However, eNACH is not to be confused with eMandates.

Despite being used almost interchangeably, eNACH and eMandate are two separate and different processes with the shared objective of making recurring payments easier using payment automation and a digital framework.

As far as the end result is concerned, both eNACH and eMandate have the same purpose but are implemented differently.

What are eNACH eMandates?

eNACH is an electronic process of helping financial institutions, including banks and NBFCs, and various government entities to provide automated payment services.

eNACH is built by combining all the Electronic Clearing Systems (ECS), which lenders previously used to auto-debit money from borrowers.

When utilizing eNACH for debit or credit, users digitally sign the NACH form and generate a Unique Mandate Registration Number (UMRN). Once the eNACH has been initiated, electronic NACH functions as permission granted by the user to the concerned authority to debit an agreed-upon amount periodically.

eMandates, on the other hand, are slightly different from eNACH.

What is an eMandate?

A mandate is a standing instruction given to the bank where a customer holds their account to debit a fixed amount to another bank account automatically.

eMandates are electronic versions of mandates, wherein customers can register, edit, and delete mandates entirely online.

Mandates are offered in 3 forms –

- API eMandate: These mandates are registered using APIs

- eSign eMandate: In this case, mandates are authorized by customers using Aadhaar eSign. This form of eMandate registration was recently legitimized by NPCI.

- Physical mandate: Here, the mandate process is almost completely manual and involves the customer filling up NACH forms and moving these forms between banks

Differences between eNACH and eMandate

While both eNACH and eMandate offer similar payment automation services, there are a few differences between the two processes.

eNACH is a digital framework controlled by NPCI (National Payments Corporation of India), used by nearly all businesses and individuals to automate periodic payments.

eMandates, on the other hand, are standing instructions provided by individual customers to auto-debit money from their accounts for various purposes, including bill payments, subscriptions, loans, and more.

eNACH eMandate – Background

India has been on the path of digitization since the 1980s, when the first computers were launched in the nation. This resulted in the rapid digitization of finance, resulting in the era of credit cards and net banking, followed by mobile banking.

Recently, Aadhaar has been instrumental in providing over a billion Indians with valid digital identities and consequently access to social and financial services.

As India continues to transform digitally, the Indian government has sought to increase digital adoption rates by introducing various digital services such as Aadhaar eKYC, eStamping, eSignatures, and NACH. Additionally, various government schemes have also encouraged digital growth.

The eMandate facility is among the most beneficial digital services initiated by the Government of India through the NPCI.

Manual Mandate Process

As mentioned previously, mandates are standard instructions provided to financial institutions and several other types of businesses, including –

The manual mandate process involves manually completing NACH paperwork, physically transferring eNACH documentation from bank to bank, and high failure rates.

