What is Video KYC?

Video-based KYC or Video KYC is a recently introduced KYC (Know Your Customer) procedure, involving the video-based verification of a customer’s KYC details.

A customer’s KYC details are collected & verified typically before that customer can begin an account-based relationship with a regulated financial institution such as a bank, financial service provider, insurer or a securities intermediary.

These KYC verification procedures are a critical part of Customer Due Diligence (CDD), which are measures put in place to deter money laundering, fraud & the usage of funds to finance criminal activities.

Video KYC stands out from other KYC verification protocols such as eKYC or digital KYC due to its incorporation of video-enabled features, audio-visual interactions, facial matching capabilities & the all-round usage of AI technology to streamline & expedite the KYC verification process.

Let’s look at a brief overview of Video KYC to see what this means.

A Brief Overview Of Video KYC

Video KYC was first officially introduced in India by the Reserve Bank of India (RBI) on January 9, 2020 in a notification that outlined the procedures that constitute Video KYC for banks.

Video KYC is an umbrella term used to classify the various types of video-based KYC verification procedures that have been instituted since RBI’s notification VCIP, a Video-based KYC verification process.

Therefore we must note here that Video KYC is a general moniker and could refer to any of the video-based KYC procedures that are currently in use by FIs.

RBI’s video-based KYC procedure is termed Video-based Customer Identification Process (VCIP). IRDAI & SEBI, which quickly followed RBI in notifying their own Video KYC procedures, have announced a Video-based Identification Process (VBIP) & Video In-Person Verification Process (VIPV), respectively.

Although these procedures are not exactly the same, they do have a few shared & defining features.

- Digital & paper-free KYC verification

Video KYC is completely digital & involves zero paper. All three Video KYC procedures described above take place over digital channels, primarily use scanned documents or document images for verification, and can be completed over the internet

- Audio-visual interaction with a trained official

An important step in Video KYC is a randomized question-driven interaction between an official from the FI (financial institution) conducting Video KYC & the customer, which consists of random questions posed to the customer by the trained official. This interaction functions both as a liveliness check & an identifying procedure, and is used to verify the customer’s identity by authenticating document images & matching the customer’s face with photos on IDs.

- Facial matching & geo-tagging

Video KYC institutes facial matching as a key identifying procedure and geo-tagging to determine the customer’s location during KYC verification.

- Real-time & automated document verification

As opposed to manual document verification, Video KYC relies on the usage of technology to extract data from images of Officially Valid Documents (OVDs) and then verify these details in real-time. This allows for quicker verification & fewer errors, and is an important pillar of Video KYC.

While these are all neat features to have for KYC verification, we still haven’t explained what prompted the need for video-based KYC verification.

We know that Video KYC plays a huge part in customer due diligence, and this has a lot to do with the features of Video KYC.

What Role Does Video KYC Play In Due Diligence?

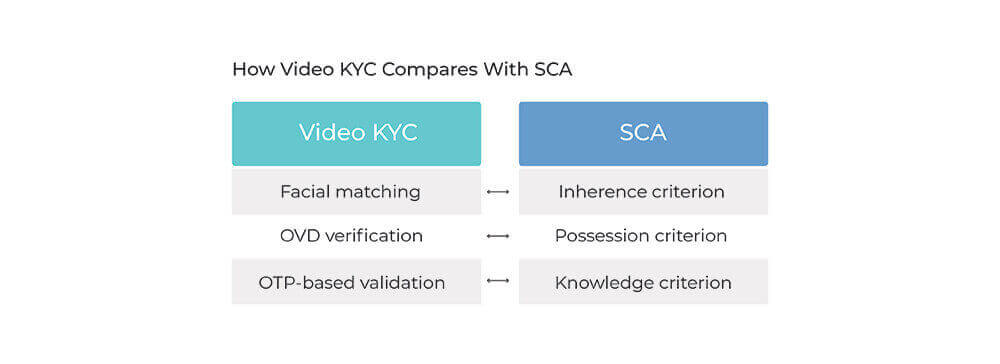

The concept of video-based KYC verification is tenuously linked with the idea of Strong Customer Authentication (SCA).

SCA is a set of regulatory requirements that has its roots in the EU Revised Directive on Payment Services (PSD2) for the general European Economic Area.

SCA is defined as customer authentication based on the use of two or more of the following elements:

- Something only the customer knows (Knowledge criterion)

This could be a password, pin, OTP, challenge questions, etc.

