sort of KYC verification. To submit the signed form and the supporting documentation, customers must physically travel to the bank, fund house office, or KYC Registration Agency.

Customers are remotely authenticated using this method using data gathered by the Unique Identification Authority of India (UIDAI). Customers have the option of choosing biometric or Aadhaar OTP-based verification

In the offline KYC verification process, the customer provides their Aadhaar number and enters the OTP received to decrypt an Aadhaar XML file containing the customer’s KYC information. Alternately, the QR code present on the customer’s Aadhaar card can be scanned to complete offline KYC.

Here, KYC verification is completed digitally. The customer uploads scanned copies of KYC documents, captures live images of the original documents, and captures a photo of themselves. Following this, OCR is used to extract data from the document images and these are verified against KYC data retrieved by APIs.

- DigiLocker KYC

Customers make a one-time upload of their KYC documents (Aadhaar, PAN, DL, Passport, Voter ID) and authorize FIs to view and verify these documents for KYC. FIs simply integrate with DigiLocker APIs to streamline the KYC process and enable digital document storage and management.

Aadhaar Verification APIs and their Usage

Aadhaar verification API is required for any company, financial institution, or entity that wants to assess the reliability of its clients. The Aadhaar card serves as every citizen of India’s official identification.

The Aadhaar verification API holds an advantage over manual verification systems.

- With Aadhaar verification API, it takes just a few seconds to verify Aadhaar and a customer’s KYC. Additionally, Aadhaar APIs help precisely determine a customer’s identity.

- Verification of Aadhaar APIs can be modified to suit the requirements of the business and the production process.

- Any device, including mobile, desktop, tablet, MacBook, etc., can easily incorporate APIs for Aadhaar eKYC verification.

- Aadhaar APIs are user-friendly and simple to integrate, enabling seamless and convenient verification.

Verifying KYC with Aadhaar Verification API – How It Works

Aadhaar verification API is simple tools to retrieve and verify a customer’s Aadhaar information quickly. The APIs utilize the downloadable Aadhaar XML file to read off KYC information and authenticate the same.

Integrating with an Aadhaar verification API enables banks, NBFCs, and other Financial Instiutions (FIs) to validate KYC after the client provides their Aadhaar number and OTP.

