KYC Verification For Mutual Fund Investment

Know Your Client (KYC) is a crucial aspect of customer due diligence undertaken on the part of institutions in order to prevent instances of financial crime including money laundering, funding of illicit activities & general financial fraud.

Mutual fund investment is an attractive area for newer investors to dip their toes in the financial market due to the low threshold for minimum capital required & the relatively low risk involved. Therefore, mutual funds are a popular option for would-be investors starting out & for people looking for stable returns on investment.

This popularity has inevitably fuelled the need for checks and balances in the process, which is where KYC comes in.

KYC for mutual funds is informed by the Prevention of Money Laundering Act (PMLA), which came into effect on July 1, 2005.

PMLA Rules For Intermediaries

The Securities and Exchange Board of India (SEBI), mandated KYC for all intermediaries handling mutual funds shortly after the passing of PMLA.

SEBI began requiring KYC compliance for mutual funds & all other investors from January 1, 2011. Compliance with KYC has been mandated irrespective of the capital invested & includes –

- All new or additional investments

- Switching transactions, i.e for investments in new assets or via new intermediaries

- New registrations for SIP/ STP/ Flex STP/ FlexIndex/ DTP

- Any SIP/STP/trigger-related products launched after PMLA

How To Perform KYC For Mutual Funds

Mutual fund KYC consists of a basic KYC verification followed by an In-Person Verification process.

The process can additionally be completed either online or offline. The offline KYC process consists of –

- Filling KYC form & attaching documents including proof of identity & proof of address

- Submitting the application at a KRA in person

- Getting yourself verified by the KRA, AMC, distributor, mutual fund or transfer agent

The offline KYC process is completely paper-based & can take 20-30 days to complete.

If potential investors want to get themselves verified online, they can get their basic KYC done completely online via eKYC. This involves a preliminary KYC verification procedure consisting of OTP-based verification performed via the UIDAI database.

After this however, the process goes offline & involves a physical In-Person Verification (IPV) process, in which the investor must be physically present in order to be verified by officials from the KRA, AMC, or any organization designated by the registered intermediary.

In both cases, the IPV process is responsible for taking up the bulk of an agency’s or intermediary’s time, since it involves presence-based KYC verification & manual document validation.

Additionally, there’s an investment cap for investors who have only gone through eKYC and not IPV. Such investors can only invest upto Rs. 50, 00 in one fund house per fiscal year. In order to increase & diversify investments, clients will have to undergo IPV.

This situation, however, was drastically changed on April 24, 2020.

SEBI Notification On VIPV

SEBI has recently released a notification with vast ramifications for investors & intermediaries, in which it outlines a revamped system for online investor KYC & digitizes IPV.

For an in-depth look at what the notification says & its implications, go here.

Meanwhile, here’s an overview of SEBI’s vision for investor onboarding going forward –

- SEBI has put forward new rules for online investor KYC, according to which certain fund houses can onboard investors without IPV.

- These intermediaries can accept online submission of proof of identity & residence, and verify these documents online via procedures prescribed by SEBI in its notification. These procedures mainly involve eSign-based ID submission

- Intermediaries can develop & implement applications for online investor KYC & roll these out following audit procedures. This application must have features for liveness detection, image capture, ID scanning, geo-tagging & Digilocker integration.

- The fund houses & intermediaries who can rely on online investor KYC without IPV are the same ones for whom SEBI has allowed Aadhaar-based KYC verification. These organizations are –

- Bombay Stock Exchange Limited

- National Securities Depository Limited

- Central Depository Services (India) Limited

- CDSL Ventures Limited

- NSDL Database Management Limited

- NSE Data and Analytics Limited

- CAMS Investor Services Private Limited

- Computer Age Management Services Private Limited

- Link Intime India Pvt. Ltd.

- SEBI-registered intermediaries can opt for a new Video In-Person Verification (VIPV) procedure instead of the traditional IPV process to complete investor KYC. SEBI has outlined the steps involved in VIPV in its notification

- Since only a few intermediaries are allowed to bypass IPV, the new procedure for mutual fund KYC now involves a preliminary customer verification followed by a video-based kyc verification procedure

So what are the steps involved in VIPV?

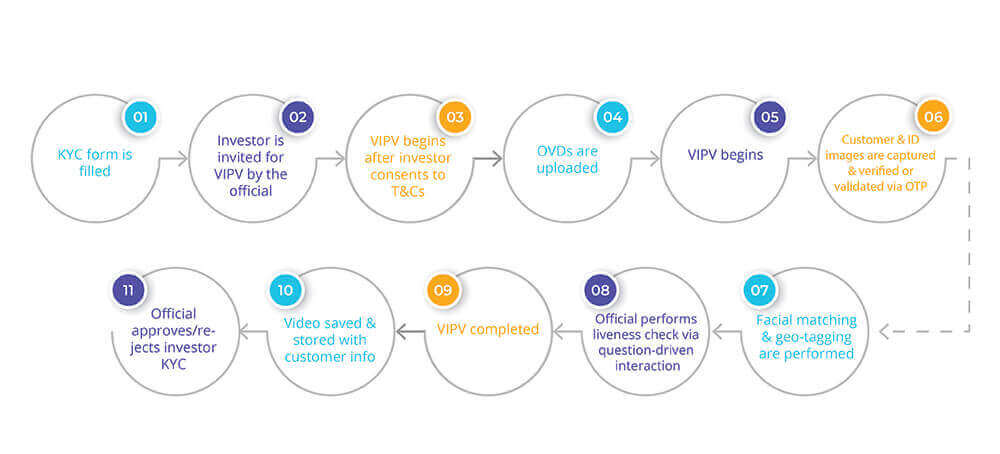

Procedure For VIPV

According to the SEBI notification, the prescribed steps for VIPV are –

- VIPV of an investor is undertaken by an authorized official after obtaining his/her informed consent. The activity log along with the credentials of the official performing VIPV is stored for easy retrieval.