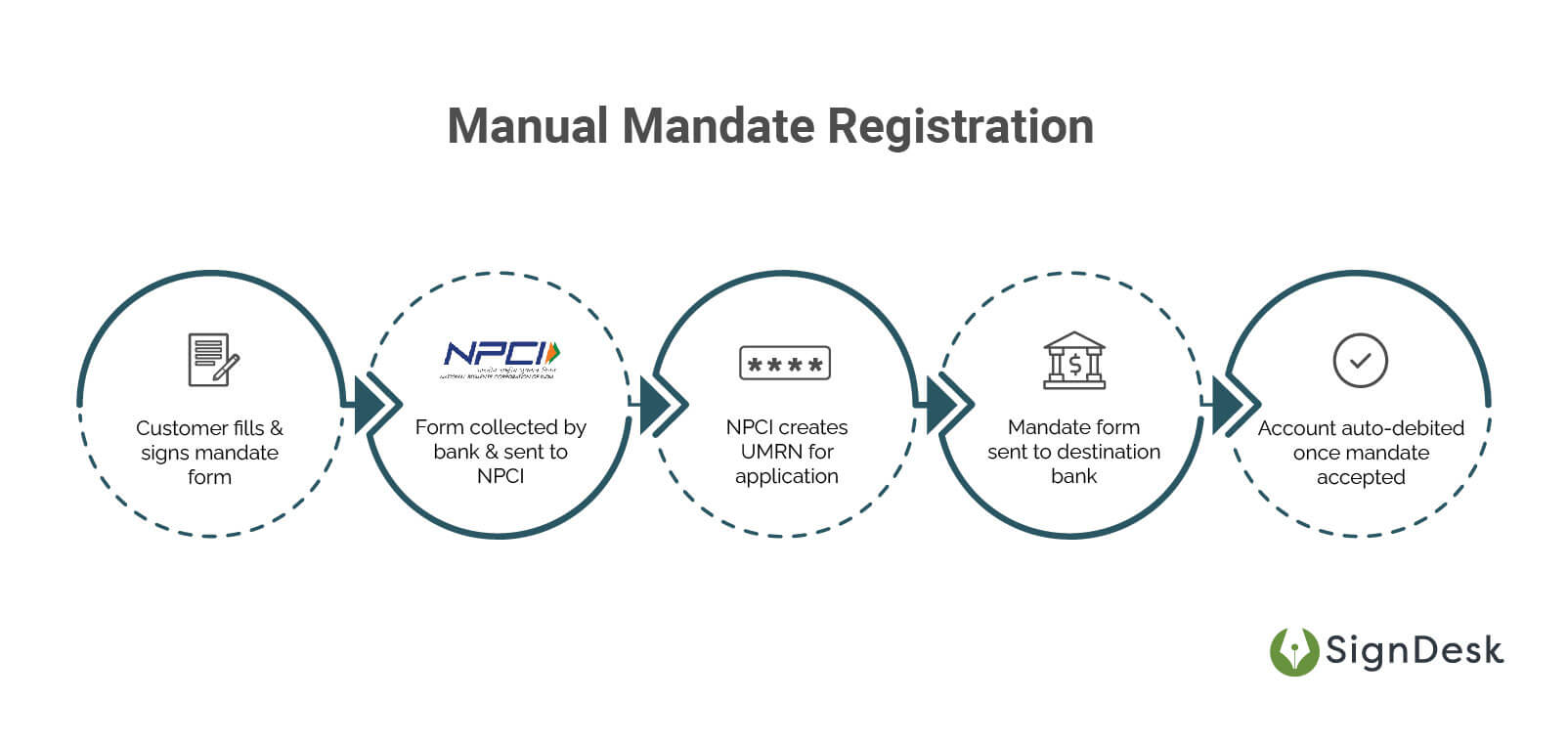

The manual mandate process is as follows:

- The company/bank collects a signed form from the customer. This form indicates that the customer agrees to have a certain amount of money automatically debited from their bank account on a repetitive basis, directly in favor of the company/bank.

- The Company/Bank sends this form to the NPCI, which creates a Unique Mandate Reference (UMRN) and sends the customer’s application to the bank where the account is held.

- If the bank accepts this mandate, the Company/Bank will be able to debit the customer’s account directly.

This process takes between 7-14 business days depending on various factors and has a high failure rate, resulting in fragmented payment processes. Additionally, this time span results in long and frequent business delays for the Company or Bank, inconvenience for the customer, and massive expenses.

API or eSign eMandates expedite these debit and credit workflows, enabling payment completion within 3-4 days at a low failure rate.

Challenges:

- 15+ days to register a mandate

- 30% success rate

- Inconvenient & expensive

eNACH eMandate Process – Recurring Payment Automation

The e-NACH eMandate process has been set up to automate recurring payments while removing the need for paperwork. With eNACH eMandates, the need to fill the NACH forms and convey NACH paperwork from bank to bank is eliminated.

When using electronic NACH, the mandate registration process can be completed within a few hours since the entire system requires minimum human interaction and logistical dependency is very low.

eNACH utilizes the services of NPCI’s National Automated Clearing House (NACH) to attain its objectives.