- Something only the customer possesses (Possession criterion)

This could be a generated OTP, QR code, OVDs, electronic evidence, etc.

- Something only the user is (Inherence criterion)

This could be biometrics, facial matching, voice recognition, vein recognition, keystroke dynamics, etc.

This means that, according to SCA, a customer is only authenticated when at least two of the three requirements above have been validated.

Therefore, if the customer evidences any two of the three elements of SCA as described above, this would constitute an authentication.

Customer Due Diligence plays a critical role in KYC. Primarily because CDD procedures root out fraud & money laundering, and deter the diversion of capital for illicit purposes, which have been huge problems for the financial sector.

Video KYC was instituted as a strong CDD procedure, and therefore it makes sense that Video KYC resembles SCA.

By incorporating some of the requirements of SCA, Video KYC has in turn become a robust and comprehensive process for conducting due diligence.

How?

- Video KYC involves facial matching, which corresponds to “Something only the customer is”

- Video KYC involves OVD verification which corresponds to “Something only the customer possesses”

- In certain cases, Video KYC involves OTP-based identity authentication, which corresponds to “Something only the customer knows”

Video KYC, therefore, is a relatively strong CDD procedure that has evidently been recommended to make KYC verification comprehensive & robust.

This elicits the question – “If we’re only getting strong CDD now, what KYC verification procedures were in place before Video KYC?”

What Preceded Video KYC?

The notion of KYC goes back all the way to ancient China, but the concept was first codified in the USA as The Federal Deposit Insurance Act, which required banks to identify their customers during the 1940s.

Following a global reckoning regarding the dangers of money laundering in the late 1980’s, the Financial Action Task Force (FATF) was established in July 1989 at the G-7 summit in Paris. The FATF is a global money laundering & financial terrorism watchdog, with the purpose of setting international standards & regulations to deter financial crime.

Countries desirous of joining the FATF must pass appropriate laws to prevent financial crime following the recommendations of the FATF, and will be evaluated by the FATF periodically to check the efficacy of money laundering laws & suggest improvements.

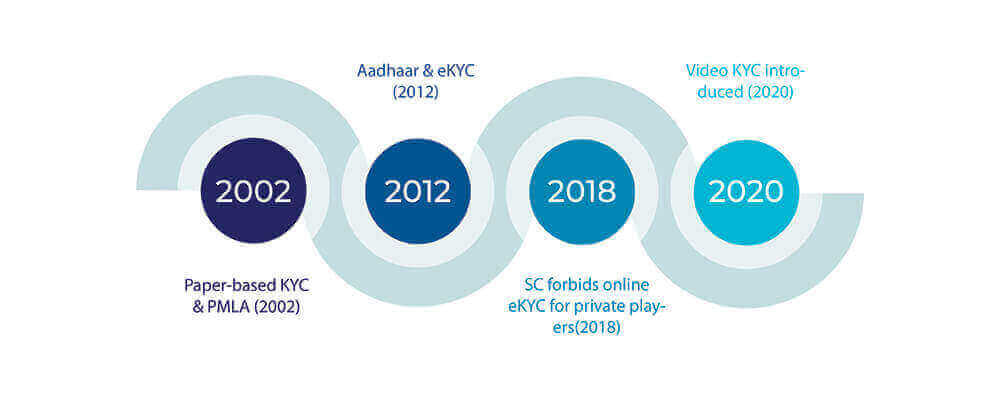

India joined the FATF after passing its first KYC rules in 2002 along with the Prevention Of Money Laundering Act (PMLA), and directed all banks to ensure compliance by 2005.

The RBI additionally stipulated that KYC must be performed when an account is being opened, when money is being internationally transferred to someone who isn’t an account holder with the bank, or in case of suspicions about the identification data obtained, among other scenarios.

The very first KYC verification procedures were all paper-based, consisted of voluminous compliance requirements & were exceedingly expensive for businesses.

Then, following the introduction of the Aadhaar scheme and the inception of the Aadhaar database by UIDAI, eKYC (Electronic KYC) was introduced as a faster & cost-effective means of KYC verification.

eKYC initially involved the usage of an Aadhaar-registered customer’s mobile number or biometrics, to retrieve identifying information from the UIDAI database for the FI to authenticate.

However, due to large-scale concerns about privacy, the Supreme Court ruled in 2018 that private entities cannot use online eKYC for KYC verification. Unregulated players could still use offline methods involving XML files or QR codes for KYC, but had to shell out a license fee and a per transaction fee to conduct eKYC.