- VIPV will take place in a live environment, i.e everything will be recorded on video

- VIPV must be clear and still, and the investor in the video must be easily recognisable.

- The VIPV process will include random question and response from the investor including displaying the OVD, KYC form and signature, which can also be confirmed via OTP.

- The intermediary must ensure that the investor’s picture downloaded via UIDAI matches with the investor in the VIPV.

- The VIPV must be digitally saved in a safe, secure and tamper-proof, easily retrievable manner while bearing date and timestamps.

This procedure is quite similar to the other Video KYC procedures mandated by RBI

& IRDAI

, in which an authorized official gets on a video call with the customer & verifies the customer’s OVDs in real-time.

SignDesk offers a customizable Video KYC solution designed for intermediaries to onboard investors via VIPV. Our solution uses AI-powered ID verification, OCR-based image data extraction & ML-enabled filters to mitigate fraud.

Here’s how our Video KYC solution works.

As evidenced here, VIPV takes place on a completely digital channel and is an alternative to the traditional IPV process.

Now that we’ve seen what VIPV involves, let’s look at who’s required to perform it.

Who Can Perform VIPV

The following entities are authorized to perform VIPV for mutual funds.

- KYC registration agencies (KRAs)

- Asset management companies

- Mutual fund agents

- Mutual fund distributors

- Registrars of mutual fund houses

- Transfer agents like CAMS or Karvy

These entities are also responsible for performing eKYC for mutual fund investment on behalf of registered intermediaries. VIPV can therefore be made seamless with the usual procedure for KYC verification at these points of contact.

So why should RIs implement VIPV?

Why VIPV Is The Future Of Investor Onboarding

As mentioned before, IPV can take 20-30 days to complete & involves strenuous manual verification of IDs.

Digitizing & automating the process for mutual fund KYC entails huge benefits for RIs, including –

- 85-90% reduction in onboarding costs – Paper-based mutual funds KYC simply has too many pain points & inefficiencies, leading to huge expenses. These can be automated away & precipitate real cost benefits.

- 99% reduction in TAT – Firms & intermediaries take 20-30 days to securely onboard a mutual funds investor. VIPV reduces this TAT to less than 10 minutes while making investor verification even more secure.

- Reduced paperwork – VIPV involves zero paperwork since it’s an online procedure. This, along with the streamlined VIPV workflow, makes documentation & compliance easier.

- Fewer errors & improved productivity – Manual verification results in an 80% loss of productivity & is susceptible to manual errors. Automated VIPV removes manual redundancies & improves the efficiency of mutual funds KYC.

- Flexible and accessible – VIPV can be easily integrated into the KYC verification process for mutual funds investors since the entities already have the requisite machinery in place.

- Assured compliance – Compliance is a major issue for RIs, VIPV streamline the mutual funds KYC process & uses checks and balances to make sure that your activities comply with regulatory requirements and leaves a virtual audit trail in the form of stored video & information.

- Smooth & investor-centric onboarding – Mutual funds investors are usually first-time investors & require a smooth & friendly introduction to the world of securities. VIPV ensures this by allowing a completely digital process that investors can complete from the comfort of their homes.

Now that we’ve gone over the numerous advantages of implementing VIPV. Here are some reasons why automated mutual funds KYC is a must-have for RIs.

- Digital KYC verification is now an industry benchmark for FIs. Digitization as a trend is here to stay & following the COVID-19 pandemic, investors are demanding online mutual funds KYC due to the ease & security it entails.

- Automated Video KYC for mutual funds provides massive ROI, especially if RIs digitize the entire KYC verification process. Analyses of automated KYC show that AI-powered KYC automation ensures a minimum 50% reduction in operating expenses.

- Compliance is a major issue for RIs since IPV is usually conducted manually & the interpretation of rules is left to the discretion of individual officials. VIPV automates compliance procedures & thus massively reduces the compliance burden on RIs.

So if you’re an RI looking to implement VIPV, which service provider should you choose?

Trusted & Award-Winning KYC Verification

SignDesk is an award-winning provider of AI-powered verification and documentation solutions to businesses.

We use real-time AI-powered document verification techniques, OCR-enabled image data extraction, OCR verification, facial matching & ML-based fraud filters to automate and expedite the KYC verification process.

Our verification solutions have helped our 250+ clients reduce onboarding expenses, cut down on KYC drop-offs, reduce TAT by 99%, and safeguard against fraud using cutting edge compliance technology.

Our efforts to automate KYC have been recognized in the form of numerous awards, the latest being DigiMarcom’s Digital Transformation Service Provider of the Year in 2021, the Best AI/ML Product at InnTech 2020, and the Global Banking & Finance Review’s Best Digital Onboarding Product of 2020.

Are you ready to join 200+ businesses including 50+ major FIs and start onboarding with Video KYC? Book a demo with us now and let’s get started!