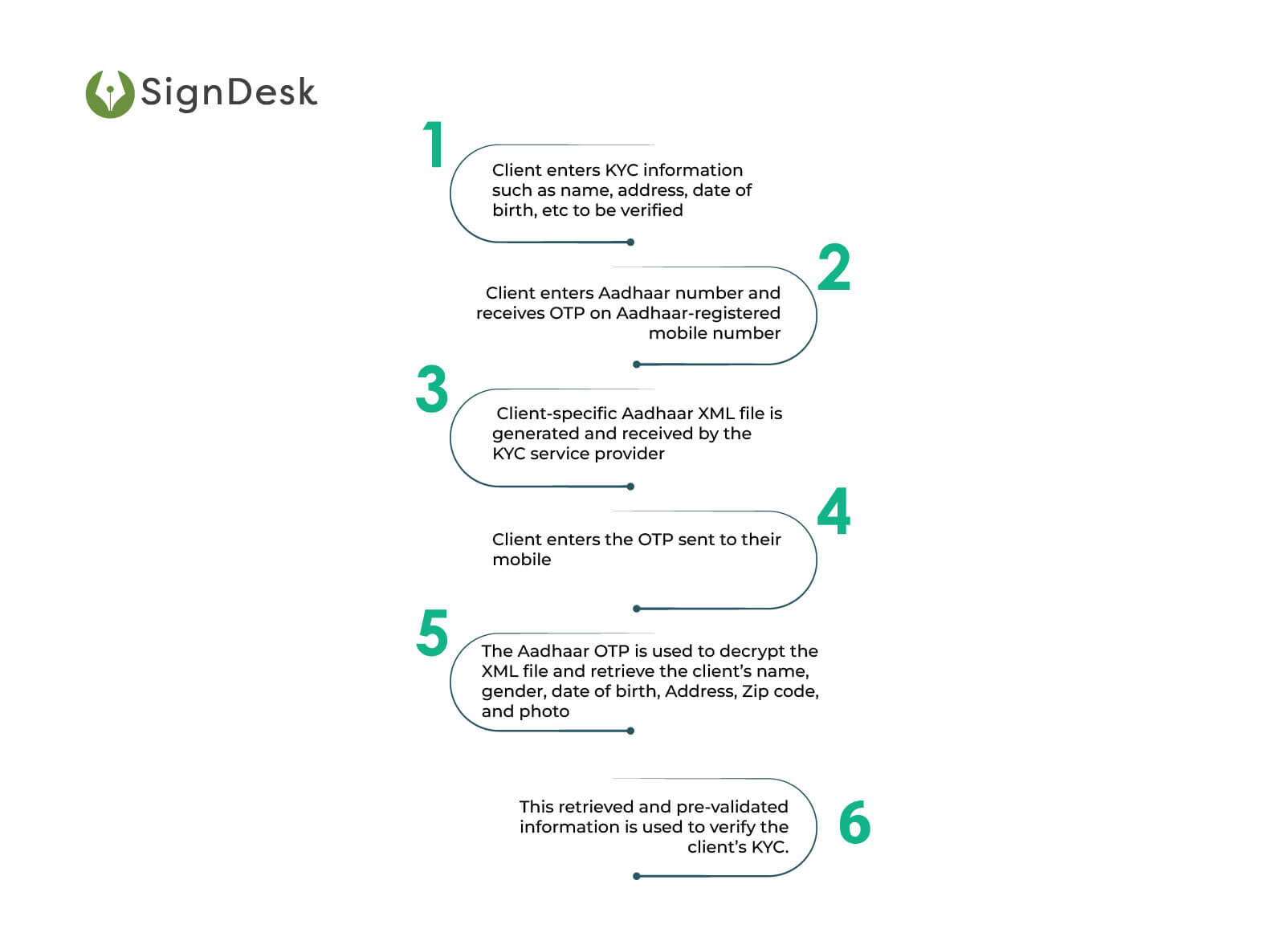

Here’s how verifying customer KYC with an Aadhaar verification API works.

Step 1: Client enters KYC information such as name, address, date of birth, etc to be verified

Step 2: Client enters Aadhaar number and receives OTP on an Aadhaar-registered mobile number

Step 3: Client-specific Aadhaar XML file is generated and received by the KYC service provider

Step 4: Client enters the OTP sent to their mobile

Step 5: The Aadhaar OTP is used to decrypt the XML file and retrieve the client’s name, gender, date of birth, Address, Zip code, and photo.

Step 6: This retrieved and pre-validated information is used to verify the client’s KYC.

The Benefits of KYC Verification with Aadhaar Verification API

With the implementation of Aadhaar verification APIs, the workflows of many industries are streamlined and automated.

- Banks and other financial organizations can instantly check a person’s Aadhaar and expedite KYC verification

- When a person checks in to board a flight, Aadhaar Verification is available. The Aadhaar API allows for the digitalization of the entire process, which makes it more faster.

- Aadhaar API helps in saving resources as it is used in many buildings, including offices of MNCs and even conventional enterprises.

- Banks are constantly at risk of falling victim to financial fraud, which can have negative financial and reputational effects. Aadhaar verification APIs help banks reduce the risk of money laundering and other fraudulent actions. In order to verify the legitimacy of a person or organization, banks use Aadhaar eKYC services.

- Additionally, KYC verification is required when requesting a bank locker, asking for a loan or credit card, etc. It is the banks’ responsibility to ensure KYC compliance. If the bank doesn’t make the guarantee, there may be severe consequences.

Aadhaar Authentication API – Behind the Scenes

The back-end Aadhaar authentication API process can be described in two different workflow scenarios as mentioned by UIDAI:

Scenario 1:

- To use a service provided by the authenticator user agency or AUA, an Aadhaar holder must enter their Aadhaar Number or another unique identifier into terminal devices owned by the AUA.

- Installed application software on the device that supports Aadhaar authentication bundles and encrypts these input parameters before sending them to the AUA server over an internet network and AUA-specific protocol.

- After validation, the AUA server inserts the required headers and forwards the request to UIDAI’s Central Identities Data Repository.

- The “yes/no” response provided by the Aadhaar authentication server depends on whether the input parameters match.

- Lastly, AUA executes the transaction based on the Aadhaar authentication server’s response.

Scenario 2:

- In this scenario, the Aadhaar holder performs transactions on the mobile device using Aadhaar authentication.

- Transaction data in this instance is recorded on the mobile application that AUA has made available.

- The owner of the Aadhaar gives the required demographic information, along with an OTP, as well as AUA-specific identifiers such as an account number or a PIN.

- After the identification is done, the rest that follows is the same as scenario 1.

UIDAI, the Indian government’s regulatory body to ensure Aadhaar for every Indian citizen under the Aadhaar Act 2016 states that, all Aadhaar holders have access to a practical method of proving their identity through Aadhaar authentication. It offers a platform for identity identification and can be applied to efficiently serve Aadhaar holders across the nation with services.

SignDesk’s KYC Verification Solution: Scan.It

Scan.It, SignDesk’s brainchild for KYC verification for customer onboarding, uses cutting-edge compliance technology. Scan.It has helped our clients save onboarding expenses, cut TAT by more than 50 percent, protect against forgery, decrease drop-off rates for KYC and facilitate seamless customer onboarding. The inclusion of pan aadhaar link verification further enhances the security and accuracy of our KYC processes.

Empower your business with the simplicity and security of SignDesk’s Aadhaar-based solutions. Whether streamlining processes with Aadhaar e-signatures, ensuring compliance through Udyog Aadhaar verification API, or enhancing security with Aadhaar card verification, SignDesk is your partner in efficiency.

Numerous awards, the most recent of which were Best AI/ML Product at InnTech 2020 and Best Digital Onboarding Product of 2020 from the Global Banking & Finance Review, have been presented for our KYC solutions in recognition of our efforts to automate Aadhaar verification with simple-to-use Aadhaar verification API and AI-powered customer authentication.

Leverage Scan.It is to securely enroll customers through the KYC verification process using Aadhaar verification API. Set up a free demo with us to get started.