Another glaring problem with eKYC authentication is that accounts opened following eKYC will have certain restrictions –

- The maximum balance of an eKYC account cannot exceed ₹ 1 lakh

- In a financial year, funds exceeding ₹ 2 lakh cannot be added to the eKYC account

- A minimum KYC account can only be used for a year, after which full KYC must be completed for continued use

It was in this situation that RBI announced its VCIP, and thus introduced Video KYC as an alternative & digital means for KYC verification.

Now that it’s been a year since the introduction of Video KYC, who’s allowed to use it?

Who Can Perform Video KYC?

As explained before, Video KYC is an umbrella term for video-based verification procedures instituted by a variety of regulatory bodies.

We’ll list each of the regulatory bodies that have allowed Video KYC and who’s allowed to use Video KYC in each case.

- RBI & VCIP

While both banks & NBFCs are free to use VCIP to onboard customers, RBI’s circular on VCIP explicitly notes that only banks can use online Aadhaar authentication for customer identification. Unregulated FIs will have to use offline methods of eKYC.

- IRDAI & VBIP

IRDAI states, in its circular on VBIP, that all general & life insurers can use VBIP to onboard customers.

- SEBI & VIPV

SEBI has stated that VIPV is for use by all SEBI-registered intermediaries who want to start account-based relationships with individual investors.

Now that we’ve listed who can use Video KYC procedures, let’s finally get to the various types of Video KYC.

What are the different types of Video KYC?

As mentioned before, different types of FIs have their own version of Video KYC depending upon the regulatory body.

Currently, there are 3 major video-based KYC procedures in use.

- VCIP

Video-based Customer Identification Procedure (VCIP) was notified by RBI for use by banks & NBFCs.

- VBIP

Video-based Identification Process (VBIP) was notified by IRDAI for use by insurers.

- VIPV

Video In-Person Verification (VIPV) was instituted by SEBI for use by registered intermediaries.

Apart from these regulators, a few other organizations have also taken a welcome step towards Video-based KYC verification.

The PFRDA (Pension Fund Regulatory & Development Authority) has instituted a video-based verification procedure similar to VCIP to obtain NPS services.

SignDesk offers KYC verification services that support all three types of Video KYC.

Let’s now look at the three main video-based KYC procedures currently in use.

RBI’s VCIP For Banks & NBFCs

RBI officially announced VCIP as an amendment to the Master Direction on KYC.

VCIP is a customer due diligence procedure for individuals to be conducted before beginning an account-based relationship with a bank or NBFC.

VCIP is a seamless video-based procedure taking place over a digital channel (via mobile or web). It involves two people – the customer and a trained official from the FI. The official is trained explicitly for the purposes of conducting VCIP & will assist the customer through the process, which will be recorded on video.

VCIP is to be triggered from the domain of the FI and the application used for VCIP is to undergo quality & security audits to ensure that the process is seamless, encrypted & secure. FIs are also encouraged to use AI & ML techniques to improve their Video KYC procedures.

Before initiating VCIP, the customer’s identification details must be collected. This is done via online or offline Aadhaar authentication for banks & private entities respectively. The customer also uploads at least one OVD for document verification purposes.

The Video KYC Process typically concludes within 10 minutes of initiation. RBI also mandates that concurrent audits take place simultaneously with VCIP to ensure that the process is without errors, and that all accounts opened via VCIP are to be made operational only after a concurrent audit. The customer’s Aadhaar is also to be redacted or blacked out.

Upon completion of VCIP, the video of the process is viewed again by the official to make sure that it wasn’t pre-recorded. The video is then stored for auditing purposes along with the date, time-stamps & GPS coordinates.

Now that we know what generally goes on in VCIP, let’s take a hard look at the steps involved.

What Are The Steps In VCIP?

Here’s a run-down of the steps involved in VCIP.

- The official initiates the process after obtaining the customer’s consent

- The customer’s Aadhaar is authenticated online or offline via XML or QR code

- The customer uploads OVDs such as PAN

- The official initiates a live interaction with the customer

- The official captures a video and a photo of the customer

- The official captures an image of the customer’s PAN

- The official ensures that the face captured in the image is the same as the one in the customer’s PAN or Aadhaar. The official must also verify the rest of the details in the customer’s PAN or Aadhaar.