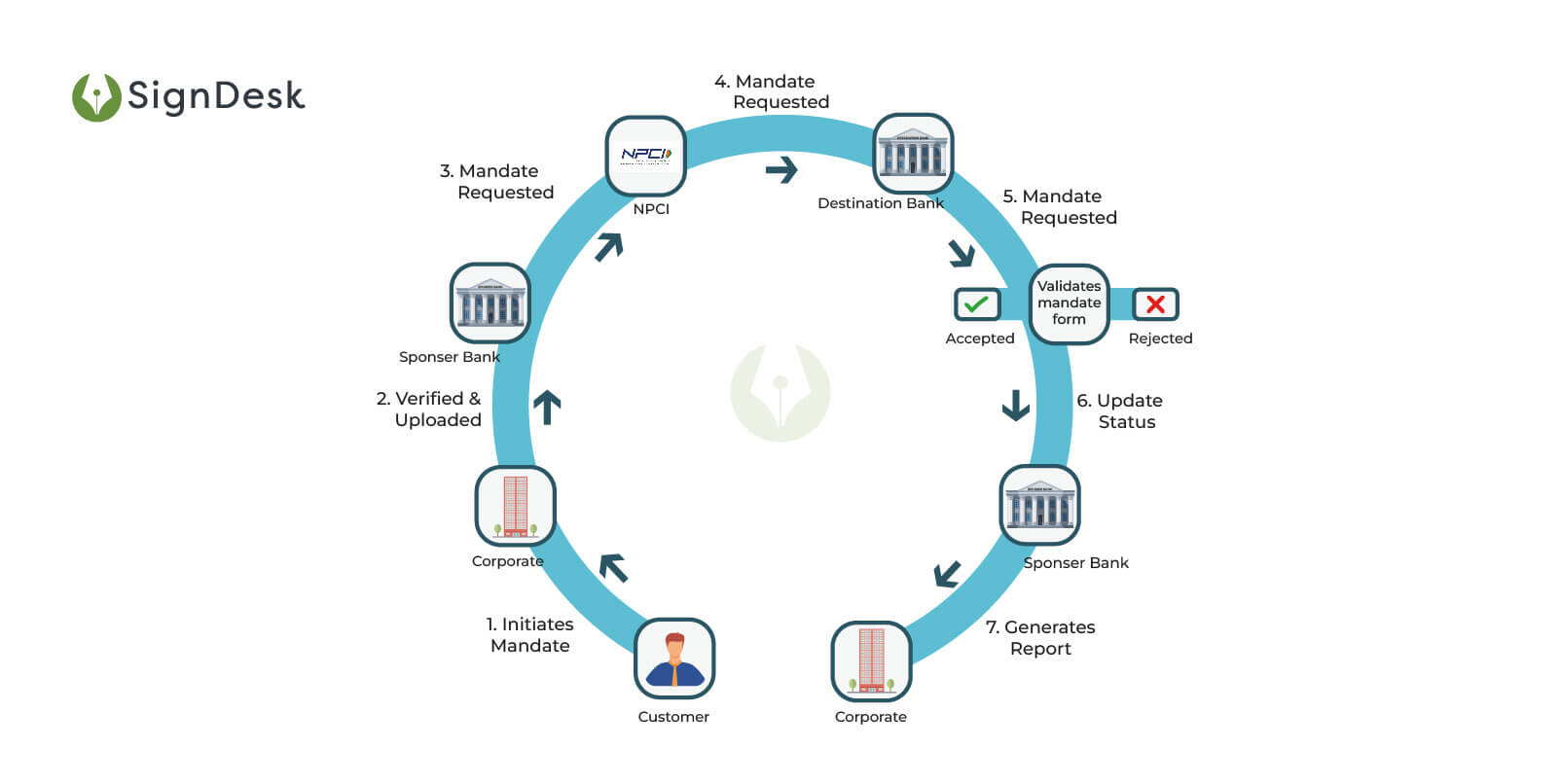

The following entities are involved in the eNACH process:

- NPCI – A regulatory body constituted by the Government of India to oversee all retail payments in India. It was set up with the guidance and support of the Reserve Bank of India (RBI) and the Indian Banks’ Association (IBA).

- Sponsor Bank – These are the banks impaneled with the NPCI to facilitate the eMandate process. There are currently three sponsor banks HDFC, HSBC, and Punjab National Bank.

- Destination Bank – The bank where the customer holds their account from which the automatic debit is made.

- Corporate – The Company/Bank for which the eMandate is requested, to enable auto-debits from the customer’s bank account.

- Customer – The person who registers and authorizes the eMandate

The eNACH eMandate system assists in issuing and confirming by the customers through alternatives to paper-based mandates.

The process is routed so that the destination bank, after authentication, moves the mandate to the sponsor bank or from the corporate to the sponsor bank and then to the destination bank, which includes the attributes of the customer.

How eNACH eMandate Works

The eNACH eMandate process involves the following steps:

Mandate Registration

- The customer registers their eMandate at the destination bank (i.e., the bank where the customer holds their account) through an eNACH eMandate service provider.

- The mandate details are then sent to the sponsor bank, NPCI, and the various destination banks. Once the destination bank confirms the eMandate, the response is shared with the electronic NACH provider.

Debit sheet Generation

- After mandate registration, the next step is debit sheet presentation. A debit sheet containing mandate details is generated and shared with the sponsor bank, NPCI, and the destination bank.

- Once the destination bank has the debit sheet, a response regarding success rates is generated. This response is shared with the eNACH provider.

Fund Transfer

- After receiving this response, the allocated amount is debited from the destination bank and transferred to NPCI, after which the amount is sent to the sponsor bank and then a nodal bank account of the eNACH service provider.

- Finally, the allocated amount is transferred to a corporate account the next day.

Advantages of eNACH eMandate

The primary objective of eNACH/eMandate is to reduce the burden of processing on the destination bank; therefore, all the aspiring participants on the eMandate platform should implement end-to-end process automation, including auto submission of authenticated mandates to the NACH system.

Financial institutions are afforded the following advantages upon leveraging eNACH eMandate –

NPCI reserves the right to allow participation in the eMandate process depending on the readiness of the bank to process with full automation.

eNACH is among the newer methods of electronic payment and is still in the early stages of adoption. Several banks and NBFCS have already adopted eMandates to automate recurring payments and have experienced reduced processing times, faster payment cycles, reduction in expenses, and improved efficiency.

Are you still using the paper NACH forms? Try our SignDesk MANDATE service and automate your recurring payments with ease.