For any enterprise, transacting with a new customer brings with it an inherent risk. By the very nature of their operations, organizations in Banking, Financial Services and Insurance (BFSI), retail, healthcare, and education are more susceptible to risks emerging from transacting with new customers. Banks are especially susceptible to frauds.

Businesses need to undertake due diligence processes to mitigate customer onboarding risk. The first step here is Know Your Customer (KYC) – identifying new customers and verifying their authenticity, usually via government-issued identity documents. A company’s executives can also meet new customers in person and verify these documents. However, scheduling these in-person meetings can be inefficient, especially in the current times. Further, the manual verification of documents also leaves room for error. Therefore, businesses incur a heavy expenditure – an average of $60 million in Europe, the US, South Africa and Asia-Pacific – to meet their KYC requirements [2].

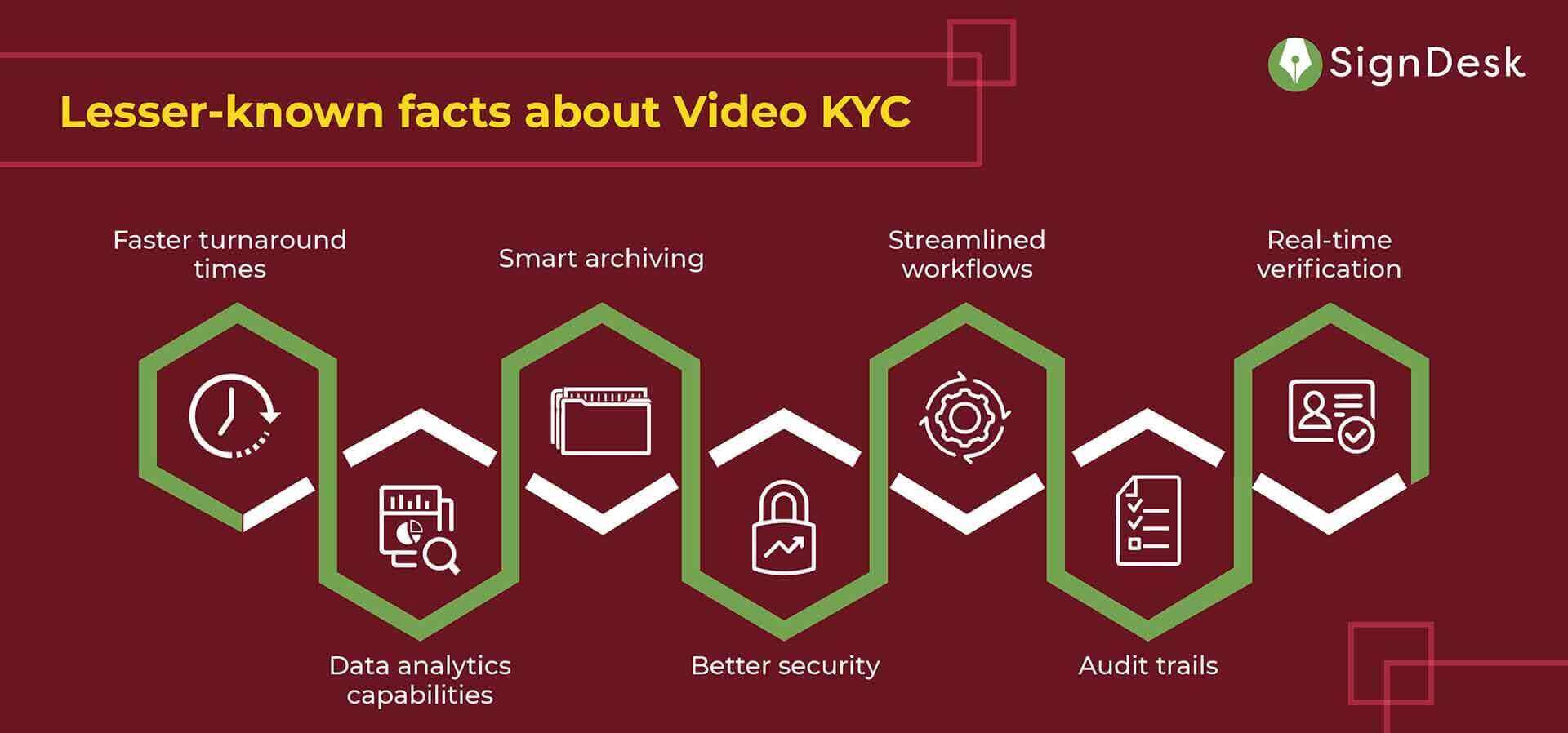

Lesser-known facts about Video KYC

Video KYC helps to overcome inefficiencies of the conventional methods by allowing businesses to identify and authenticate customers remotely. Faster digital adoption worldwide, too, aids this. Here’s a look at a few lesser-known facts about video KYC.

- Faster turnaround times

Organizations employing video KYC report significantly faster onboarding times along with savings in compliance costs. Executives can focus on their core business activities instead of verifying documents, copying and filing them. According to McKinsey [3], customer onboarding time reduces by up to 90% – down from days or weeks to mere minutes.

- Data analytics capabilities

Collecting customer data through diligent KYC processes is the first step in preventing financial crimes. Video KYC is equipped with Artificial Intelligence and Machine Learning tools which facilitate analytical capabilities and offer a cutting edge to the entire process. For example, SignDesk’s video KYC solution allows users to analyze voluminous customer information on the basis of different variables.

- Smart archiving

Traditional KYC relies on collecting customer information, filing them physically, and storing them. However, given the growing user base of organizations, these files become tedious to store over time. When updating customer information, executives may find it difficult to retrieve these files. Video KYC allows enterprises to save the KYC files digitally resulting in seamless retrieval of information.. In turn, this enables easy modification of customer data.

- Better security