- Geo-tagging technology determines the customer’s real-time location

- A live question-based interaction takes place between the official and the customer to make sure that the customer’s video feed has not been pre-recorded

- The official completes VCIP

- The official must now store the recorded video for future reference

- A concurrent audit is performed alongside KYC verification & accounts opened will only be activated following this concurrent audit

Next, let’s look at the video-based KYC procedure for insurers.

IRDAI’s VBIP For Insurers

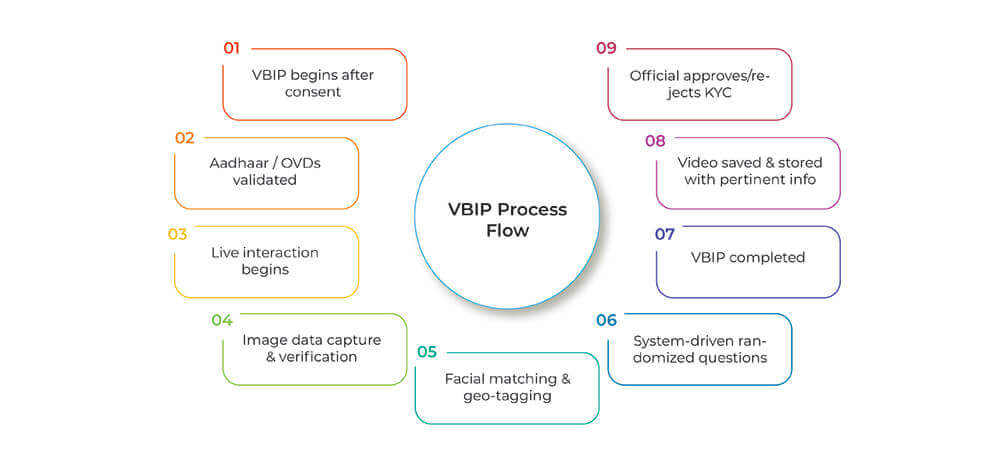

VBIP was announced officially by IRDAI in a press release on 21st September 2020.

VBIP is an alternative, face-to-face & paper-less KYC process to be carried out by a trained official from the insurer. This process mainly consists of a seamless, secure, real-time & consent-based audio-visual interaction between the customer and the trained official, in order to obtain identifying information. This interaction is recorded & stored after the process is completed.

Like VCIP, the procedure takes place over a secure application after appropriate security & software audits. VBIP places increased importance on the interactive aspect of Video KYC, by mandating that the official conducting VBIP ensure that the customer’s face is recognizable & that the video feed is of satisfactory quality.

The application is to be triggered from the domain of the insurer and must be hosted within India. It must also clear security testing through a CERT-In empanelled vendor.

Unlike VCIP however, customer identification can not only be done through online or offline Aadhaar authentication, but also by uploading a digitally signed OVD through DigiLocker or by uploading a scanned OVD through the eSign mechanism.

The XML file or QR code used for offline Aadhaar authentication must also not be more than 3 days old at the time of VBIP.

Once VBIP is concluded, the recorded video is stored along with details of the official, the date, time-stamps & GPS coordinates of the customer.

Here are the steps involved in VBIP.

What Are The Steps In VBIP?

This is the procedure for IRDAI’s VBIP.

- The customer’s consent is obtained before initiating VBIP

- The official collects identifying information from the customer as follows:

1. Through online Aadhaar authentication, subject to the customer’s consent

2. Through offline Aadhaar, i.e XML file or QR code, subject to the customer’s consent

3. Through a digitally signed copy of an Officially Valid Document (OVD) issued to DigiLocker

4. Through a photo or scanned copy of an OVD using eSign mechanism

- The official will initiate an audio-visual interaction with the customer

- The official ensures that the customer’s picture in the Aadhaar or OVD match these customer’s face in the video interaction

- The official poses a sequence of randomized questions to ensure that the interaction is taking place in real-time

- The customer’s location is determined via geo-tagging technology to be within India

- Once the interaction is concluded, the recorded video is stored safely with date, timestamps, GPS coordinates and other necessary information

- The activity log of the interaction is maintained along with the details of the authorized official

- Any account opened via VBIP will only be activated following verification and audits

While the workflow of VBIP involves interaction with a trained official, SignDesk additionally offers an unassisted module of VBIP, in which customers are verified and onboarded without assistance from an official from the insurer.

Finally, let’s look at SEBI’s video-based KYC verification procedure.