Be it a buyer, a student or someone looking to access financial services, protecting the identification data of all external stakeholders assumes significant importance. Traditional KYC files are susceptible to theft and misplacement. On the other hand, video KYC employs the latest end-to-end encryption tools and data security standards to ensure that customers’ data is protected from miscreants.

- Streamlined workflows

Conventional processes are rife with frictional inefficiencies thanks to the bulky paperwork involved. Additionally, confusing language in application forms, the high volume of information and the need to visit a physical space leads to poor user experience. In contrast, video KYC improves customer experience as users can share the required information easily through video calls. And for this, all they need is a phone with an internet connection. Businesses also experience better workflow efficiencies as video KYC ensures standardized business processes. It also improves compliance as procedures are now implemented on a streamlined platform.

- Audit trails

Auditing paper-based files is an unsustainable practice, since tracing and retrieving files becomes highly cost-inefficient. Video KYC overcomes these audit inefficiencies due to its digital nature. Auditors can conveniently trace the centrally-located files’ timestamps and geo-locations, and extract relevant insights from them. Besides, they can also audit video KYC sessions in real-time. This enhances trust in the overall KYC process, from the point of view of regulators as well as the business stakeholders, and transforms it into a valuable asset for the organization.

- Real-time verification

Verifying physical KYC documents involves sharing them with third-party KYC agencies who then compare the customers’ documents with government databases. The entire process involves a lag of several days to weeks. However, video KYC processes offer real-time verification. For example, SignDesk’s video KYC solution smartly captures the image of the identity document. Real-time comparisons with government databases lead to instant verification of the document. This protects the organization from forgery attempts, besides reducing error rates and saving valuable time.

Be it education or retail, BFSI or health, organizations across industries, including digital student onboarding, can benefit exponentially from adopting video KYC and face verification. It not only enables seamless customer onboarding but also leads to efficiencies across a wide spectrum of business processes contributing to better ROI and profitability. Such a technological adoption promises to make the organization future-ready besides drastically improving customer experience. In essence, video KYC can prove to be a vital strategic asset in ensuring an edge over competitors, providing numerous Video KYC benefits.

To learn more about KYC, you can check out SignDesk’s KYC e-book, which includes a detailed, easy-to-follow guide on all things Video KYC.