SEBI’s VIPV For Securities Intermediaries

SEBI released a circular detailing changes to the required KYC & IPV (In-Person Verification) procedures on 24th April, 2020.

The circular illustrated a new online KYC process for registered intermediaries (RIs) to onboard investors. You can read about SEBI’s online KYC process here.

Traditionally, SEBI has required RIs to perform an IPV process along with the submission of KYC documents to complete investor onboarding. According to the circular however, RIs are exempt from performing IPV in the following cases –

- When the investor’s KYC is completed using Aadhaar authentication

- When the KYC form has been submitted online & documents are submitted via DigiLocker or other means that are verifiable online

Therefore, SEBI has, in effect, largely made the IPV process redundant. However, even in cases where IPV is required, the new regulations for VIPV make the process seamless, digital & easy to perform.

RIs must perform VIPV through a sufficiently audited application which preserves the activity log of the procedure for future reference, along with the date and timestamps. VIPV will consist of a face-to-face interaction with a trained official who must make sure that the customer’s face is easily recognisable through the video feed.

The entire process must take place in a live environment and RIs must ensure that once the process is completed, the video & logs are stored in a safe, secure & tamper-proof manner.

Now let’s take a look at the steps involved in VIPV.

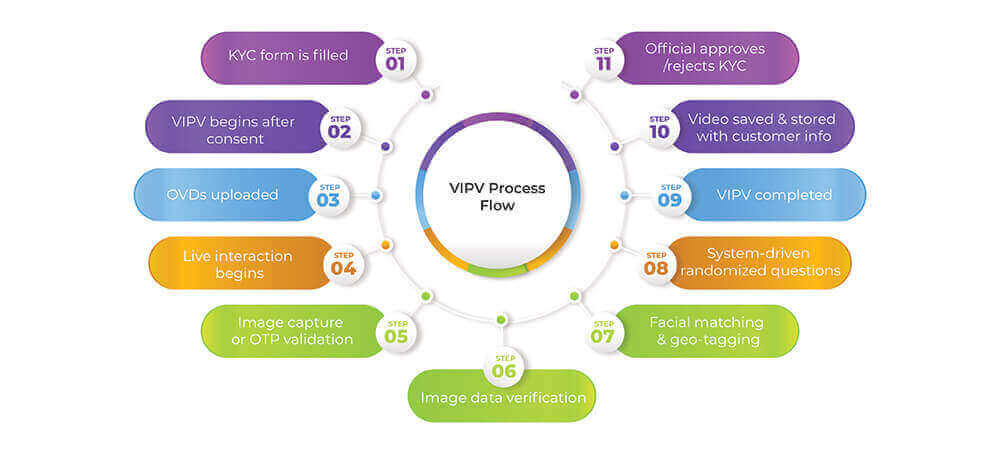

What Are The Steps In VIPV?

Here is the procedure envisaged in SEBI’s VIPV.

- The customer obtains & fills up the KYC form.

- An authorized official of the RI begins VIPV of the investor after obtaining consent.

- The process must take place in a live environment, and the investor must be clear and recognizable.

- The process must include random questions and responses to ensure the liveliness of the video.

- The investor must display their OVD, KYC form, and signature. However, this can also be confirmed via OTP.

- The official must ensure that the photo of the customer downloaded through Aadhaar verification matches with the investor in the video.

- Once the interaction is concluded, it must be saved in a secure manner along with the date and time stamps.

So now that we’ve gone through the major types of Video KYC, let’s look at why they’ve been such a big deal.

What Are The Benefits Of Video KYC?

Ever since its introduction, Video KYC has been massively popular & precipitated huge benefits for businesses.

The banking sector has been the most enthusiastic adopter of Video KYC, with millions of accounts opened using VCIP over the last year. Now with large numbers of insurers & RIs also getting onboard, Video KYC is starting to become a staple in KYC verification.

Here’s why Video KYC has produced amazing results and real benefits for FIs.

- Massive reductions in onboarding & KYC expenses

Several reports estimate that automating KYC procedures can entail a minimum of 50% reduction in expenses.

Video KYC in particular, has been shown to reduce onboarding costs by 90%, due to the digital nature of the process, the absence of paperwork & the utilization of automated verification methods.

- Shortened turnaround times

The total duration of a KYC verification process that isn’t digitized can stretch from 10 to 20 days.

Video KYC demonstrably reduces the turnaround time for KYC verification by automating the validation process, instantly verifying KYC details & digitizing the documentation involved.

Video-based KYC verification procedures have been shown to reduce TAT from 10 days to within 10 minutes.

- Increased productivity & fewer documentation errors

Video KYC boosts worker productivity by removing the inefficiencies associated with paper-based documents & manual workflows.

Reports estimate that digitizing paperwork can boost productivity by 20%, and the usage of AI-powered verification techniques further boosts efficiency by reducing potential verification errors.

- Seamless onboarding journey with fewer drop-offs

Previous paper-based KYC procedures were often too fragmented & slow, resulting in about 40% of customers abandoning the KYC verification process.

Video KYC ensures a smooth & seamless onboarding process for customers by making the process entirely digital & automated, which is directly in line with customer demands, since more 55% of customers prefer a digital method of identity verification.

Surveys have further indicated that automating KYC procedures reduces KYC drop-offs by 20%.

- Usage of cutting edge technology

All the circulars released regarding Video KYC encourage the use of AI & other emerging technology to enhance the Video KYC process.

SignDesk has taken this as an opportunity to strengthen our KYC verification solution with cutting edge AI-powered document verification, OCR-based image data extraction, facial matching capabilities & ML-enabled fraudulent profile filters.

Reports have shown that automating KYC procedures using AI technology massively reduces expenses & boosts ROI.

- Safety & security are prioritised

Fraud, cyber-crimes & money laundering have been huge problems for FIs and were the primary reason for instituting KYC norms in the first place.

Banks & insurers pay millions of dollars in fraud-related fines every year, and cases of financial fraud have only been on the rise in the last year due to the trend of digitization.

Additionally, the conditions brought about by COVID-19 have rendered people unable to have physical interactions, thus increasing the need for a presence-less form of onboarding.

Video KYC solves all these problems, including digital student onboarding, by incorporating strong security protocols, ML-powered filters, data security measures & a completely digital workflow for remote & presence-less KYC verification.

Therefore, Video KYC can both greatly mitigate fraud & help vulnerable people receive the financial and insurance services they need.

These are just a few of the advantages of Video KYC. However, they do not touch on perhaps the most important aspect of Video KYC, which makes it a real gamechanger.

How Is Video KYC A Gamechanger?

As we’ve seen before, the only option for digital KYC before the introduction of Video KYC involved online Aadhaar authentication; before which only paper-based verification processes were available. These older KYC processes cost businesses between ₹75 and ₹200.

Also recall that private entities can only use online eKYC provided that they obtain permission from UIDAI to do so, and after paying an eKYC licence fee of around ₹ 25 lakh. Private entities must also pay a ₹ 20 transaction fee for every eKYC verification performed.

Therefore it isn’t a stretch to say that compliance with KYC processes were (and sometimes continue to be) a huge burden for FIs.

However, with the introduction of Video KYC, we can observe a change in the tide.

Video KYC is completely digital & automated, allowing for major compliance cost reductions, and uses technology to expedite & simplify the KYC process.

Additionally, Video KYC can be used by both regulated & private FIs (with certain exceptions), and therefore reflects a change in the attitude of regulators.

Completing Video KYC also counts as a full KYC, as opposed to the half KYC accounts that are opened if customers only complete eKYC.

By allowing technological innovation in the KYC process, regulators have eased compliance burdens on FIs and harnessed the innovative capacity of the private sector to further automate & expedite KYC compliance.

Video KYC therefore, is more a sign of these times, in which regulators and innovators are increasingly working hand-in-hand to foster innovation.

Award-Winning & Automated Video KYC

SignDesk is an award-winning provider of AI-powered verification and documentation solutions to businesses.

To learn more about KYC, you can check out SignDesk’s KYC e-book, which includes a detailed, easy-to-follow guide on all things Video KYC.

We use real-time AI-powered document verification techniques, OCR-enabled image data extraction, facial matching & ML-based fraud filters to automate and expedite the KYC verification process.

Our verification solutions have helped our 250+ clients reduce onboarding expenses, cut down on KYC drop-offs, reduce TAT by 99%, and safeguard against fraud using cutting-edge compliance technology.

Our efforts to automate KYC have been recognized in the form of numerous awards, the latest being the Best AI/ML Product at InnTech 2020, and the Global Banking & Finance Review’s Best Digital Onboarding Product of 2020.

Are you ready to join 50+ major banks and start onboarding with Video KYC? Book a demo with us now and let’s get started!